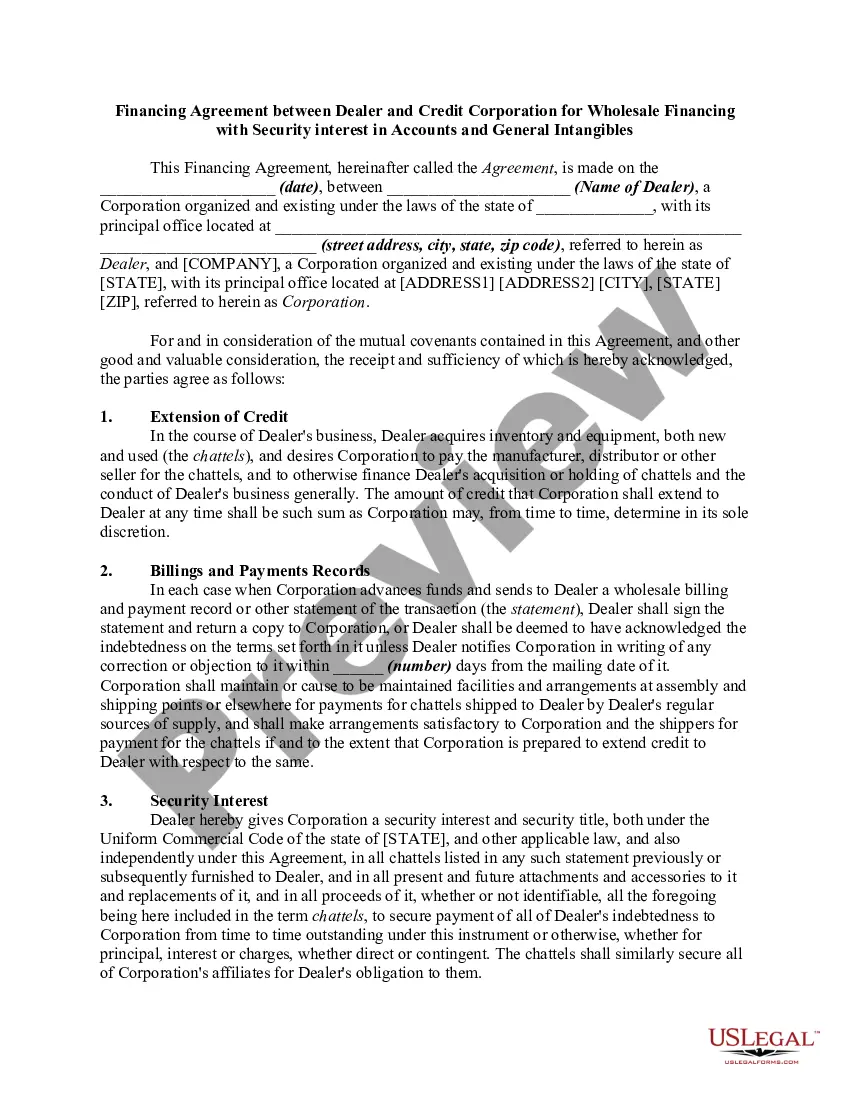

Have you been in a situation the place you will need papers for either enterprise or person uses just about every day time? There are tons of lawful record layouts available on the Internet, but discovering ones you can rely on isn`t simple. US Legal Forms provides 1000s of form layouts, just like the Delaware Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles, that happen to be created to fulfill federal and state demands.

Should you be previously acquainted with US Legal Forms site and also have a merchant account, simply log in. Afterward, you can obtain the Delaware Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles format.

If you do not offer an profile and need to begin to use US Legal Forms, adopt these measures:

- Discover the form you will need and make sure it is for that right town/region.

- Make use of the Preview key to review the shape.

- See the outline to ensure that you have selected the correct form.

- If the form isn`t what you`re searching for, utilize the Look for field to get the form that suits you and demands.

- If you get the right form, just click Purchase now.

- Select the pricing prepare you desire, submit the specified details to make your money, and pay money for an order with your PayPal or bank card.

- Decide on a hassle-free data file structure and obtain your version.

Find each of the record layouts you have purchased in the My Forms food selection. You can obtain a further version of Delaware Financing Agreement between Dealer and Credit Corporation for Wholesale Financing with Security interest in Accounts and General Intangibles anytime, if needed. Just click on the necessary form to obtain or print out the record format.

Use US Legal Forms, the most extensive collection of lawful types, in order to save some time and steer clear of mistakes. The assistance provides professionally created lawful record layouts that can be used for a variety of uses. Produce a merchant account on US Legal Forms and begin generating your lifestyle easier.