Delaware Checklist for Business Loans Secured by Real Estate

Description

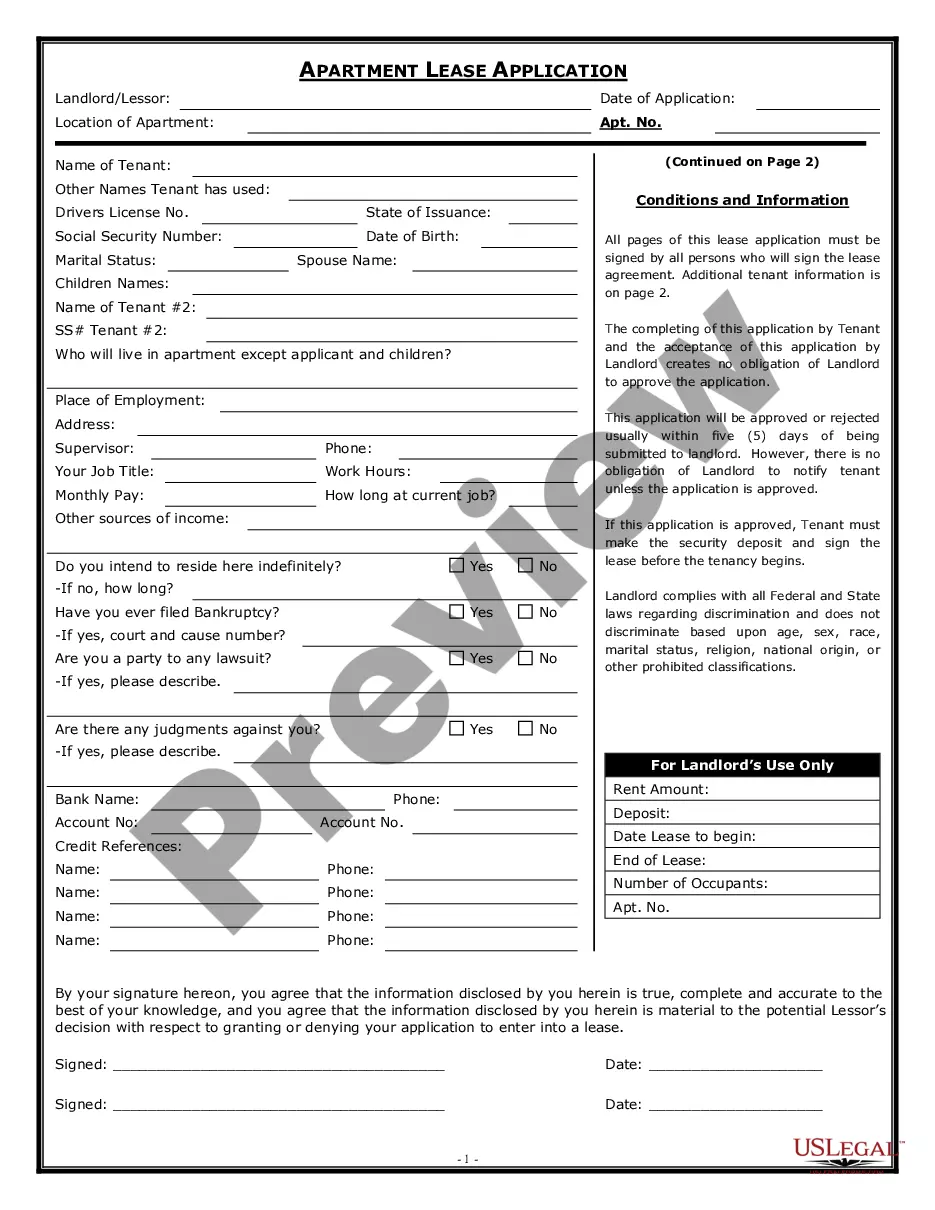

How to fill out Checklist For Business Loans Secured By Real Estate?

Discovering the right legitimate record web template might be a battle. Obviously, there are a variety of themes available online, but how do you discover the legitimate type you will need? Utilize the US Legal Forms website. The assistance gives thousands of themes, like the Delaware Checklist for Business Loans Secured by Real Estate, that can be used for company and private needs. All the forms are checked by experts and satisfy federal and state specifications.

If you are already listed, log in for your accounts and then click the Download option to have the Delaware Checklist for Business Loans Secured by Real Estate. Make use of your accounts to appear with the legitimate forms you have purchased in the past. Proceed to the My Forms tab of your accounts and acquire another copy from the record you will need.

If you are a fresh consumer of US Legal Forms, allow me to share easy guidelines for you to follow:

- Initially, make certain you have selected the appropriate type for your metropolis/area. You can look through the shape making use of the Review option and browse the shape information to ensure it will be the right one for you.

- In the event the type does not satisfy your requirements, utilize the Seach area to discover the correct type.

- When you are certain the shape is proper, click on the Purchase now option to have the type.

- Pick the rates prepare you would like and type in the necessary details. Design your accounts and buy the order making use of your PayPal accounts or bank card.

- Choose the document file format and down load the legitimate record web template for your system.

- Full, revise and produce and indicator the acquired Delaware Checklist for Business Loans Secured by Real Estate.

US Legal Forms is definitely the greatest library of legitimate forms that you will find different record themes. Utilize the company to down load expertly-made files that follow state specifications.

Form popularity

FAQ

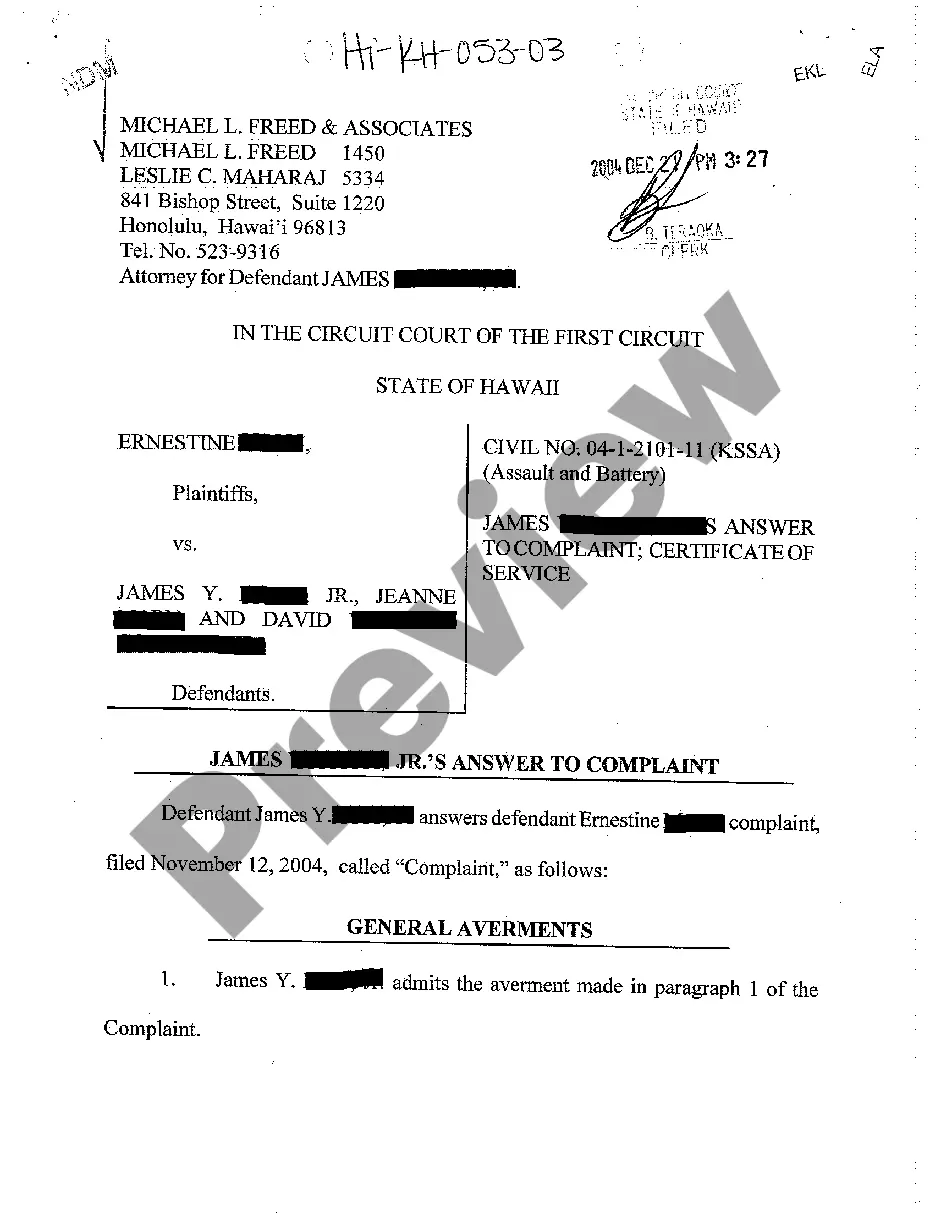

Here are the typical items required for any small business loan application: Loan Application Form. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

A secured business loan requires a specific piece of collateral, such as a business vehicle or commercial property, which the lender can claim if you fail to repay your loan.

Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. Having these documents on hand will not only make the application process smoother but will increase your chances of getting approved in a timely manner.

Get your financials in order. To this end, you should generally try to have three years' worth of business and personal tax returns on hand as well as year-to-date profit and loss figures, balance sheets, accounts receivable aging reports, and inventory breakdowns, if possible.

Using property as collateral on a business loan Lenders prefer assets of a high value that can be resold relatively quickly in the event of default. This allows them to recoup their money with few issues and as property is one of the highest value assets available, it's commonly used to secure a business loan.

Minimum credit score by business loan type Term loanWhile banks and credit unions typically require a score of 670 or above, online lenders may only require a score of 500SBA loanLenders offering SBA loans require credit scores between 620 and 6804 more rows ?

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.

Income statement, balance sheet, and cash flow statement Lenders want to see that your business is generating enough revenue and cash for you to take on a loan. The income statement, balance sheet, and cash flow statement combine to help a lender evaluate your business's financial performance.