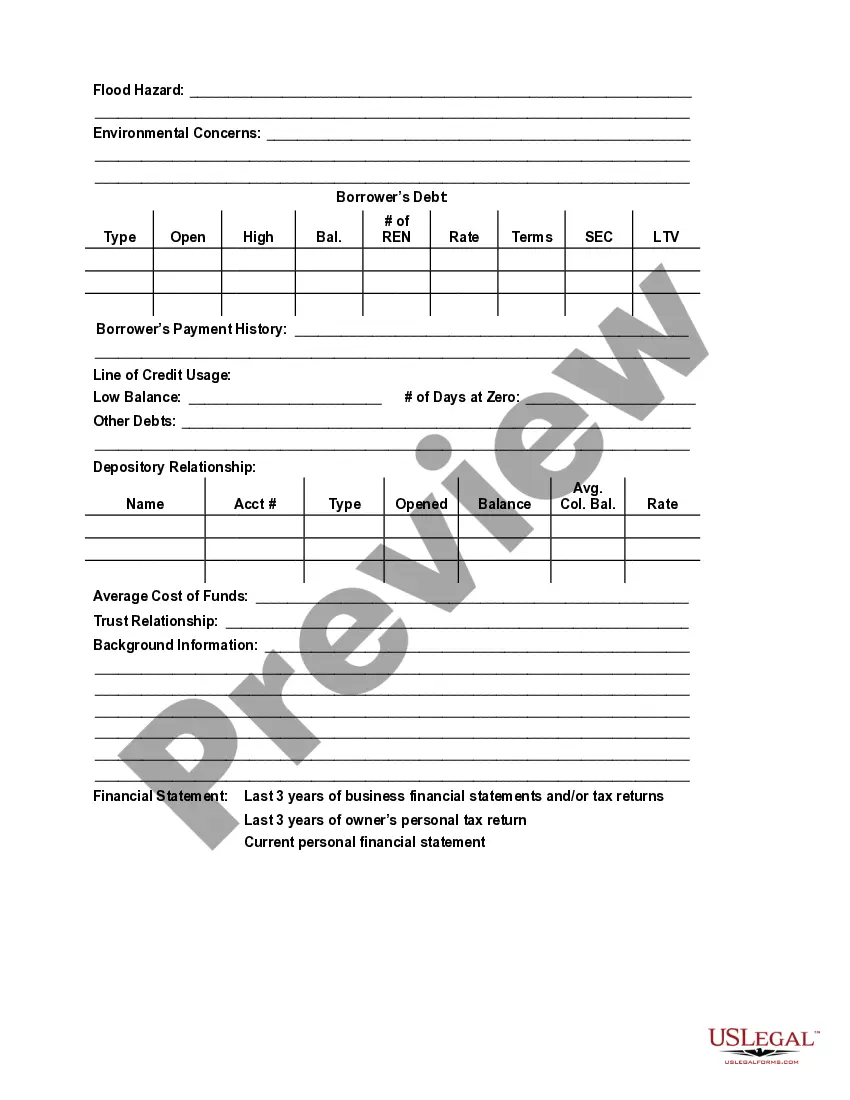

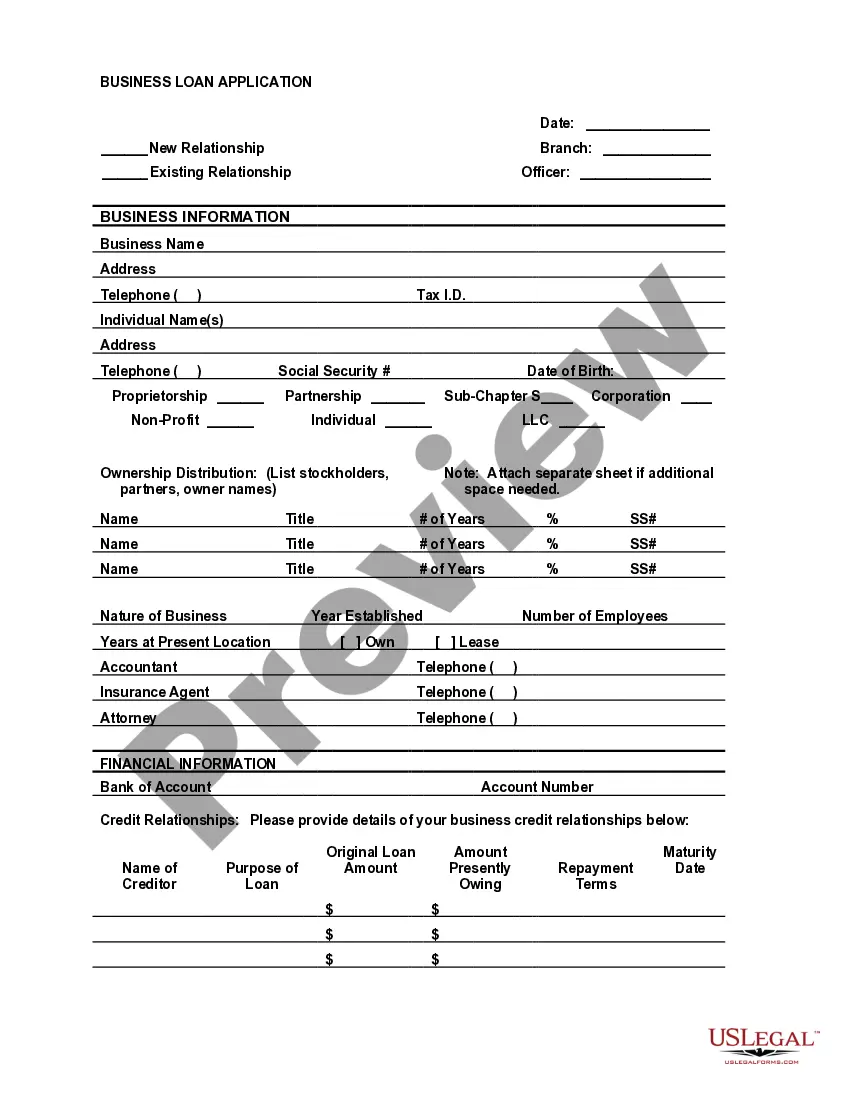

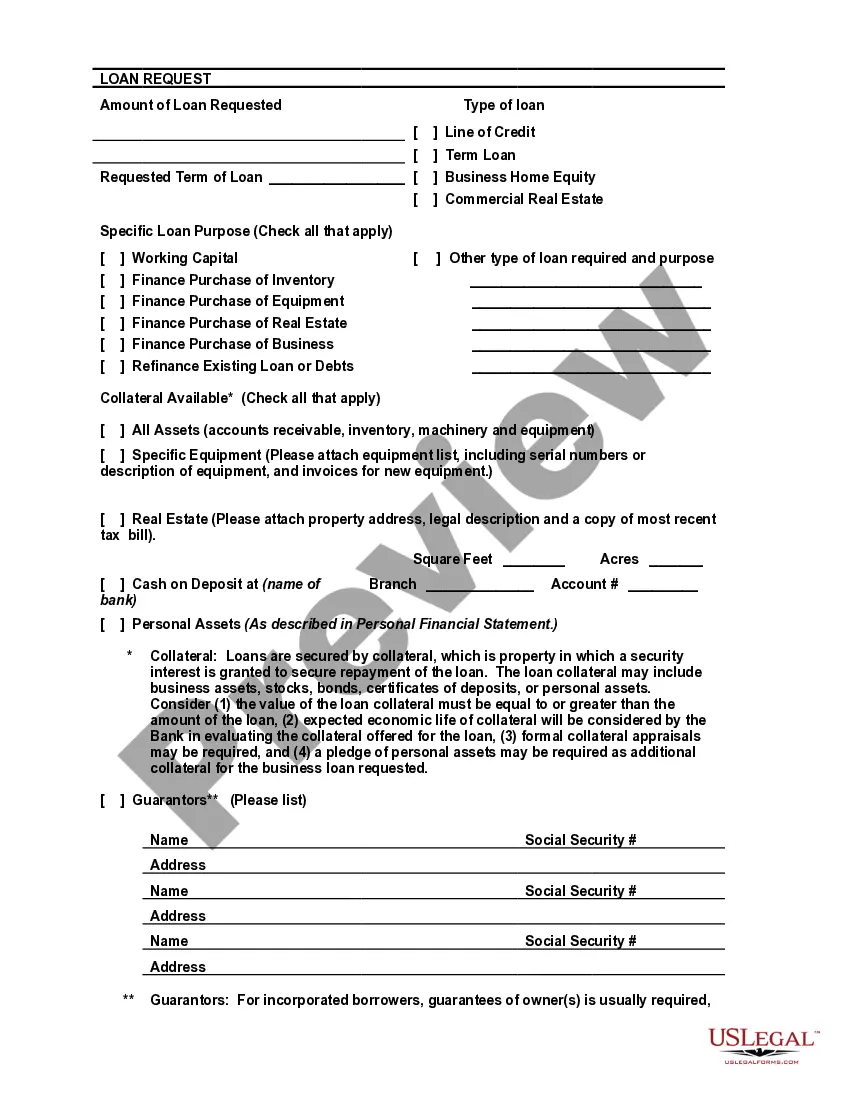

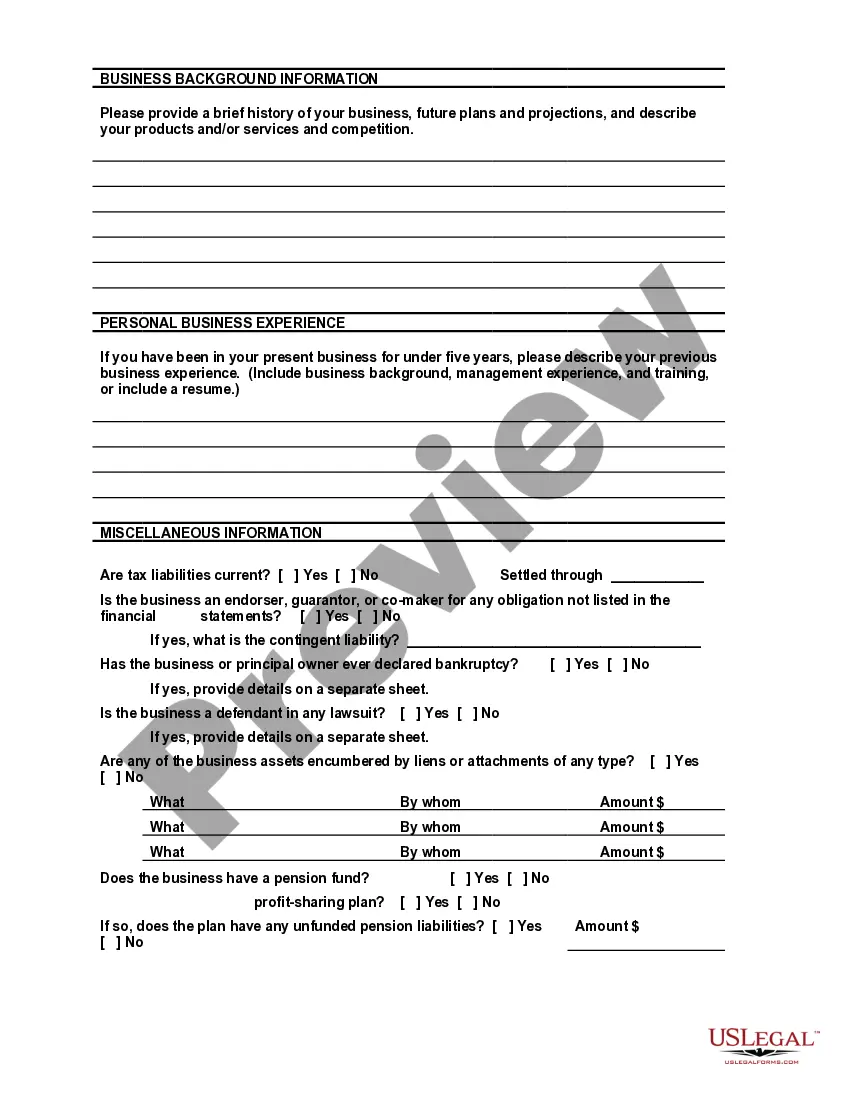

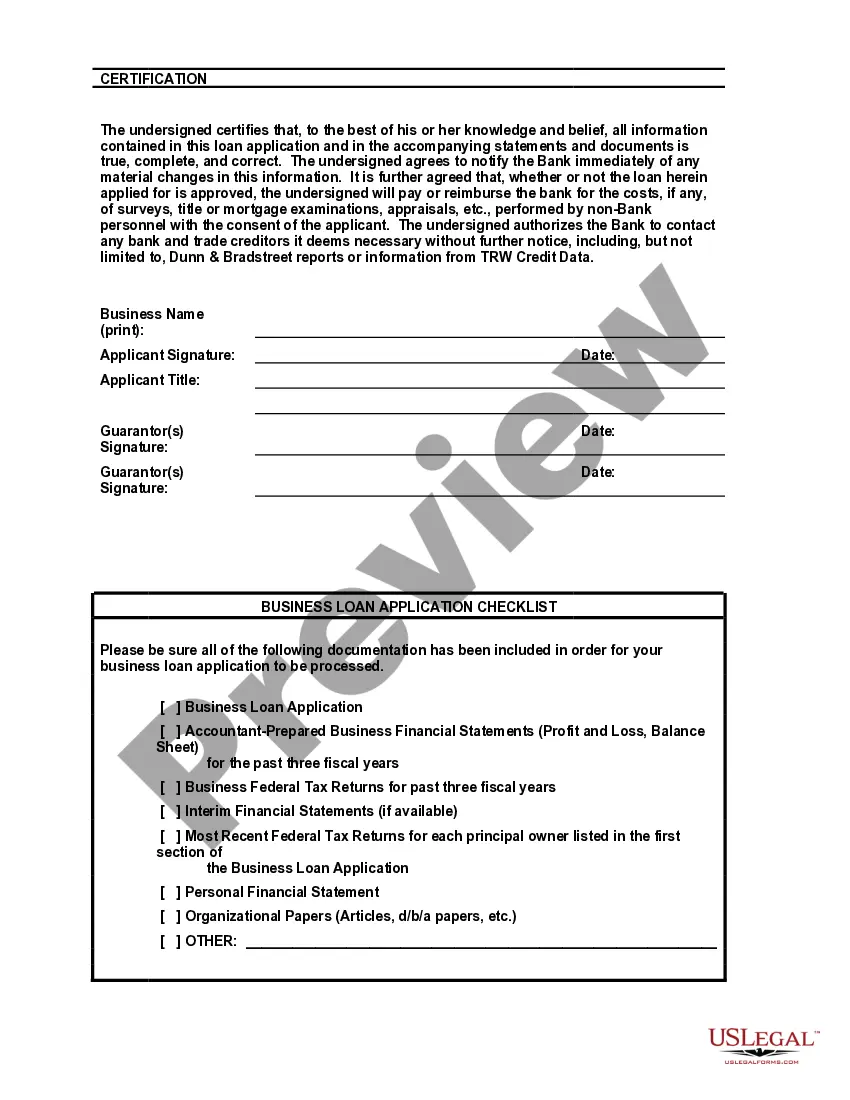

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Delaware Bank Loan Application Form and Checklist - Business Loan

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

Are you inside a situation the place you need to have documents for sometimes business or individual purposes nearly every day time? There are a variety of authorized record web templates available on the Internet, but discovering kinds you can depend on isn`t easy. US Legal Forms offers 1000s of develop web templates, just like the Delaware Bank Loan Application Form and Checklist - Business Loan, which are published to fulfill federal and state demands.

In case you are currently acquainted with US Legal Forms website and get a merchant account, simply log in. After that, you may down load the Delaware Bank Loan Application Form and Checklist - Business Loan format.

Unless you provide an bank account and want to begin to use US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is for that correct city/area.

- Use the Preview option to check the shape.

- Read the outline to actually have selected the right develop.

- In case the develop isn`t what you are seeking, take advantage of the Lookup field to find the develop that suits you and demands.

- Once you get the correct develop, click on Acquire now.

- Pick the prices strategy you need, complete the necessary details to generate your money, and buy an order with your PayPal or credit card.

- Pick a convenient document file format and down load your version.

Locate every one of the record web templates you have purchased in the My Forms food selection. You may get a further version of Delaware Bank Loan Application Form and Checklist - Business Loan anytime, if possible. Just click the essential develop to down load or produce the record format.

Use US Legal Forms, by far the most comprehensive variety of authorized kinds, to save lots of efforts and prevent blunders. The services offers expertly manufactured authorized record web templates that can be used for an array of purposes. Create a merchant account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

What do I need to apply for a personal loan? Application form. ... Proof of identity. ... Employer and income verification. ... Proof of address. ... Get a co-signer. ... Choose a secured personal loan. ... Work on your credit score. ... Consider a credit card.

If you have good credit and can meet the lender's eligibility guidelines, getting a business loan with an LLC can often be easy. But new businesses and businesses with limited revenue may have difficulty getting approved, especially with traditional banks and credit unions.

First, the withdrawal should be documented as a loan and a legally enforceable promissory note should exist. Valid corporate minutes should exist authorizing the loan. Second, interest should at a minimum be provided for at the applicable federal rate. Collateral should be provided where appropriate.

Decide Why You Need Financing. There's more than one kind of small business loan. ... Check Your Eligibility. ... Compare Business Lending Options. ... Gather the Required Documents. ... Submit Your Application.

Bank Loan Request for Small Business Start your bank loan request by briefly explaining what your business does. ... Include essential business information. ... Specify how much money you would like to borrow and what type of loan you are seeking. ... Explain how you will use the loan proceeds to attain specific business goals.

Income eligibility to apply for Business Loans A turnover of Rs. 40 lakhs is the minimum consideration. For self-employed professionals, a minimum of Rs. 1.5 lakhs per annum should be the minimum annual income.

Types of Business Loans 10 Best Options for You Working Capital Loan. ... Loan against Property for SME. ... Invoice Financing. ... Equipment Financing. ... Business Loan for Women. ... Overdraft. ... Merchant Cash Advance. ... Business Credit Card.

Qualifying for a business loan usually requires an operating history of at least two years. Additionally, you need to meet minimum revenue, personal credit, and business credit requirements. If you're applying for a secured loan, your assets will also have an impact on your eligibility.