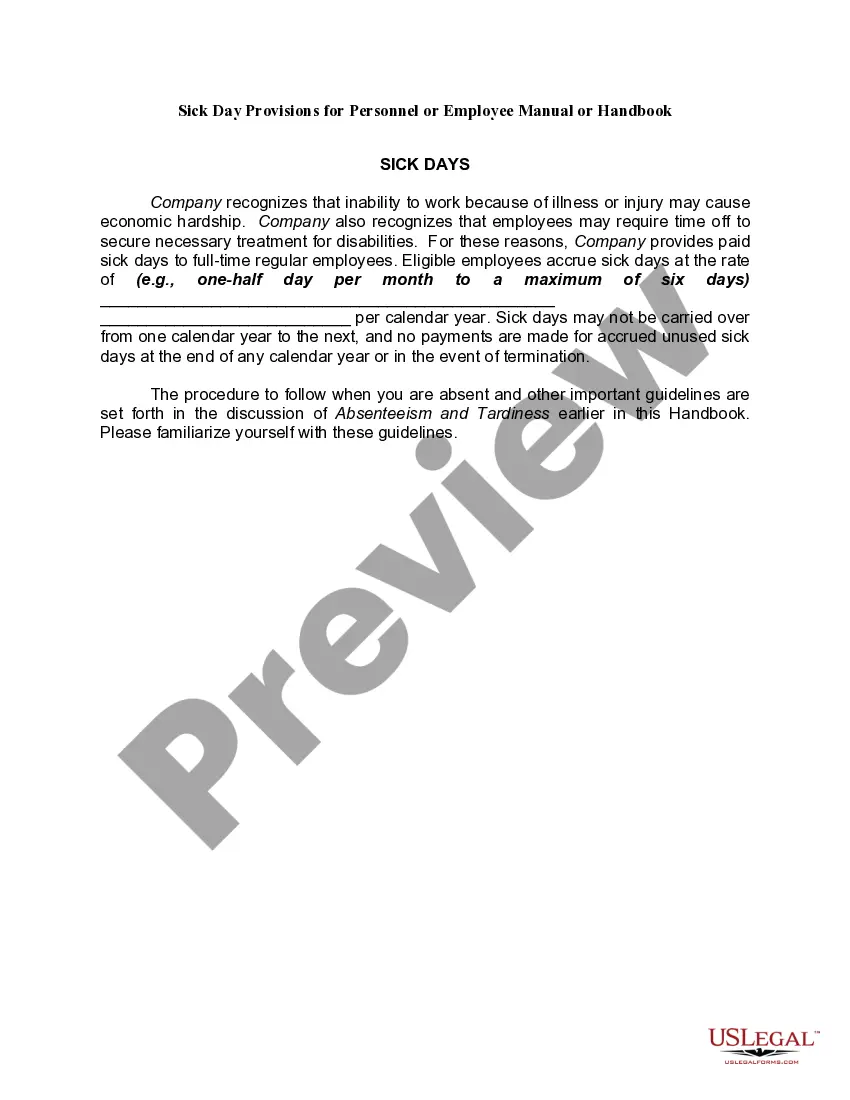

Delaware Business Deductions Checklist is a comprehensive tool used by businesses in Delaware to ensure they claim all eligible deductions while filing their tax returns. This checklist helps businesses organize and maximize their deductions, ultimately reducing their taxable income and lowering their overall tax liability. It is essential for businesses to utilize this checklist to optimize their tax planning strategies and take advantage of available deductions. The Delaware Business Deductions Checklist covers various categories of deductions that businesses can claim, ranging from ordinary and necessary business expenses to specific industry-related deductions. Below are some key categories included in the checklist: 1. Startup Costs Deductions: This section outlines deductions that can be claimed for expenses incurred during the initial setup of a business, such as legal fees, research costs, and advertising expenses. 2. Employee Expenses: Businesses can deduct various costs associated with employees, such as wages, salaries, benefits, and training expenses. This category also includes deductions for employee-related insurance premiums. 3. Home Office Deductions: If a business owner operates from a home office, they may be eligible to claim deductions for a portion of their rent, mortgage interest, utilities, and other related expenses. 4. Travel and Entertainment Expenses: This section covers deductions for business travel, including transportation, lodging, meals, and entertainment expenses incurred while conducting business activities away from the office. 5. Equipment and Property Deductions: Businesses can claim deductions for the depreciation of equipment and property used for business purposes, as well as repairs and maintenance expenses. 6. Professional Services Deductions: Businesses can deduct fees paid to professionals, such as accountants, lawyers, consultants, and marketing agencies, for services related to their business operations. 7. Interest and Loan Expenses: Deductions related to interest payments on business loans, credit card interest, and other borrowing costs can be captured in this category. 8. Charitable Contributions: Businesses that make donations to qualified charitable organizations may be eligible to deduct these contributions from their taxable income. 9. State and Local Taxes: This section outlines deductions for various state and local taxes paid by businesses, including Delaware income tax, sales tax, real estate tax, and personal property tax. 10. Other Deductions: This final category encompasses a range of deductions that may be applicable to specific industries or unique circumstances, such as research and development expenses, advertising costs, and bad debt deductions. It is important to note that while the general structure of the Delaware Business Deductions Checklist remains consistent for most businesses, certain industries may require additional checklists tailored to their specific deductions. For instance, the checklist for manufacturing businesses may include separate categories for raw material deductions and equipment maintenance costs. By utilizing the Delaware Business Deductions Checklist, businesses can ensure they are aware of all the potential deductions available to them, enabling them to optimize their tax planning strategies and minimize their tax obligations.

Delaware Business Deductions Checklist

Description

How to fill out Delaware Business Deductions Checklist?

US Legal Forms - one of several biggest libraries of legitimate forms in the United States - offers a wide range of legitimate papers layouts you can obtain or printing. Making use of the web site, you can get thousands of forms for organization and specific purposes, categorized by types, claims, or keywords.You can get the most recent variations of forms much like the Delaware Business Deductions Checklist within minutes.

If you currently have a membership, log in and obtain Delaware Business Deductions Checklist from the US Legal Forms local library. The Acquire button will show up on each and every develop you perspective. You have access to all formerly downloaded forms inside the My Forms tab of the account.

If you want to use US Legal Forms the first time, listed below are simple guidelines to obtain began:

- Ensure you have picked the best develop for the metropolis/county. Click on the Preview button to examine the form`s articles. Read the develop information to actually have selected the correct develop.

- In the event the develop doesn`t fit your specifications, take advantage of the Lookup industry near the top of the screen to find the one that does.

- In case you are satisfied with the form, validate your decision by simply clicking the Acquire now button. Then, pick the costs prepare you like and supply your references to register for the account.

- Method the deal. Make use of charge card or PayPal account to accomplish the deal.

- Find the file format and obtain the form on the system.

- Make changes. Load, change and printing and indicator the downloaded Delaware Business Deductions Checklist.

Every single format you included with your bank account does not have an expiration date and it is your own forever. So, if you want to obtain or printing an additional version, just go to the My Forms segment and click about the develop you need.

Gain access to the Delaware Business Deductions Checklist with US Legal Forms, one of the most substantial local library of legitimate papers layouts. Use thousands of expert and express-specific layouts that meet up with your organization or specific requires and specifications.

Form popularity

FAQ

If you need ways to reduce your taxable income this year, consider some of the following methods below.Employ a Family Member.Start a Retirement Plan.Save Money for Healthcare Needs.Change Your Business Structure.Deduct Travel Expenses.The Bottom Line.

You can either deduct or amortize start-up expenses once your business begins rather than filing business taxes with no income. If you were actively engaged in your trade or business but didn't receive income, then you should file and claim your expenses.

Delaware's state and local taxes are among the lowest in the nation. There is no state sales tax in Delaware, which makes it a popular place for shoppers. It also has some of the lowest property taxes around, as Delaware's effective property tax rate of 0.56% ranks as one of the lowest in the country.

Delaware corporation income tax is assessed at a flat 8.7% of taxable income derived from Delaware. (By comparison, the state's personal income tax rate varies from zero for nominal personal income to the highest rate of 6.6%.)

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor service and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new personal property.

Here are 10 taxes that might surprise youand cost you, if you fail to declare them as income and wind up being audited.Social Security.Alimony payments.Major gifts.Scholarships.Gambling winnings.Fantasy football.Found property.Big prizes.More items...?

Yes, getting a business off the ground takes time, and the IRS recognizes this. In your first few months or year of operation you may not bring in any income. Even without income, you may be able to deduct your expenses, as long as you meet certain IRS guidelines.

Delaware tax includes the following:Personal income tax.A tax on gross receipts.Property taxes.Estate taxes.Capital gains tax.Property tax.Cigarette tax.Alcohol tax.More items...

Even if your business has no income during the tax year, it may still benefit you to file a Schedule C if you have any expenses that qualify for deductions or credits. If you have no income or qualifying expenses for the entire tax year, there is no need to file a Schedule C for your inactive business.

(a) Alaska, Delaware, Montana, New Hampshire, and Oregon do not levy taxes on groceries, candy, or soda.