Delaware Checklist - Evaluation to Buy a Business

Description

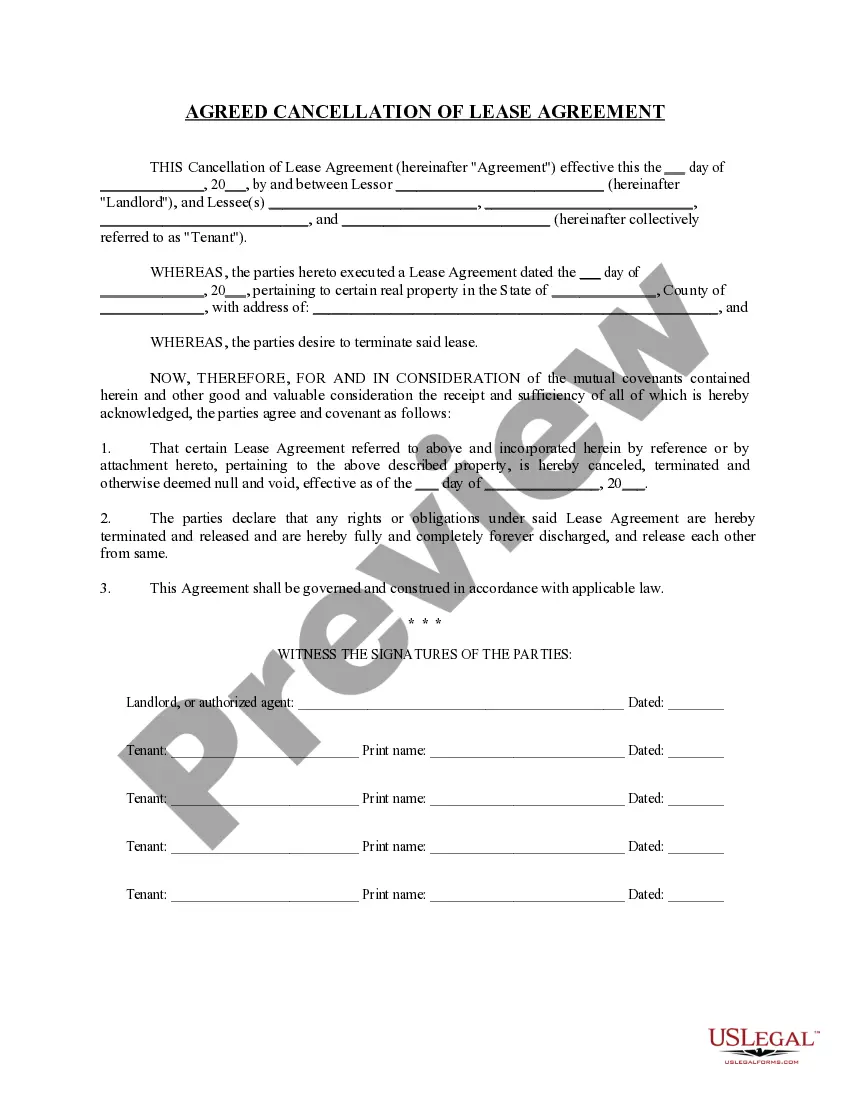

How to fill out Checklist - Evaluation To Buy A Business?

If you want to finalize, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms accessible online. Make use of the site’s user-friendly and convenient search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Employ US Legal Forms to locate the Delaware Checklist - Evaluation to Purchase a Business with just a few clicks.

If you are already a US Legal Forms client, sign in to your account and click the Purchase button to access the Delaware Checklist - Evaluation to Purchase a Business. You can also retrieve forms you previously saved in the My documents section of your account.

Every legal document template you acquire is yours permanently. You have access to every form you saved within your account. Visit the My documents section and select a form to print or download again.

Stay competitive and download, and print the Delaware Checklist - Evaluation to Purchase a Business with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the correct form for the specific city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find different variations of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and input your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Delaware Checklist - Evaluation to Purchase a Business.

Form popularity

FAQ

Delaware offers many advantages for LLC formations that make it a prime choice for business owners. The state has a well-established legal framework that supports business-friendly regulations, which aids in smoother operations. Additionally, the Delaware Checklist - Evaluation to Buy a Business highlights the privacy and flexibility in management that Delaware LLCs provide. By choosing Delaware, you secure a streamlined process and a supportive environment for your business venture.

Yes, obtaining a seller's permit is essential if you plan to sell taxable goods or services in Delaware. This permit allows you to collect sales tax from customers legally. Incorporate this step into your Delaware Checklist - Evaluation to Buy a Business to ensure your operations are compliant and well-prepared.

Yes, Delaware requires a resale certificate for businesses making tax-exempt purchases intended for resale. This certificate helps ensure the proper collection of sales tax on final sales. For anyone laying out plans for a business, knowing this detail is vital. The Delaware Checklist - Evaluation to Buy a Business provides guidance on compliance and proper documentation.

Verifying a company in Delaware can be done through the Division of Corporations' online tool, which allows you to search for corporate filings and status. This verification helps you confirm the legitimacy of a business, an important step in your Delaware Checklist - Evaluation to Buy a Business. Consider using our platform for additional resources and support during this process.

To change ownership of a Delaware corporation, you typically need to update your corporate records and file necessary documents with the Division of Corporations. This may include amending the corporate bylaws and informing current shareholders. For a smooth transition, consult our Delaware Checklist - Evaluation to Buy a Business to ensure you complete all necessary steps accurately.

Setting up a Delaware holding company involves choosing a unique name, filing a Certificate of Incorporation with the Delaware Division of Corporations, and obtaining an Employer Identification Number (EIN). This structure can offer advantages such as asset protection and tax benefits. Using the Delaware Checklist - Evaluation to Buy a Business can simplify this process and ensure you meet all legal requirements.

Yes, if your business sells taxable goods or services in Delaware, you must register for a sales tax permit. This registration process helps you collect and remit sales tax appropriately. To streamline your compliance efforts, refer to our Delaware Checklist - Evaluation to Buy a Business.

Yes, an LLC in Delaware generally requires a business license to operate legally. The license ensures compliance with local and state regulations. It is advisable to check specific industry requirements, as they may vary. The Delaware Checklist - Evaluation to Buy a Business can guide you through the steps to obtain this necessary license, making the process smoother.

The formula for buying an existing business typically includes assessing the value, securing financing, and understanding the market. An important aspect is to perform comprehensive due diligence. This involves evaluating the operational efficiency of the business and its future potential. Utilizing the Delaware Checklist - Evaluation to Buy a Business aids in structuring your approach and maximizing your investment.

Utilizing a buying a business checklist is crucial for a thorough evaluation. This timeline typically begins when you identify a business of interest. Make sure to assess its market position, financial records, and legal obligations. The Delaware Checklist - Evaluation to Buy a Business helps you stay organized and focused throughout the process, increasing the chances of a successful acquisition.