Delaware Checklist — Key Employee Life Insurance Introduction: Key employees play a crucial role in the success and stability of a business. In order to protect your Delaware-based business and ensure its smooth functioning, it is essential to consider key employee life insurance. This type of insurance provides financial security and support in the event of the untimely death of a key employee. In Delaware, there are different types of key employee life insurance options available, each catering to specific needs and requirements. Types of Delaware Checklist — Key Employee Life Insurance: 1. Key Person Life Insurance: Key Person Life Insurance is a policy that aims to protect a business from potential financial losses that may occur due to the death of a key employee. This type of insurance offers coverage in the form of a death benefit paid to the company, allowing it to mitigate the impact caused by the loss of a valuable employee. It helps businesses navigate through challenging times, bridging the gap left by the absence of a key employee. 2. Business Overhead Expense Insurance: Business Overhead Expense Insurance is designed to cover the ongoing expenses of a business in the absence of a key employee. This coverage ensures that the business operations can continue smoothly during the disability or illness of a key employee. It includes expenses such as rent, utilities, employee salaries, and other fixed costs. This insurance relieves the burden on a business and prevents financial strain during a challenging period. 3. Executive Bonus Plan: The Executive Bonus Plan, often referred to as "Section 162 Bonus Plan," is a type of life insurance that aims to attract and retain key employees. With this plan, a business agrees to pay the premium for a life insurance policy owned by the employee. The employee becomes the recipient of the death benefit, providing financial security for their loved ones, while the business benefits by retaining valuable talent. 4. Split Dollar Life Insurance: Split Dollar Life Insurance is a type of arrangement where the premiums and benefits of the insurance policy are shared between the business and the key employee. The business pays a portion of the premium, and the employee pays the remainder. Upon the employee's death, the death benefit is typically split between the employee's beneficiaries and the business. This type of insurance is an attractive incentive for key employees, as it allows them to obtain life insurance coverage with a reduced financial burden. Conclusion: Key employee life insurance plays a vital role in protecting Delaware businesses from unexpected events and financial challenges. Whether through Key Person Life Insurance, Business Overhead Expense Insurance, Executive Bonus Plans, or Split Dollar Life Insurance, it is crucial to assess your business's specific needs and implement a policy that best suits your requirements. By securing your key employees' lives, you safeguard your business's future and ensure its resilience in the face of uncertainties.

Delaware Checklist - Key Employee Life Insurance

Description

How to fill out Delaware Checklist - Key Employee Life Insurance?

Have you been in the placement that you require papers for sometimes enterprise or individual uses just about every day time? There are plenty of lawful file web templates accessible on the Internet, but finding ones you can trust is not straightforward. US Legal Forms gives 1000s of kind web templates, such as the Delaware Checklist - Key Employee Life Insurance, that are created in order to meet state and federal specifications.

When you are previously familiar with US Legal Forms site and have an account, merely log in. After that, you are able to obtain the Delaware Checklist - Key Employee Life Insurance design.

If you do not come with an profile and wish to begin to use US Legal Forms, follow these steps:

- Find the kind you require and make sure it is to the correct area/county.

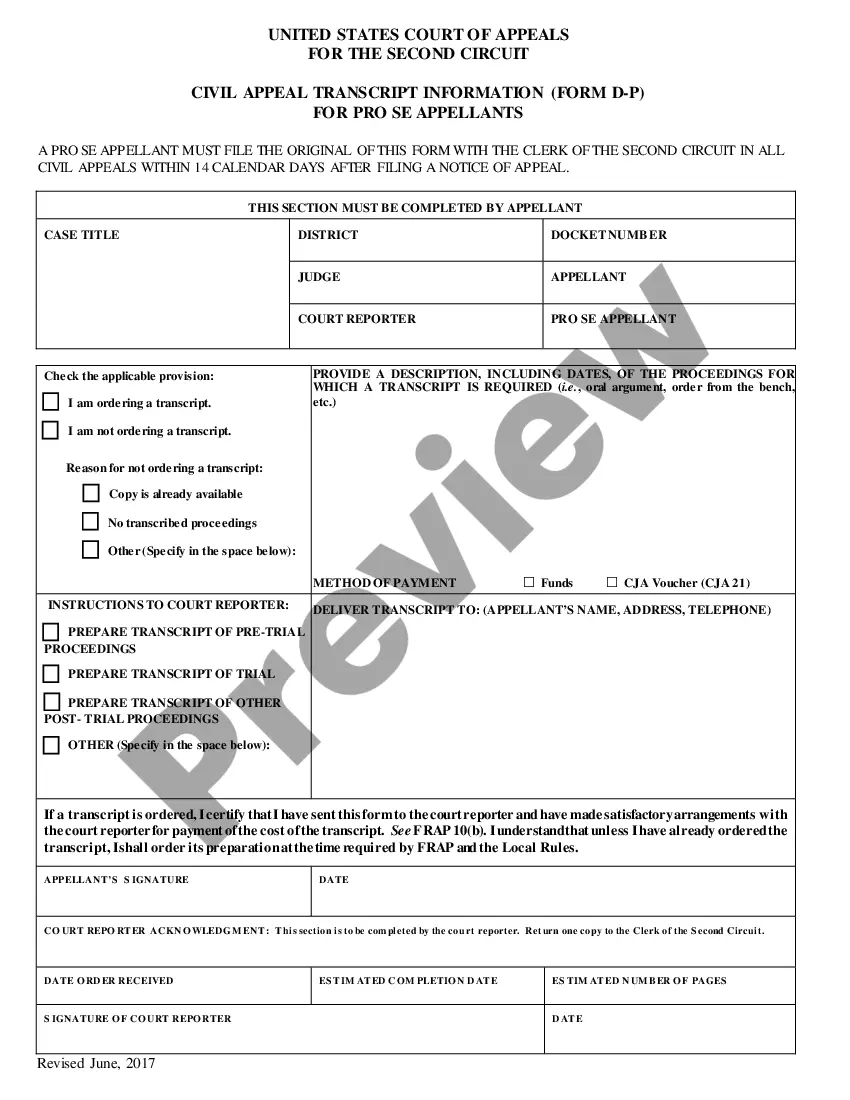

- Take advantage of the Preview key to analyze the shape.

- See the description to actually have chosen the right kind.

- If the kind is not what you are trying to find, utilize the Research industry to find the kind that fits your needs and specifications.

- When you obtain the correct kind, click on Buy now.

- Select the rates plan you want, complete the required information and facts to make your money, and pay money for your order with your PayPal or charge card.

- Select a hassle-free data file structure and obtain your copy.

Locate all the file web templates you may have bought in the My Forms menus. You may get a further copy of Delaware Checklist - Key Employee Life Insurance any time, if required. Just select the essential kind to obtain or print out the file design.

Use US Legal Forms, one of the most comprehensive assortment of lawful varieties, to save lots of time and avoid mistakes. The service gives expertly produced lawful file web templates that you can use for an array of uses. Generate an account on US Legal Forms and commence producing your daily life easier.