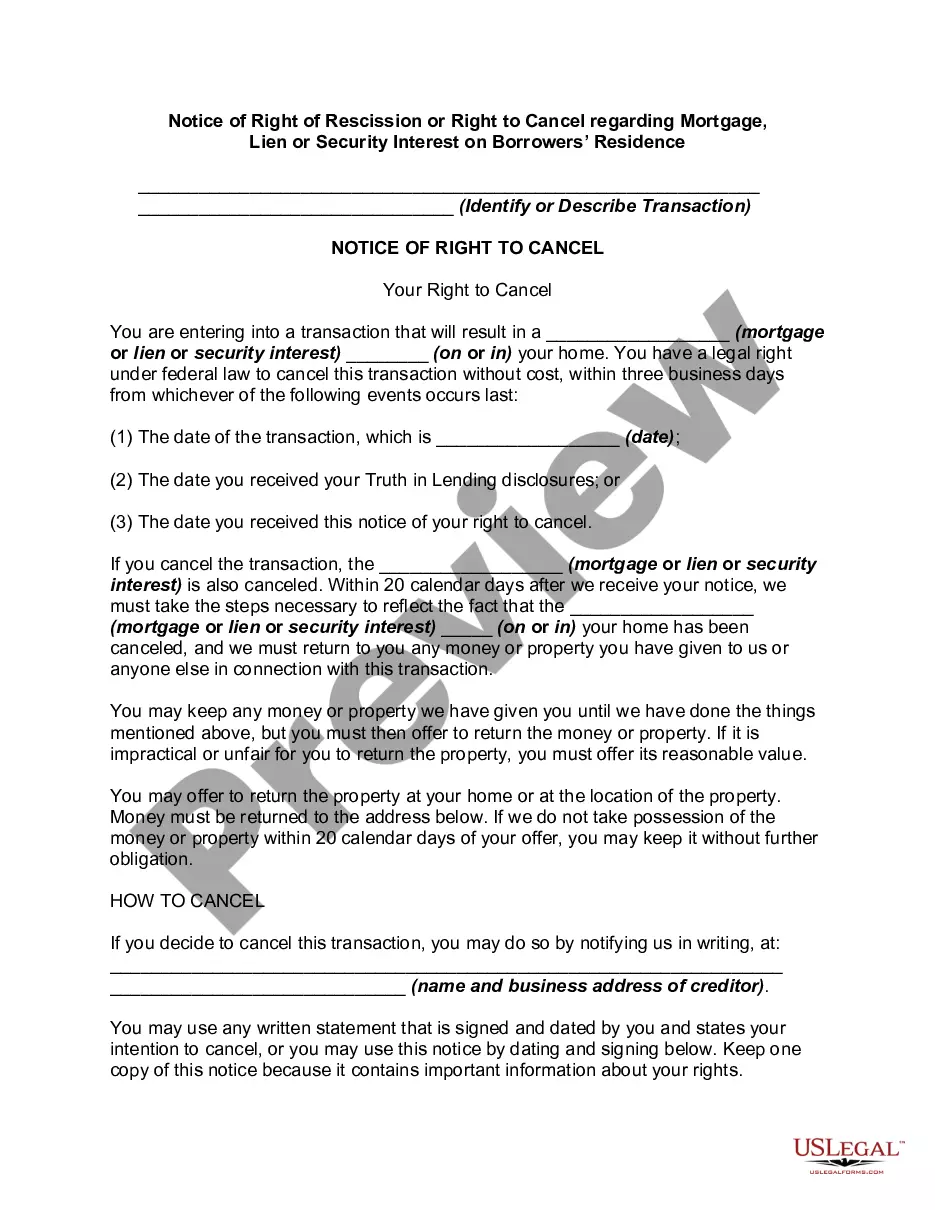

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

Delaware Notice of Right of Rescission or Right to Cancel: Understanding Your Protection as a Borrower In Delaware, the Notice of Right of Rescission or Right to Cancel ensures that borrowers have the opportunity to reconsider their decision after entering into a mortgage, lien, or security interest agreement on their residence. This important document outlines the timeframe within which borrowers can exercise their right to cancel without any penalty or obligation. The primary purpose of the Delaware Notice of Right of Rescission is to protect borrowers from entering into loans or financial arrangements that they may later regret. It gives borrowers the time and opportunity to carefully review the terms of the mortgage, lien, or security interest agreement and seek out professional advice, if desired, before finalizing the transaction. Under Delaware law, there are different types of Notice of Rescission or Right to Cancel, depending on the nature of the loan or financial arrangement: 1. Right of Rescission for Mortgage Loans: For mortgage loans on residential properties, such as home purchases or refinancing agreements, borrowers are granted a three-day right of rescission. This means that borrowers have three business days (excluding Sundays and legal holidays) from the date of signing the mortgage contract to cancel the agreement. If borrowers decide to exercise this right, they must provide written notice to the lender or creditor within the specified timeframe. 2. Right to Cancel for Home Equity Lines of Credit (Helots): In the case of Home Equity Lines of Credit, which allow borrowers to borrow against the equity in their homes, borrowers are entitled to a three-day right to cancel as well. Similar to mortgage loans, borrowers must notify the lender in writing if they decide to exercise this right within three business days of signing the agreement. 3. Right to Cancel for Liens or Security Interests: In situations where borrowers are granting a lien or security interest on their residence, such as when using their home as collateral for a loan, they are usually granted a three-day right to cancel, provided that the transaction is not connected to the purchase or refinancing of the property. It is vital for borrowers to understand their rights and obligations under the Delaware Notice of Right of Rescission. By carefully reading the agreement and seeking professional advice if needed, borrowers can make an informed decision before committing to a long-term financial obligation. If borrowers decide to exercise their right to cancel, they should promptly notify the lender in writing within the specified timeframe mentioned in the Notice. Remember, the Notice of Right of Rescission or Right to Cancel is a valuable protection mechanism designed to promote transparency and safeguard the interests of borrowers in Delaware.Delaware Notice of Right of Rescission or Right to Cancel: Understanding Your Protection as a Borrower In Delaware, the Notice of Right of Rescission or Right to Cancel ensures that borrowers have the opportunity to reconsider their decision after entering into a mortgage, lien, or security interest agreement on their residence. This important document outlines the timeframe within which borrowers can exercise their right to cancel without any penalty or obligation. The primary purpose of the Delaware Notice of Right of Rescission is to protect borrowers from entering into loans or financial arrangements that they may later regret. It gives borrowers the time and opportunity to carefully review the terms of the mortgage, lien, or security interest agreement and seek out professional advice, if desired, before finalizing the transaction. Under Delaware law, there are different types of Notice of Rescission or Right to Cancel, depending on the nature of the loan or financial arrangement: 1. Right of Rescission for Mortgage Loans: For mortgage loans on residential properties, such as home purchases or refinancing agreements, borrowers are granted a three-day right of rescission. This means that borrowers have three business days (excluding Sundays and legal holidays) from the date of signing the mortgage contract to cancel the agreement. If borrowers decide to exercise this right, they must provide written notice to the lender or creditor within the specified timeframe. 2. Right to Cancel for Home Equity Lines of Credit (Helots): In the case of Home Equity Lines of Credit, which allow borrowers to borrow against the equity in their homes, borrowers are entitled to a three-day right to cancel as well. Similar to mortgage loans, borrowers must notify the lender in writing if they decide to exercise this right within three business days of signing the agreement. 3. Right to Cancel for Liens or Security Interests: In situations where borrowers are granting a lien or security interest on their residence, such as when using their home as collateral for a loan, they are usually granted a three-day right to cancel, provided that the transaction is not connected to the purchase or refinancing of the property. It is vital for borrowers to understand their rights and obligations under the Delaware Notice of Right of Rescission. By carefully reading the agreement and seeking professional advice if needed, borrowers can make an informed decision before committing to a long-term financial obligation. If borrowers decide to exercise their right to cancel, they should promptly notify the lender in writing within the specified timeframe mentioned in the Notice. Remember, the Notice of Right of Rescission or Right to Cancel is a valuable protection mechanism designed to promote transparency and safeguard the interests of borrowers in Delaware.