Delaware Sample Letter for Tax Exemption - Review of Applications

Description

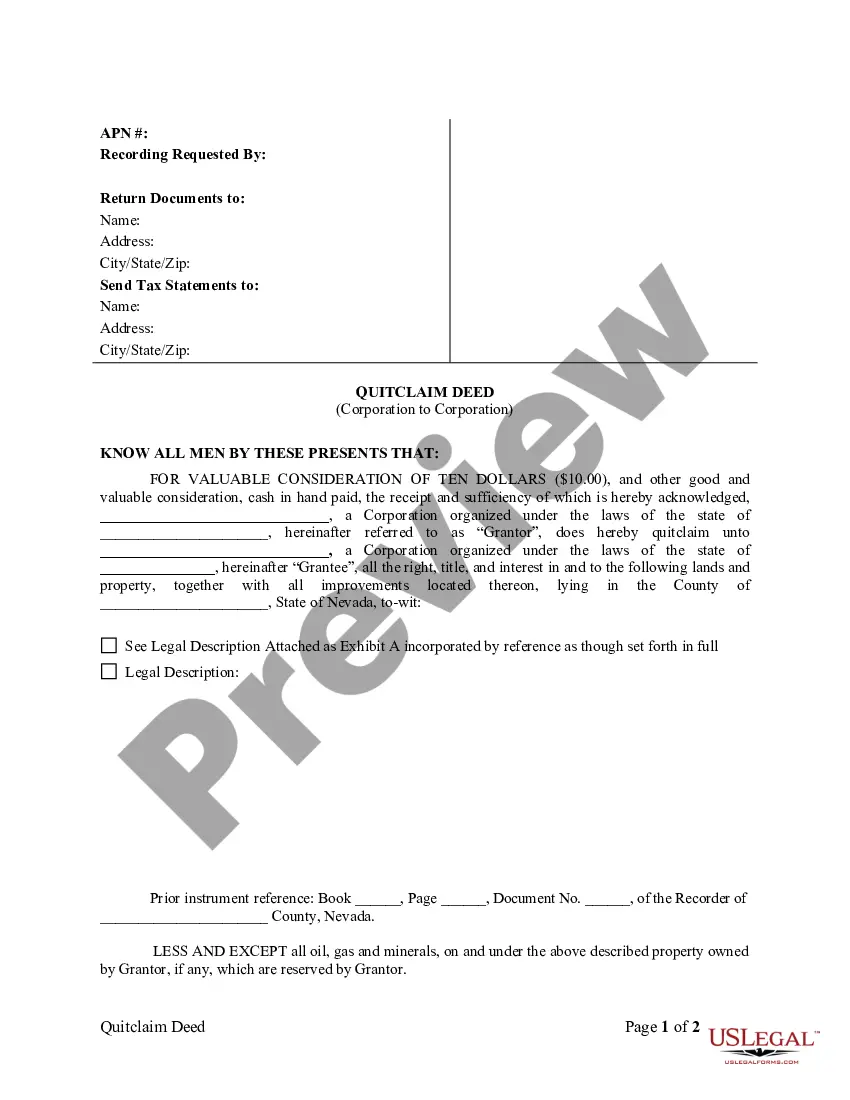

How to fill out Sample Letter For Tax Exemption - Review Of Applications?

Choosing the best legal record web template might be a have difficulties. Naturally, there are a lot of layouts available online, but how will you find the legal kind you need? Use the US Legal Forms site. The service delivers a huge number of layouts, such as the Delaware Sample Letter for Tax Exemption - Review of Applications, that you can use for organization and personal demands. All of the varieties are checked out by experts and meet state and federal needs.

When you are previously listed, log in to the bank account and then click the Down load button to get the Delaware Sample Letter for Tax Exemption - Review of Applications. Make use of your bank account to appear throughout the legal varieties you possess purchased earlier. Visit the My Forms tab of your own bank account and have an additional duplicate in the record you need.

When you are a whole new user of US Legal Forms, allow me to share straightforward recommendations that you should stick to:

- Initially, be sure you have selected the appropriate kind for the area/state. It is possible to check out the form using the Review button and read the form description to make certain this is the right one for you.

- When the kind does not meet your requirements, use the Seach area to discover the correct kind.

- When you are sure that the form is suitable, select the Acquire now button to get the kind.

- Pick the rates prepare you need and type in the necessary details. Make your bank account and pay money for an order making use of your PayPal bank account or charge card.

- Select the data file file format and obtain the legal record web template to the device.

- Complete, revise and print and sign the attained Delaware Sample Letter for Tax Exemption - Review of Applications.

US Legal Forms is definitely the most significant library of legal varieties that you can find numerous record layouts. Use the service to obtain expertly-created files that stick to status needs.

Form popularity

FAQ

Delaware does not impose a state or local sales tax, but does impose a gross receipts tax on the seller of goods (tangible or otherwise) or provider of services in the state.

Every domestic or foreign corporation doing business in Delaware, not specifically exempt under Section 1902(b), Title 30, Delaware Code, is required to file a corporate income tax return (Form 1100 or Form 1100EZ) and pay a tax of 8.7% on its federal taxable income allocated and apportioned to Delaware.

Property Taxes: All real property is subject to tax unless specifically exempt. Personal property, tangible and intangible property is exempt.

There are no state or local sales taxes in Delaware and as such, sales tax exemption certificates and reseller certificates are not applicable to Delaware. Delaware imposes license and gross receipt taxes on the sale of most goods and services.

First-time buyers in Delaware typically qualify for state-level exemptions. For example, Delaware first-time buyers automatically qualify for a state transfer tax exemption on a purchase price up to $400,000. First-time buyers purchasing property worth more than $400,000 will pay 1.25% of the amount above $400,000.

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn't tax earned wages. States with no income tax often make up the lost revenue with other taxes or reduced services.

As of 2023, nine states ? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming ? do not levy a state income tax. New Hampshire Department of Revenue Administraton. Frequently Asked Questions - Interest & Dividend Tax.

Tax exemption cards are printed by the U.S. Government Printing Office at its facility in Washington and mailed via the U.S. Postal Service to the cardholder's residential address.