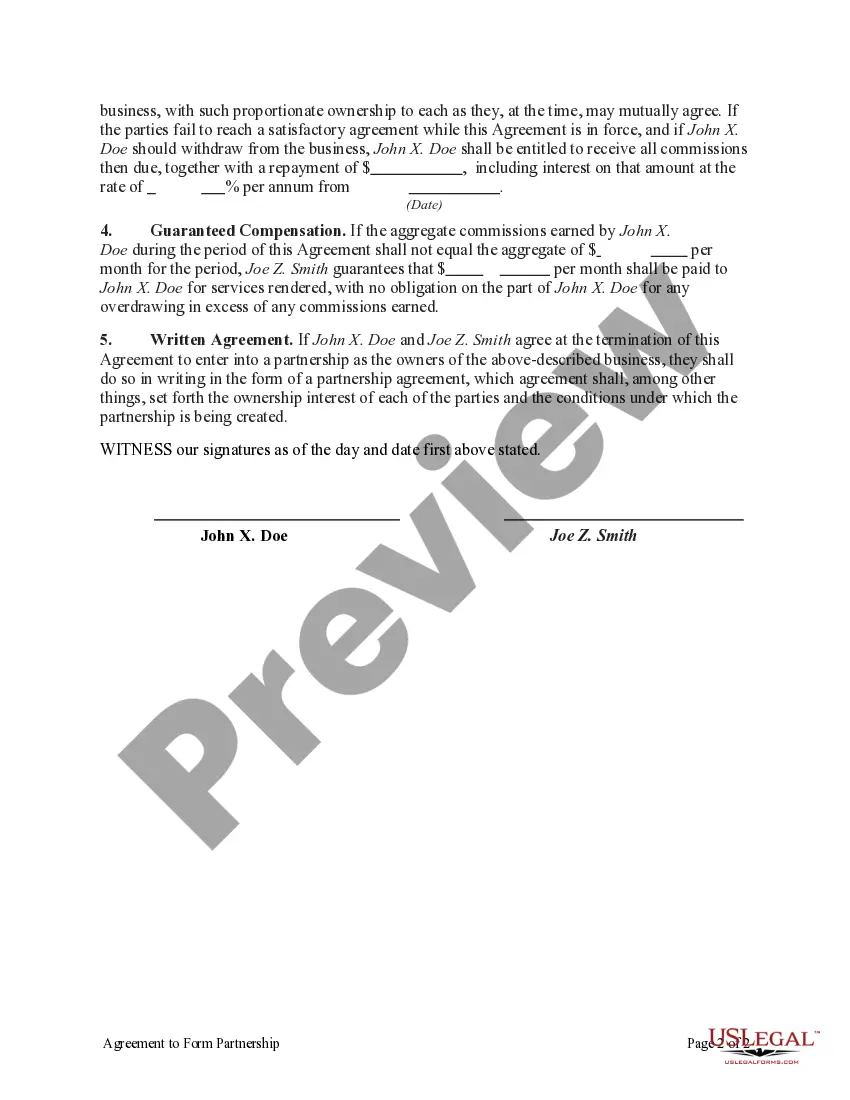

Delaware Agreement to Form Partnership in Future to Conduct Business is a legal document that serves as a preliminary agreement between two or more parties who wish to establish a partnership in the state of Delaware. This agreement outlines the terms, conditions, and intentions of the parties involved regarding the formation of a potential partnership, emphasizing their commitment to move forward with the venture. The Delaware Agreement to Form Partnership in Future to Conduct Business typically includes various key elements such as: 1. Parties Involved: The agreement identifies all the parties involved in the potential partnership, including their legal names, addresses, and contact information. 2. Purpose: This section outlines the purpose of the partnership and the intended business activities the parties plan to engage in once the partnership is formally established. 3. Contributions: Each party's contribution, such as capital, assets, expertise, or other resources, should be clearly defined. These contributions may be financial, intellectual property, equipment, or any other valuable item, and their worth should be quantified if possible. 4. Management and Control: The agreement may specify how the partnership will be managed and the decision-making process once the partnership is formed. It could cover aspects like voting rights, profit distribution, and the roles and responsibilities of each partner. 5. Financial Aspects: This section addresses the division of profits and losses, tax implications, and the financial arrangements between the partners. It may also include provisions for additional capital contributions or the withdrawal of funds from the partnership. 6. Duration: The agreement should establish the duration of the partnership and any provisions for its termination or dissolution. It may include provisions for renewing or extending the partnership. Types of Delaware Agreement to Form Partnership in Future to Conduct Business: 1. General Partnership Agreement: This is the most common type of partnership agreement, where all partners have shared equal rights and responsibilities in the management and decision-making process. 2. Limited Partnership Agreement: In this type of agreement, two or more partners form a partnership, but some partners (limited partners) have limited liability and do not participate in the day-to-day management of the business. There must also be at least one general partner who assumes full liability and retains management responsibilities. 3. Limited Liability Partnership (LLP) Agreement: An LLP agreement provides limited liability protection to the partners, protecting them from personal liability for business debts and claims resulting from the actions of other partners. 4. Joint Venture Agreement: This agreement is similar to a partnership agreement, but it typically involves a specific project or venture rather than a long-term partnership. Partners collaborate on a particular undertaking, with a defined start and end date, and share the associated risks and rewards. In summary, a Delaware Agreement to Form Partnership in Future to Conduct Business is a legally binding document that outlines the intentions and terms of a partnership's establishment in Delaware. By carefully considering the key components mentioned above, parties can ensure a clear understanding of their roles, responsibilities, and expectations before entering into a formal partnership.

Delaware Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Delaware Agreement To Form Partnership In Future To Conduct Business?

Discovering the right legal record template could be a struggle. Of course, there are tons of templates accessible on the Internet, but how will you get the legal form you will need? Take advantage of the US Legal Forms website. The service delivers a large number of templates, like the Delaware Agreement to Form Partnership in Future to Conduct Business, that can be used for organization and personal needs. All of the kinds are checked by pros and fulfill federal and state requirements.

Should you be already signed up, log in to your account and click the Acquire key to find the Delaware Agreement to Form Partnership in Future to Conduct Business. Make use of your account to check through the legal kinds you have purchased previously. Go to the My Forms tab of the account and obtain one more version of your record you will need.

Should you be a new consumer of US Legal Forms, allow me to share simple instructions that you can adhere to:

- First, make certain you have chosen the proper form to your metropolis/county. You may look over the shape making use of the Preview key and read the shape explanation to guarantee it is the best for you.

- In case the form is not going to fulfill your needs, utilize the Seach industry to find the right form.

- When you are certain that the shape is acceptable, click the Buy now key to find the form.

- Select the prices strategy you need and enter in the needed information. Create your account and pay money for an order with your PayPal account or credit card.

- Select the data file formatting and down load the legal record template to your system.

- Complete, change and print and sign the obtained Delaware Agreement to Form Partnership in Future to Conduct Business.

US Legal Forms is the largest local library of legal kinds that you can see various record templates. Take advantage of the service to down load appropriately-made files that adhere to state requirements.