Title: A Comprehensive Guide to Delaware Sample Letters for Payment Schedules Introduction: Delaware sample letters for payment schedules serve as indispensable tools for businesses, organizations, or individuals in Delaware seeking to establish clear and transparent payment arrangements. These sample letters provide a framework for outlining payment terms, due dates, and other related details to ensure successful financial transactions. This article will explore the various types of Delaware sample letters for payment schedules and detail their importance in facilitating smooth payment processes. Section 1: Delaware Sample Letter for Payment Schedule — General Format The general format for a Delaware sample letter for payment schedule typically includes relevant contact information, a formal salutation, and concise yet comprehensive sections addressing specific aspects of the payment schedule. Key components often covered include the payment terms, installment amounts, due dates, and instructions for making payments. These letters can be modified to suit specific payment arrangements. Section 2: Types of Delaware Sample Letters for Payment Schedule 1. Business-to-client payment schedule letter: This type of letter is used by businesses in Delaware when outlining the payment schedule for their clients or customers. It helps maintain transparency and ensures both parties are on the same page regarding payment expectations. 2. Business-to-vendor payment schedule letter: Businesses in Delaware may also utilize this letter to establish a payment schedule with their vendors or suppliers. By setting clear expectations, businesses can mitigate potential disputes and maintain healthy relationships with their partners. 3. Landlord-to-tenant payment schedule letter: Landlords in Delaware often use this letter to communicate the payment schedule to their tenants. It outlines due dates, acceptable payment methods, late fee policies, and other relevant information to ensure consistent and timely rental payments. 4. Loan-repayment payment schedule letter: Financial institutions, lenders, or individuals that have extended loans in Delaware may employ this letter to provide the borrower with a clear repayment schedule. It details monthly installments, interest rates, dates, and other related terms to ensure prompt loan repayment. Section 3: Importance of Delaware Sample Letters for Payment Schedule 1. Clarity and transparency: These letters foster transparency by clearly stating the payment terms, due dates, and any associated penalties. This mitigates misunderstandings and disputes related to payment expectations. 2. Legal protection: A Delaware sample letter for payment schedule can serve as a legally binding document when both parties agree to its terms. In case of any payment-related issues, the letter can be referred to resolve disputes or seek legal remedies. 3. Professionalism and documentation: Utilizing a sample letter for payment schedules demonstrates professionalism and allows for keeping a detailed record of payment arrangements. This documentation becomes valuable when the need for future references arises. Conclusion: Delaware sample letters for payment schedules are essential templates for establishing systematic and transparent payment plans. Whether used by businesses, organizations, landlords, or individuals, these letters ensure both parties are aware of and adhere to the agreed-upon payment terms. By leveraging sample letters, Delaware entities can maintain healthy financial relationships, mitigate disputes, and foster a more efficient payment process.

Delaware Sample Letter for Payment Schedule

Description

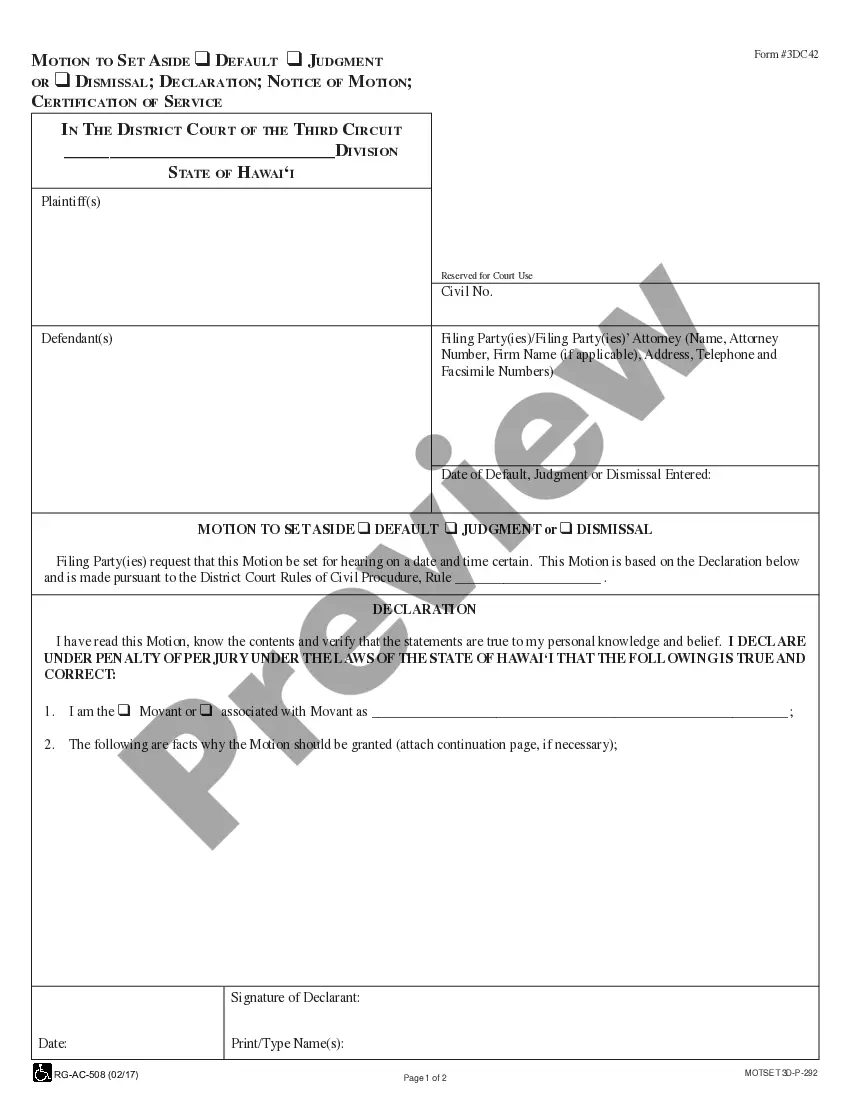

How to fill out Delaware Sample Letter For Payment Schedule?

Choosing the right lawful file format can be a have a problem. Naturally, there are plenty of web templates accessible on the Internet, but how will you find the lawful form you require? Make use of the US Legal Forms website. The services delivers thousands of web templates, such as the Delaware Sample Letter for Payment Schedule, which you can use for organization and personal requires. All the kinds are checked by specialists and meet state and federal requirements.

If you are currently authorized, log in to your profile and then click the Download button to find the Delaware Sample Letter for Payment Schedule. Use your profile to appear through the lawful kinds you possess acquired previously. Check out the My Forms tab of your profile and get an additional copy of the file you require.

If you are a brand new end user of US Legal Forms, listed below are basic recommendations that you can adhere to:

- Very first, be sure you have chosen the proper form to your metropolis/area. You can check out the shape utilizing the Review button and look at the shape outline to make certain this is basically the best for you.

- In the event the form fails to meet your expectations, utilize the Seach field to discover the appropriate form.

- When you are certain that the shape is proper, click the Get now button to find the form.

- Opt for the rates plan you would like and type in the essential information and facts. Make your profile and buy the order with your PayPal profile or charge card.

- Pick the submit format and acquire the lawful file format to your system.

- Total, edit and produce and indication the obtained Delaware Sample Letter for Payment Schedule.

US Legal Forms will be the most significant catalogue of lawful kinds in which you can find different file web templates. Make use of the company to acquire appropriately-created papers that adhere to express requirements.