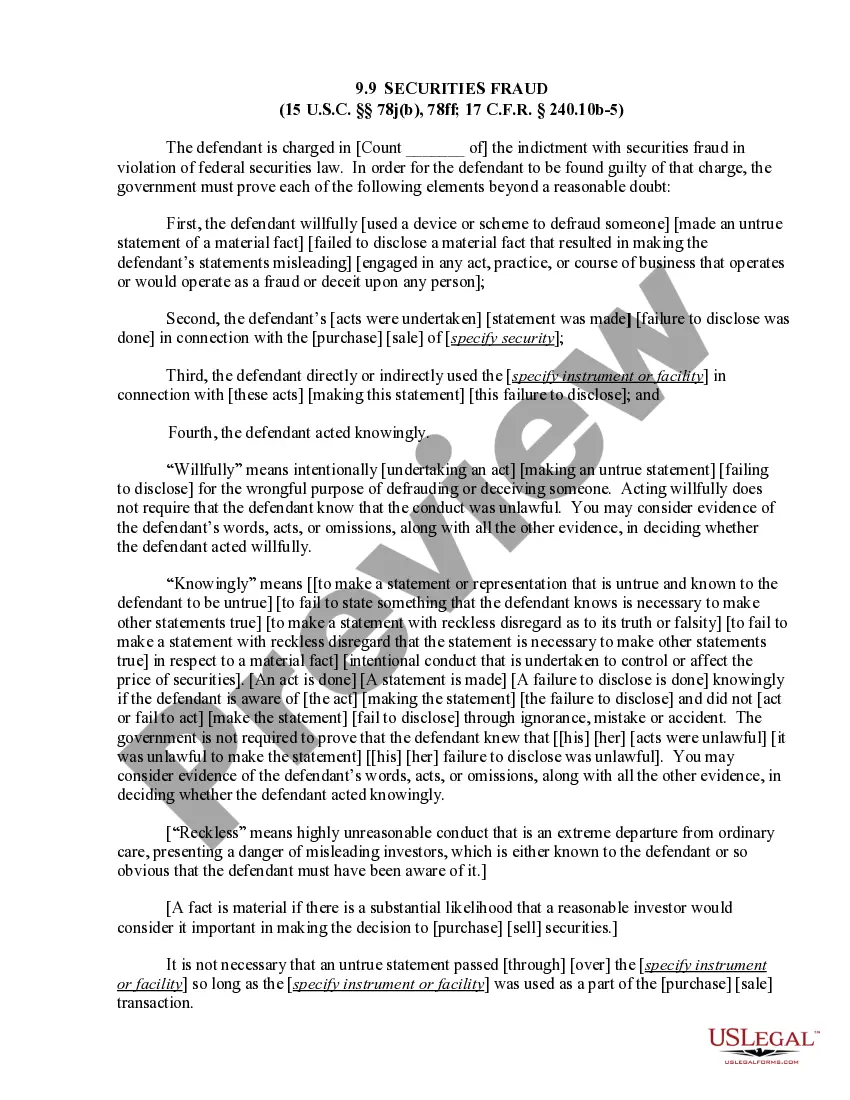

Delaware Collection Report: Exploring the Comprehensive Evaluation of Collections Delaware Collection Report refers to a comprehensive assessment of collections within the state of Delaware, focusing on the efficiency, accuracy, and effectiveness of the collections process. It provides valuable insights into the management of debts owed to various organizations in Delaware, including government agencies, financial institutions, and businesses. This report plays a crucial role in understanding the overall collection environment in Delaware and assists in making informed decisions related to debt recovery, financial planning, and resource allocation. It offers a detailed analysis of collection practices, policies, and procedures, aiming to identify areas for improvement, streamline operations, and enhance the overall debt recovery process. The Delaware Collection Report encompasses a wide range of debt types, such as tax liabilities, unpaid fines, overdue loans, delinquent accounts, and outstanding payments. By examining these different categories, the report offers an accurate representation of the financial landscape in Delaware, aiding concerned entities in devising strategies to optimize their collection efforts, minimize losses, and maximize revenue generation. Types of Delaware Collection Reports: 1. State Tax Collection Report: This report focuses specifically on the collection of state taxes owed by individuals and businesses in Delaware. It evaluates the effectiveness of tax collection practices and identifies areas for improvement. 2. Unpaid Fines Collection Report: Consisting of fines and penalties from various agencies and courts, this report assesses the efficiency of fine collection processes, identifies potential bottlenecks, and suggests strategies for timely recovery. 3. Loan Collection Report: This report entails an examination of loan collection activities conducted by financial institutions, including banks and credit unions. It evaluates the loan recovery performance and provides recommendations to enhance collection efforts. 4. Delinquent Account Collection Report: Focusing on overdue payments owed to businesses and service providers, this report analyzes the efficiency of debt recovery techniques, highlights trends, and suggests strategies to minimize delinquencies. 5. Government Debt Collection Report: This report concentrates on the collection efforts of government agencies at various levels, including municipal, county, and state-level organizations. It assesses the effectiveness of debt recovery methods and recommends improvements to increase collection rates. In conclusion, the Delaware Collection Report serves as an indispensable tool for evaluating the collection practices across different sectors in the state. Through its in-depth analysis and insights, it assists organizations, government bodies, and financial institutions in enhancing their debt recovery efficiency, optimizing resources, and ensuring fiscal stability.

Delaware Collection Report

Description

How to fill out Delaware Collection Report?

US Legal Forms - one of many biggest libraries of lawful forms in the States - delivers a variety of lawful papers themes you can obtain or produce. Making use of the website, you may get 1000s of forms for enterprise and specific functions, sorted by categories, suggests, or search phrases.You will discover the latest variations of forms like the Delaware Collection Report in seconds.

If you already possess a membership, log in and obtain Delaware Collection Report through the US Legal Forms library. The Obtain button can look on each and every kind you perspective. You get access to all previously downloaded forms inside the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, allow me to share basic guidelines to get you started off:

- Be sure you have chosen the proper kind for the town/region. Select the Preview button to analyze the form`s content. Browse the kind description to actually have selected the right kind.

- When the kind does not match your specifications, utilize the Search area near the top of the monitor to find the the one that does.

- Should you be satisfied with the form, validate your option by clicking on the Buy now button. Then, opt for the pricing program you prefer and supply your references to register on an accounts.

- Approach the transaction. Make use of charge card or PayPal accounts to perform the transaction.

- Choose the file format and obtain the form on the product.

- Make modifications. Fill up, modify and produce and sign the downloaded Delaware Collection Report.

Each and every web template you put into your account does not have an expiry date and is the one you have eternally. So, if you want to obtain or produce yet another copy, just go to the My Forms area and click around the kind you will need.

Obtain access to the Delaware Collection Report with US Legal Forms, one of the most substantial library of lawful papers themes. Use 1000s of expert and state-particular themes that fulfill your small business or specific requirements and specifications.