Dear [Insurance Provider], I am writing to request a detailed description of the Delaware Sample Letter for Mobile Home Insurance Policy. As a mobile homeowner in Delaware, I want to ensure that I have comprehensive coverage for my valuable asset. Please provide detailed information regarding the different types of policies available in the state, as well as their specific features and benefits. 1. Basic Delaware Mobile Home Insurance Policy: This type of policy provides essential coverage for a mobile home in Delaware. It typically includes protection against damages caused by fire, windstorms, hail, theft, and vandalism. Additionally, it may cover personal belongings and liability for accidents that occur on your property. Please provide specific details on the coverage limits and deductibles associated with this policy. 2. Comprehensive Delaware Mobile Home Insurance Policy: This policy is designed to offer broader protection and typically includes all the coverage options provided by the basic policy, with additional features. These additional features may include coverage for accidental water damage, falling objects, or damage caused by freezing pipes. Please provide comprehensive details on the coverage options, exclusions, and any additional benefits offered through this policy. 3. Replacement Cost Delaware Mobile Home Insurance Policy: This type of policy is specifically focused on providing coverage for the replacement cost of your mobile home, rather than its actual cash value. In the event of a covered loss, this policy ensures that you receive the amount necessary to replace or repair your mobile home without considering depreciation. Please outline the specific benefits, limitations, and exclusions associated with this policy. 4. Named Perils Delaware Mobile Home Insurance Policy: A named perils policy covers specific risks that are explicitly mentioned in the policy. This means coverage is only provided for the risks specifically listed, such as fire, windstorms, or theft. Please list and explain the named perils covered under this policy, along with any limitations or exclusions to be aware of. I would appreciate it if you could also include information on any additional coverage options available, such as flood insurance or earthquake coverage, as these perils can have a serious impact on mobile homes in Delaware. Moreover, please provide details on the process for filing a claim, any discounts or incentives available, and any documentation required for obtaining and renewing mobile home insurance policies in Delaware. Thank you for your attention to this matter. I look forward to receiving the detailed description of the Delaware Sample Letter for Mobile Home Insurance Policy to make an informed decision regarding my insurance needs. Sincerely, [Your Name]

Delaware Sample Letter for Mobile Home Insurance Policy

Description

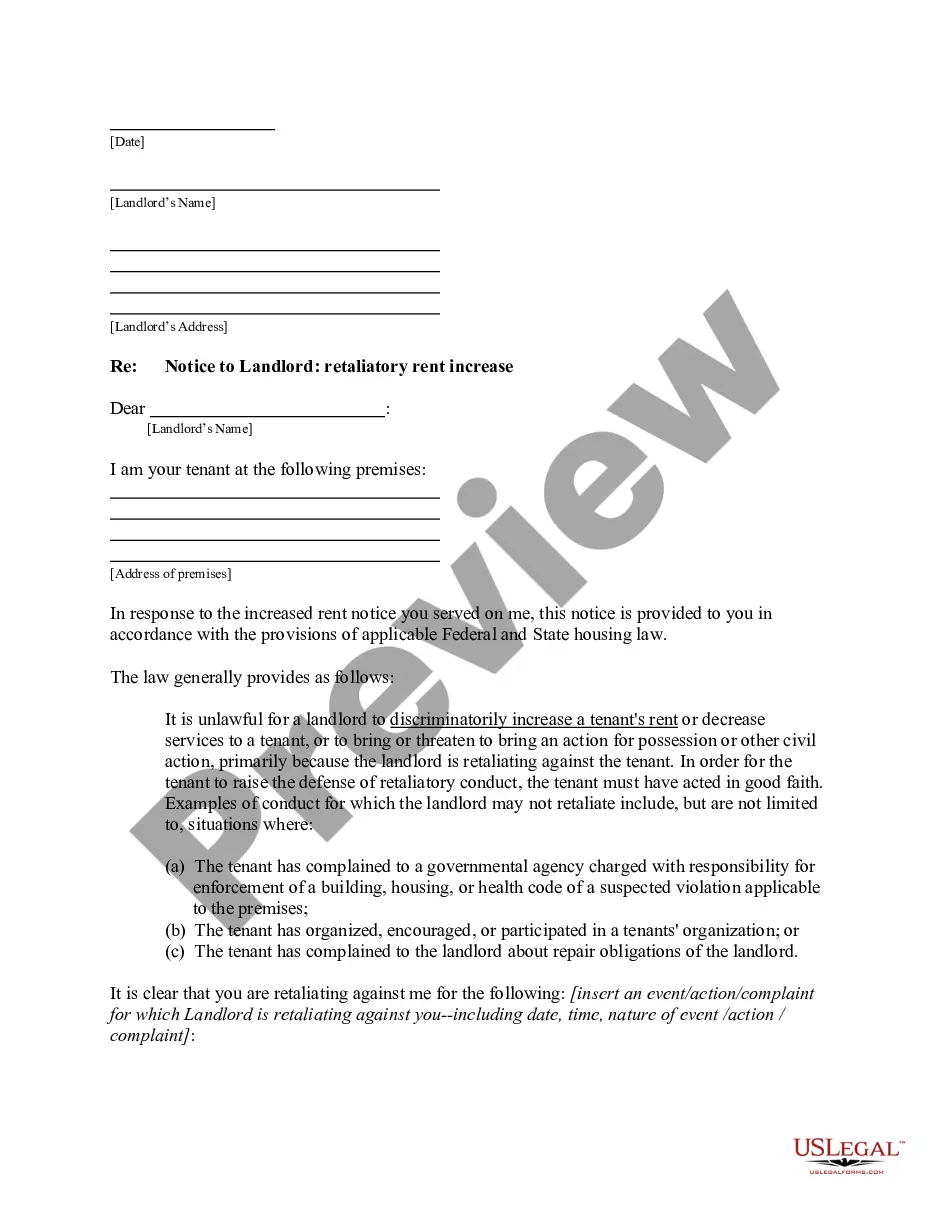

How to fill out Delaware Sample Letter For Mobile Home Insurance Policy?

If you want to comprehensive, down load, or print legitimate file themes, use US Legal Forms, the most important collection of legitimate types, that can be found on the web. Make use of the site`s easy and convenient lookup to discover the paperwork you need. Different themes for business and person reasons are categorized by types and claims, or key phrases. Use US Legal Forms to discover the Delaware Sample Letter for Mobile Home Insurance Policy in just a couple of clicks.

Should you be presently a US Legal Forms consumer, log in for your accounts and click the Down load button to get the Delaware Sample Letter for Mobile Home Insurance Policy. You can even gain access to types you earlier delivered electronically from the My Forms tab of your accounts.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your right city/region.

- Step 2. Use the Preview choice to check out the form`s information. Don`t forget to read through the description.

- Step 3. Should you be not happy with the type, take advantage of the Lookup area near the top of the monitor to locate other types in the legitimate type web template.

- Step 4. When you have located the form you need, go through the Buy now button. Opt for the prices prepare you favor and put your credentials to sign up on an accounts.

- Step 5. Procedure the financial transaction. You may use your bank card or PayPal accounts to perform the financial transaction.

- Step 6. Select the file format in the legitimate type and down load it in your device.

- Step 7. Total, modify and print or indicator the Delaware Sample Letter for Mobile Home Insurance Policy.

Each legitimate file web template you get is the one you have permanently. You might have acces to each type you delivered electronically within your acccount. Click on the My Forms area and choose a type to print or down load once more.

Be competitive and down load, and print the Delaware Sample Letter for Mobile Home Insurance Policy with US Legal Forms. There are thousands of expert and status-specific types you can utilize for the business or person needs.

Form popularity

FAQ

How much is homeowners insurance in Delaware? The average cost of homeowners insurance in Delaware is $918 per year, or $77 a month, for an insurance policy with $300,000 in dwelling coverage. This means insurance in Delaware is 48% cheaper than the national average per year.

As Commissioner, he leads the office charged with protecting, educating, and advocating for Delaware residents. The Department offers free Medicare counseling services and works on the Health Insurance Marketplace, provides arbitration services to residents, and fights and prevents fraud.

Average annual homeowners insurance rates by state CompanyTotal annual average$750,000 dwelling coverageCalifornia$1,222$1,890Colorado$2,463$3,666Connecticut$1,333$2,031Delaware$1,142$1,87446 more rows ?

Delaware doesn't require home insurance by law, but if you finance your home, your lender may require you to have a homeowners insurance policy in place. Your policy's coverages are designed to safeguard your property and assets.

Coverage D ? Loss of Use This coverage will help with additional living expenses if your home is damaged by a peril insured against to the extent that you cannot live in your home.

Our cost research shows that Delaware drivers pay an average of $2,169 per year or $181 each month for full coverage car insurance. Delaware's average auto insurance rate is about 25% higher than the national average of $1,730 per year.

How much is homeowners insurance in Delaware? The average cost of homeowners insurance in Delaware is $918 per year, or $77 a month, for an insurance policy with $300,000 in dwelling coverage. This means insurance in Delaware is 48% cheaper than the national average per year.