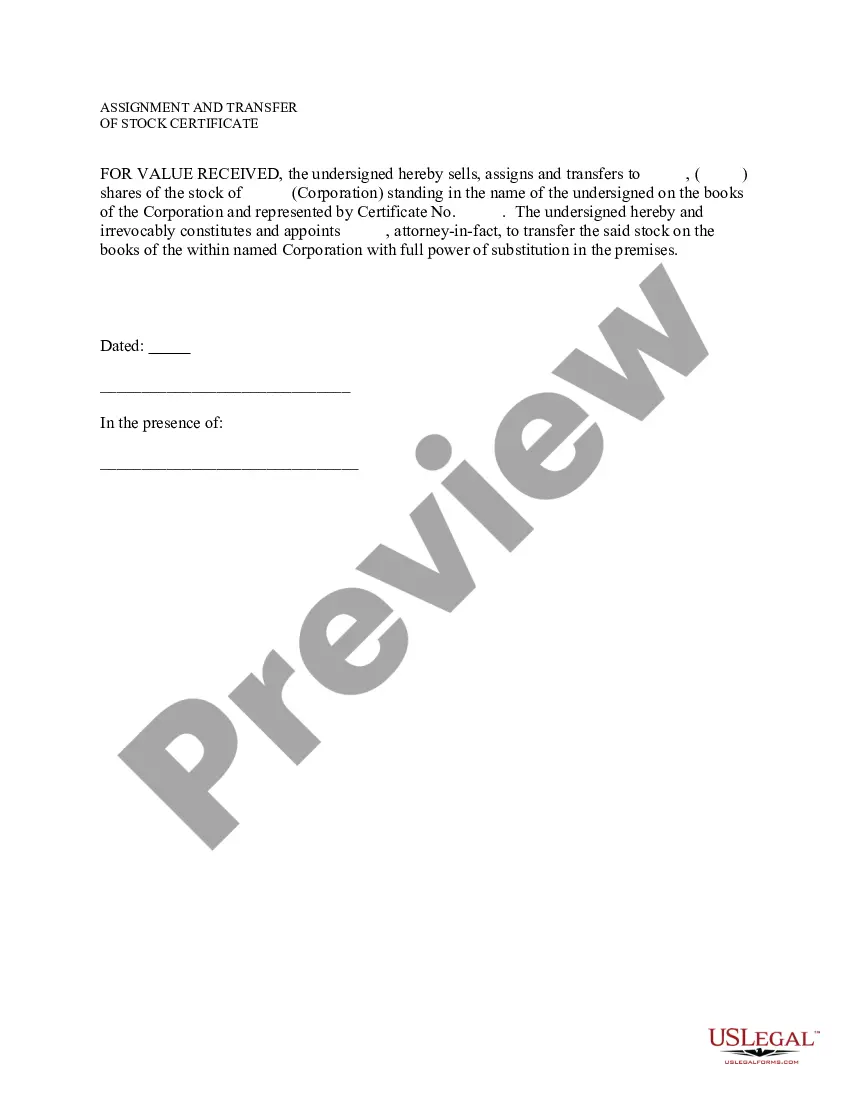

Delaware Sample Letter for Assignment and Transfer of Stock Certificate

Description

How to fill out Sample Letter For Assignment And Transfer Of Stock Certificate?

US Legal Forms - one of several largest libraries of legal types in the United States - provides a wide range of legal record themes you are able to down load or print out. Using the web site, you can get a huge number of types for organization and person uses, sorted by categories, claims, or search phrases.You will find the newest versions of types much like the Delaware Sample Letter for Assignment and Transfer of Stock Certificate within minutes.

If you have a subscription, log in and down load Delaware Sample Letter for Assignment and Transfer of Stock Certificate through the US Legal Forms collection. The Acquire key can look on each type you see. You have accessibility to all previously delivered electronically types inside the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, here are basic recommendations to help you began:

- Make sure you have selected the best type for your area/county. Go through the Preview key to analyze the form`s content material. Browse the type information to ensure that you have chosen the appropriate type.

- In case the type doesn`t fit your demands, take advantage of the Look for field on top of the display screen to obtain the one that does.

- When you are pleased with the shape, verify your selection by clicking the Get now key. Then, pick the prices program you like and give your accreditations to register on an bank account.

- Process the financial transaction. Make use of your charge card or PayPal bank account to complete the financial transaction.

- Choose the format and down load the shape on the product.

- Make adjustments. Fill up, edit and print out and indicator the delivered electronically Delaware Sample Letter for Assignment and Transfer of Stock Certificate.

Each and every web template you included with your money does not have an expiry day and is the one you have permanently. So, if you want to down load or print out an additional duplicate, just check out the My Forms section and then click around the type you need.

Get access to the Delaware Sample Letter for Assignment and Transfer of Stock Certificate with US Legal Forms, one of the most extensive collection of legal record themes. Use a huge number of skilled and state-certain themes that meet your organization or person requires and demands.

Form popularity

FAQ

In order to cash in the stock, you need to fill out the transfer form on the back of the certificate and have it notarized. Once complete, send the notarized certificate to the transfer agent, who will register the stock to you as owner.

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

If the share certificate is registered in your name, you have three options: Keep it in a safe place until you are ready to trade it. Deposit the shares into an existing brokerage account. Open a brokerage account and deposit the shares.

If you hold stocks in physical certificate form and want to sell them, you will have to send the certificate to your broker or the company's transfer agent to execute the sale. You probably will need to get your signature guaranteed. Once the brokerage firm has the stock certificates, the sell order can be executed.

This is to inform you that I,???????.. , the Shareholder of ???????..shares in your Company, request you to transfer my ???????? Equity Shares held in the Company for a total consideration of Rs ????????

Dematerialisation means your ownership will no longer be proven in material form through the holding of a paper certificate, but virtually on a share register. Anyone holding shares in US companies will be familiar with the format. Ireland is an outlier in this respect, along with the UK.

Individuals can also buy a stock certificate and gift that to the recipient, but this is expensive and requires more effort for both the giver and receiver. To transfer a physical stock certificate, the owner needs to sign it in the presence of a guarantor, such as their bank or a stock broker.

How to convert certificated shares into digital ones Find a company that will allow you to transfer your paper shares. ... Set up an investment or nominee account. ... Check that the provider you've chosen will accept your shares. ... Fill out a stock deposit instruction form.