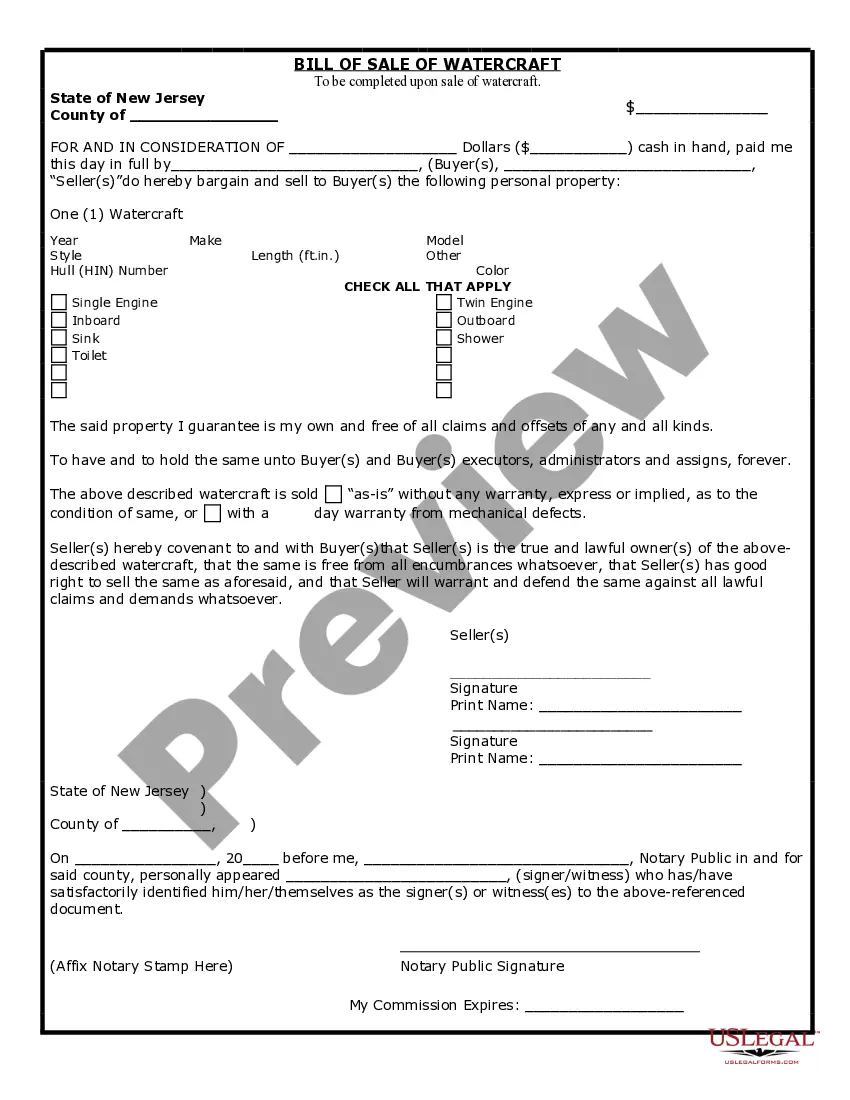

A Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default is an important legal document that outlines the process a lender follows when selling the collateral provided by a borrower to secure a loan. This notice is specific to non-consumer goods, which refers to assets that are not typically used for personal, household, or family purposes. The purpose of a Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default is to inform all interested parties, including the borrower and any other lien holders, about the upcoming private sale of the collateral. It is crucial to follow the proper legal procedures to ensure transparency and fairness in the sale process. When drafting a Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default, the following information should be included: 1. Identification of Parties: Clearly state the names and addresses of both the lender and the borrower involved in the loan agreement. 2. Collateral Description: Provide a detailed description of the non-consumer goods being used as collateral, including any unique identifiers such as serial numbers, make, model, or other relevant details. 3. Loan Agreement Details: Include the date of the loan agreement, the loan amount, and any specific terms related to the collateral provided. 4. Default Information: Clearly state that the borrower is in default of their loan obligations and highlight the specific reasons for the default, which may include failure to make payments, breach of contract, or violation of any agreed-upon covenants. 5. Intention to Sell: Clearly state the lender's intention to private sell the collateral to recover the outstanding debt owed by the borrower. Specify the date, time, and location of the private sale. 6. Notice to Borrower and Other Lien holders: Clearly state that the borrower and any other lien holders have the right to object to the private sale within a certain timeframe. Provide instructions on how to submit an objection. 7. Sale Process: Outline the specific process the lender will follow in conducting the private sale, including any terms and conditions that may apply. This may include how bids will be accepted, increments of bidding, and any legal requirements that must be met. 8. Allocation of Proceeds: Specify how the proceeds from the sale will be allocated among the outstanding debt, costs of the sale, and any other applicable expenses or obligations. Different types or variations of the Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default may not have specific names or categorizations. However, the content and format may vary depending on the nature of the collateral or any unique circumstances of the loan agreement or default. It is crucial to consult with legal professionals or utilize pre-approved templates specific to Delaware law when creating a Notice of Private Sale of Collateral (Non-consumer Goods) on Default to ensure compliance with all relevant regulations and requirements.

Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default

Description

How to fill out Delaware Notice Of Private Sale Of Collateral (Non-consumer Goods) On Default?

Discovering the right legal document format can be a have difficulties. Obviously, there are tons of themes available online, but how can you get the legal kind you will need? Take advantage of the US Legal Forms internet site. The services gives thousands of themes, for example the Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default, that you can use for enterprise and private requirements. All the varieties are checked out by specialists and meet up with federal and state needs.

If you are presently authorized, log in to the accounts and click the Obtain option to obtain the Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default. Use your accounts to check through the legal varieties you have acquired previously. Go to the My Forms tab of your accounts and acquire one more backup from the document you will need.

If you are a whole new customer of US Legal Forms, here are straightforward guidelines that you can stick to:

- Initial, be sure you have chosen the appropriate kind for the metropolis/region. You are able to check out the shape using the Preview option and read the shape information to make sure it is the right one for you.

- In case the kind is not going to meet up with your expectations, make use of the Seach area to find the proper kind.

- When you are positive that the shape is acceptable, click the Acquire now option to obtain the kind.

- Pick the pricing strategy you would like and enter the necessary information. Create your accounts and pay for the order using your PayPal accounts or charge card.

- Pick the data file formatting and obtain the legal document format to the gadget.

- Comprehensive, edit and printing and signal the acquired Delaware Notice of Private Sale of Collateral (Non-consumer Goods) on Default.

US Legal Forms is definitely the largest collection of legal varieties where you can find a variety of document themes. Take advantage of the service to obtain appropriately-manufactured paperwork that stick to state needs.