Delaware Security Interest Subordination Agreement

Description

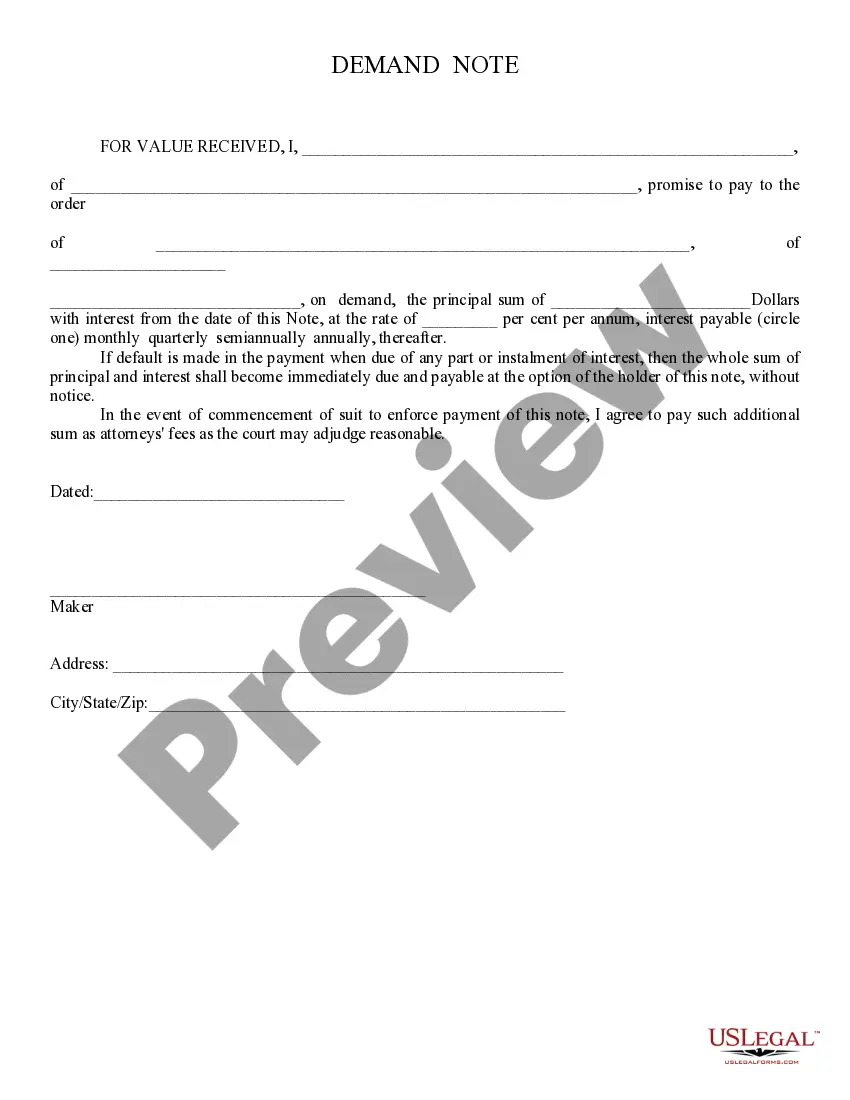

How to fill out Security Interest Subordination Agreement?

Are you presently in a placement that you require documents for possibly organization or specific reasons virtually every day time? There are a variety of legal record layouts available online, but getting ones you can rely on is not easy. US Legal Forms delivers a large number of develop layouts, like the Delaware Security Interest Subordination Agreement, which are created in order to meet state and federal demands.

Should you be currently informed about US Legal Forms site and get a merchant account, simply log in. Afterward, you can acquire the Delaware Security Interest Subordination Agreement template.

Should you not provide an account and need to begin to use US Legal Forms, follow these steps:

- Get the develop you want and ensure it is to the correct town/area.

- Use the Review option to examine the shape.

- Read the explanation to actually have chosen the proper develop.

- In the event the develop is not what you are searching for, make use of the Search industry to find the develop that meets your needs and demands.

- Whenever you discover the correct develop, just click Get now.

- Select the prices plan you want, complete the specified details to generate your money, and buy the transaction with your PayPal or Visa or Mastercard.

- Select a hassle-free file format and acquire your duplicate.

Locate all of the record layouts you may have purchased in the My Forms menu. You can obtain a extra duplicate of Delaware Security Interest Subordination Agreement anytime, if required. Just select the needed develop to acquire or printing the record template.

Use US Legal Forms, one of the most comprehensive selection of legal forms, to save lots of time as well as prevent faults. The services delivers professionally produced legal record layouts which can be used for a range of reasons. Produce a merchant account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

Subordination agreement is a contract which guarantees senior debt will be paid before other ?subordinated? debt if the debtor becomes bankrupt.

Subordinate Security Instruments means the ?Mortgage?, ?Pledge Agreement? and each other ?Loan Documents? as defined in the Subordinate Agreement (other than the Subordinate Agreement and the Subordinate Guarantee) and any documents that are designated under the Subordinate Agreement as ?Subordinate Security ...

SECURED PARTY'S RIGHTS ON DISPOSITION OF COLLATERAL AND IN PROCEEDS. (a) [Disposition of collateral: continuation of security interest or agricultural lien; proceeds.] (2) a security interest attaches to any identifiable proceeds of collateral.

Subordinated Interest means any Equity Interest that is subordinated by court order or otherwise to all other Equity Interests, in respect of which a request or motion to subordinate may be filed for up to ninety (90) days after the Effective Date, unless extended by the Court.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

? A security interest in a certificated security in registered form is perfected by delivery when delivery of the certificated security occurs under Section 8-301 and remains perfected by delivery until the debtor obtains possession of the security certificate.

Subordinated debt (also known as a subordinated debenture) is an unsecured loan or bond that ranks below other, more senior loans or securities with respect to claims on assets or earnings. Subordinated debentures are thus also known as junior securities.

Security subordination means that the subordinated lender agrees that its security interest in the shared collateral is fully subordinated to the security interest of the senior lender.

What Is a Subordination Agreement? A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on their payments or declares bankruptcy.

Filing a Financing Statement to Perfect the Security Interest. Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.