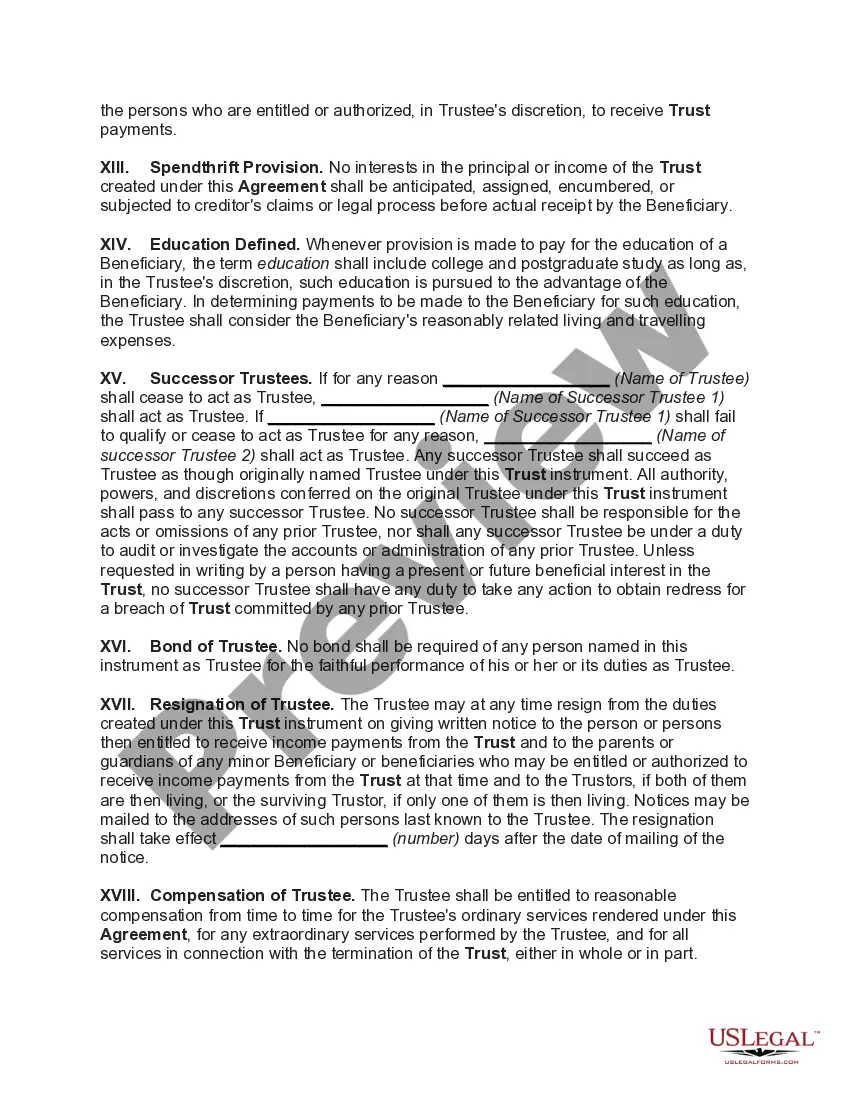

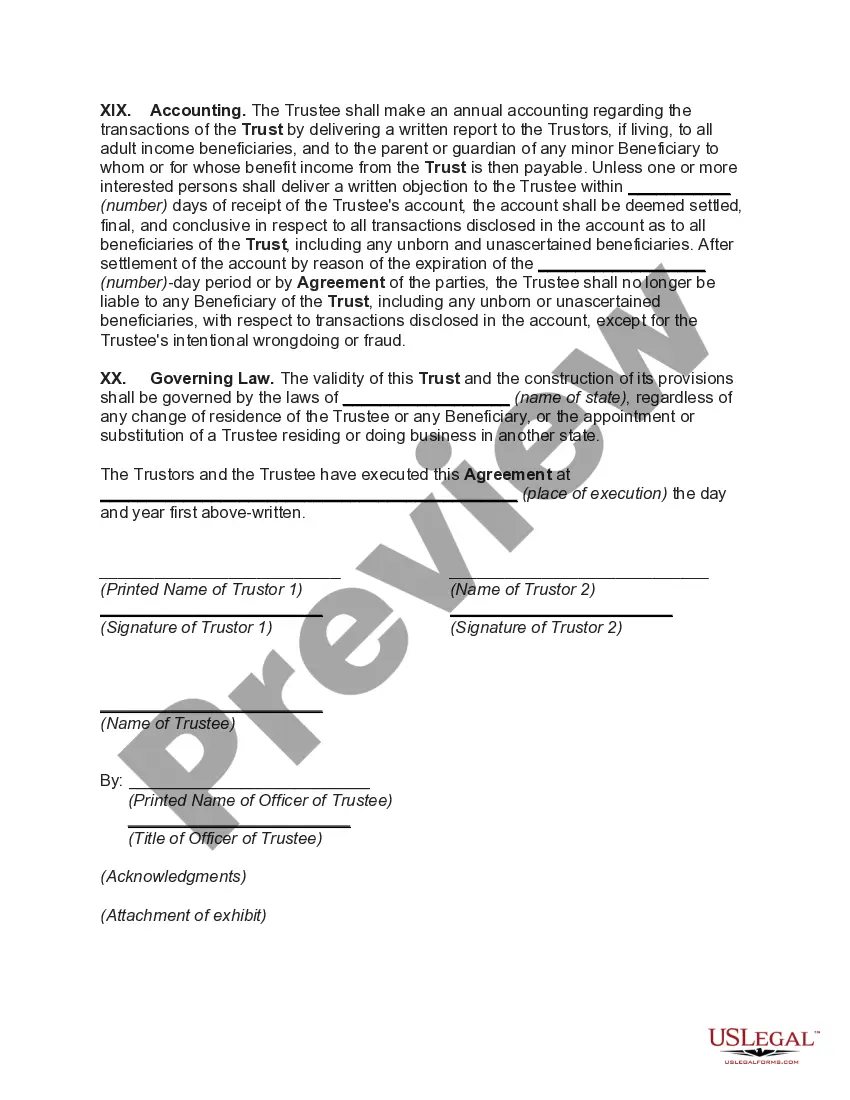

Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors

Description

How to fill out Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

US Legal Forms - one of the greatest libraries of lawful types in America - delivers a variety of lawful document web templates you can obtain or print out. Making use of the site, you will get 1000s of types for company and personal reasons, sorted by groups, states, or keywords and phrases.You will find the most up-to-date types of types just like the Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors within minutes.

If you already have a monthly subscription, log in and obtain Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors in the US Legal Forms library. The Down load button will appear on every type you see. You gain access to all formerly saved types from the My Forms tab of your respective account.

In order to use US Legal Forms the first time, allow me to share straightforward guidelines to obtain began:

- Ensure you have chosen the proper type for your personal town/state. Click on the Preview button to check the form`s content material. Look at the type outline to ensure that you have selected the right type.

- When the type does not match your demands, make use of the Lookup discipline towards the top of the monitor to discover the one which does.

- If you are pleased with the shape, affirm your choice by visiting the Buy now button. Then, select the prices strategy you like and offer your qualifications to sign up to have an account.

- Method the purchase. Utilize your credit card or PayPal account to complete the purchase.

- Choose the file format and obtain the shape on your own device.

- Make adjustments. Fill up, revise and print out and sign the saved Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors.

Each and every design you added to your bank account lacks an expiration time and is your own property forever. So, if you would like obtain or print out an additional duplicate, just visit the My Forms area and click around the type you need.

Obtain access to the Delaware Crummey Trust Agreement for Benefit of Child with Parents as Trustors with US Legal Forms, one of the most comprehensive library of lawful document web templates. Use 1000s of skilled and condition-distinct web templates that fulfill your company or personal requires and demands.

Form popularity

FAQ

How to Set Up a Trust Fund for a ChildSpecify the purpose of the Trust.Clarify how the Trust will be funded.Decide who will manage the Trust.Legally create the Trust and Trust Documents.Transfer assets into and fund the Trust.

Trust fund income is unearned income and it's ordinarily taxable, no matter how old the beneficiary is or if he's someone's dependent. If a trust retains its income and does not distribute it to beneficiaries, it must file its own return and pay taxes on the money.

Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

A Section 2503c trust is a type of minor's trust established for a beneficiary under the age of 21 which allows parents, grandparents, and other donors to make tax-free gifts to the trust up to the annual gift tax exclusion amount and the generation skipping transfer tax exclusion amount.

Crummey power is a technique that enables a person to receive a gift that is not eligible for a gift-tax exclusion and change it into a gift that is, in fact, eligible. Individuals often apply Crummey power to contributions in an irrevocable trust.

Crummey trusts are typically used by parents to provide their children with lifetime gifts while sheltering their money from gift taxes as long as the gift's value is equal to or less than the permitted annual exclusion amount.

Crummey Trust, Definition This type of trust is typically used by parents who want to make financial gifts to minor or adult children, though anyone can establish one on behalf of a beneficiary.

A Crummey Trust allows you to take advantage of the gift tax exclusions and simultaneously minimize your estate taxes. You do not have to provide an opportunity for the beneficiary to withdraw the entire balance of the trust until a certain age. A Crummey trust can have multiple beneficiaries.

Crummey powers give the beneficiary a limited time (often 30, 45 or 60 days) to withdraw contributions to a trust at will, converting the future interest gift to a present interest gift. This withdrawal right is generally limited to an amount equal to the current annual gift tax exclusion.