Delaware Indemnification Agreement for a Trust: Explained and Types Unveiled Introduction: An Indemnification Agreement for a Trust is a legal document that outlines the terms and conditions under which a Delaware trust entity or trustee can be indemnified for certain actions or liabilities incurred while acting in their fiduciary capacity. This agreement provides a means of protection and reimbursement for trust entities and trustees against potential risks, expenses, and legal proceedings arising out of their trust-related activities. In the state of Delaware, where trust laws are particularly well-developed, these agreements play a vital role in securing trust entities and trustees from financial loss and legal liability. Delaware Indemnification Agreement for a Trust: Key Components 1. Parties Involved: The agreement typically involves three parties: the trust entity or trustee seeking indemnification, the granter or settler of the trust, and any named beneficiaries. 2. Scope of Indemnification: The agreement outlines the specific scope and extent of indemnification provided. It may cover legal expenses, judgments, settlements, damages, or other costs incurred by the trustee within the ambit of their duties. 3. Standard of Conduct: A key consideration in the agreement is establishing the standard of conduct expected from the trustee. This may include provisions requiring the trustee to act in good faith and with reasonable care, prudence, and skill. 4. Reimbursement Mechanisms: The agreement specifies the mechanisms and criteria for reimbursement. It may outline the procedures for requesting indemnification, the documentation required, and the timeline for reimbursing the trustee. 5. Savings Clause: A savings clause is often included to ensure that any limitations on indemnification described in the agreement do not contravene Delaware law, thus providing maximum protection allowed by the state. Types of Delaware Indemnification Agreements for a Trust: 1. Administrative Expenses Indemnification Agreement: This type of agreement covers expenses incurred by trustees for administrative tasks, such as accounting, record-keeping, legal counsel, and tax reporting, within the framework of trust administration. 2. Litigation Indemnification Agreement: A Litigation Indemnification Agreement provides protection to trustees against legal expenses, judgments, settlements, and damages resulting from lawsuits or claims directly targeted at the trustee personally or as a trust representative. 3. Specific Transaction Indemnification Agreement: In certain cases, where a trustee is engaged in a specific transaction on behalf of the trust, a Specific Transaction Indemnification Agreement may be employed. This agreement provides indemnification for any losses or liabilities incurred solely as a result of this particular transaction. Conclusion: A Delaware Indemnification Agreement for a Trust is a crucial legal document that shields trust entities and trustees from potential risks, liabilities, and financial loss while fulfilling their fiduciary duties. By understanding the scope, mechanisms, and different types of these agreements, trust entities and trustees can ensure maximum protection allowed by Delaware law whilst carrying out their important responsibilities.

Delaware Indemnification Agreement for a Trust

Description

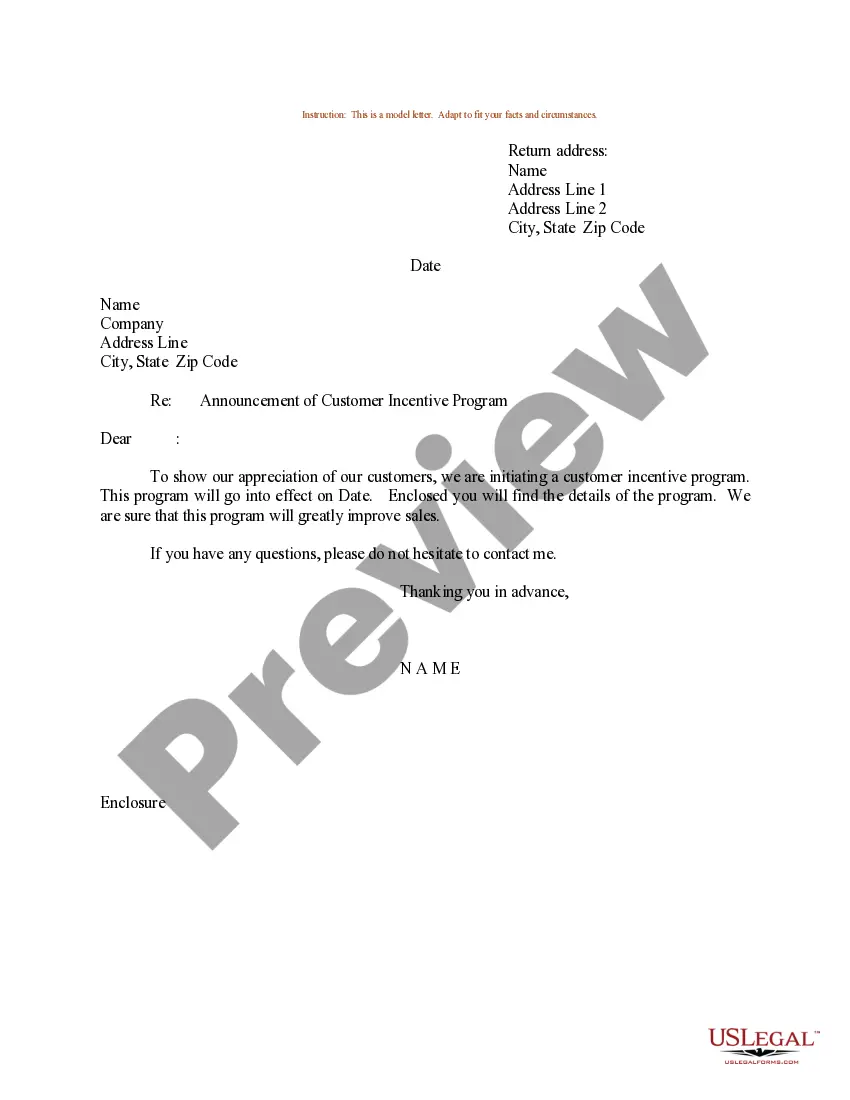

How to fill out Delaware Indemnification Agreement For A Trust?

Choosing the right legal record web template could be a struggle. Naturally, there are a lot of web templates accessible on the Internet, but how can you discover the legal kind you need? Utilize the US Legal Forms internet site. The assistance offers a large number of web templates, for example the Delaware Indemnification Agreement for a Trust, which you can use for business and personal requires. All of the varieties are examined by pros and fulfill federal and state requirements.

In case you are presently registered, log in to the bank account and click the Download option to have the Delaware Indemnification Agreement for a Trust. Use your bank account to check from the legal varieties you possess bought formerly. Check out the My Forms tab of the bank account and get another backup of your record you need.

In case you are a whole new customer of US Legal Forms, listed below are easy directions for you to stick to:

- Very first, be sure you have selected the appropriate kind for the metropolis/state. You may examine the form while using Preview option and browse the form information to ensure it will be the right one for you.

- In the event the kind is not going to fulfill your requirements, take advantage of the Seach discipline to discover the proper kind.

- When you are sure that the form would work, click on the Buy now option to have the kind.

- Opt for the prices strategy you want and enter in the required info. Design your bank account and buy an order utilizing your PayPal bank account or Visa or Mastercard.

- Select the data file format and obtain the legal record web template to the system.

- Comprehensive, modify and produce and sign the acquired Delaware Indemnification Agreement for a Trust.

US Legal Forms is the most significant collection of legal varieties for which you can discover a variety of record web templates. Utilize the service to obtain skillfully-produced files that stick to condition requirements.