The Delaware Guaranty of Payment of Dividends on Stocks is a legal provision in Delaware corporate law that ensures the payment of dividends on stocks to shareholders. This guarantee acts as a safeguard for investors, providing financial security and promoting confidence in the corporation. Under Delaware law, corporations have the flexibility to include these guarantees in their governing documents, such as the certificate of incorporation or bylaws. This provision outlines the corporation's obligation to pay dividends to its shareholders. By including this guarantee, corporations can attract more investors who seek predictable and consistent dividend payments. The Delaware Guaranty of Payment of Dividends on Stocks offers several benefits to both investors and corporations. For investors, it provides assurance that they will receive their entitled dividends, which can be crucial for those relying on them for income or are seeking a return on their investment. This guarantee can also enhance the attractiveness of a corporation's stock in the eyes of potential investors, as it demonstrates the corporation's commitment to shareholder value. This provision is especially crucial for corporations that rely on dividend payments as a primary means of distributing profits to shareholders. By explicitly stating this guarantee in their governing documents, corporations prioritize the prompt and reliable payment of dividends. Although the Delaware Guaranty of Payment of Dividends on Stocks does not have different types per se, it can vary in terms of the specific language used and the requirements set forth. Some corporations may include additional provisions such as dividend priority or preferred dividend payments, which can provide certain shareholders with preferential treatment. However, these variations are considered modifications rather than distinct types of the guarantee. In summary, the Delaware Guaranty of Payment of Dividends on Stocks is a significant provision under Delaware corporate law that ensures the timely and consistent payment of dividends to shareholders. By including this guarantee in their governing documents, corporations demonstrate their commitment to maintaining investor confidence and prioritizing shareholder value.

Delaware Guaranty of Payment of Dividends on Stocks

Description

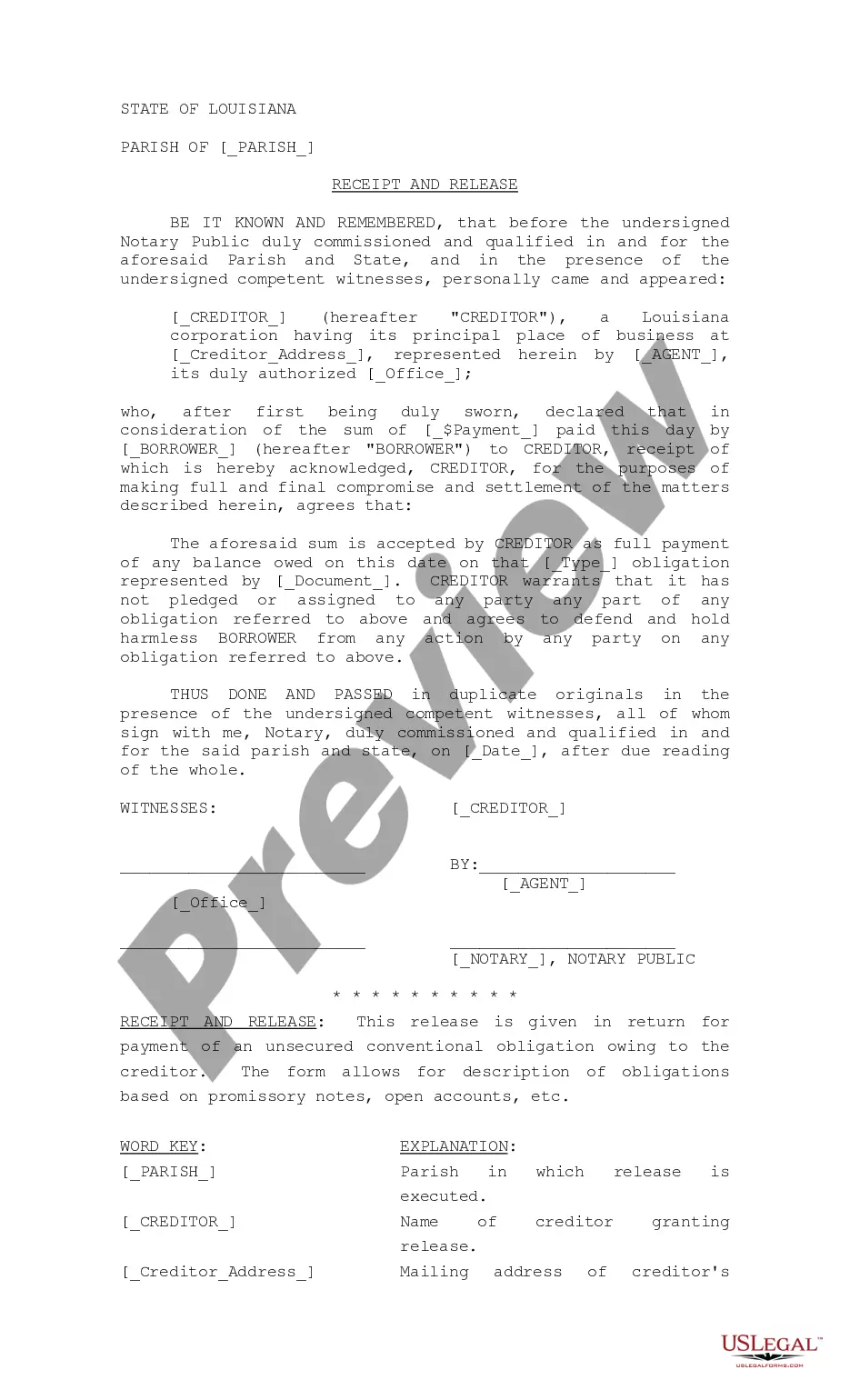

How to fill out Guaranty Of Payment Of Dividends On Stocks?

Are you currently in a place that you will need paperwork for possibly organization or person uses virtually every time? There are plenty of legitimate document templates available on the net, but locating ones you can depend on is not easy. US Legal Forms gives a large number of develop templates, much like the Delaware Guaranty of Payment of Dividends on Stocks, which are created in order to meet federal and state requirements.

In case you are currently informed about US Legal Forms web site and also have your account, basically log in. Next, you may down load the Delaware Guaranty of Payment of Dividends on Stocks format.

Should you not provide an bank account and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for that correct metropolis/county.

- Make use of the Preview option to check the form.

- Browse the outline to ensure that you have chosen the proper develop.

- In case the develop is not what you are looking for, utilize the Look for field to get the develop that fits your needs and requirements.

- Whenever you discover the correct develop, just click Acquire now.

- Opt for the rates prepare you need, complete the required information to make your bank account, and purchase the transaction using your PayPal or bank card.

- Choose a practical document structure and down load your copy.

Find all of the document templates you might have bought in the My Forms menu. You may get a additional copy of Delaware Guaranty of Payment of Dividends on Stocks whenever, if needed. Just go through the essential develop to down load or print out the document format.

Use US Legal Forms, the most extensive variety of legitimate varieties, to conserve efforts and prevent mistakes. The support gives skillfully manufactured legitimate document templates that can be used for an array of uses. Generate your account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Generally speaking, a dividend is a pro rata payment to the. stockholders of a corporation as a return on their investment. It may. be made in the form of cash, stock or other property.

Corporations § 144. Interested directors; quorum. (3) The contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified, by the board of directors, a committee or the stockholders.

Section 203 is an antitakeover statute in Delaware which provides that if a person or entity (an ?interested stockholder?) acquires 15% or more of the voting stock of a Delaware corporation (the ?target?) without prior approval of the target's board, then the interested stockholder may not engage in a business ...

Under Delaware law, a shareholder has a to right to vote on any amendment to the corporation's governing documents, whether such class of shares is entitled to vote or not under the governing documents, for actions that would (i) increase or decrease the number of authorized shares of such class; (ii) increase or ...

Section 144(a) codified judicially acknowledged principles of corporate governance to provide a limited safe harbor for corporate boards to prevent director conflicts of interest from voiding corporate action.

Section 145 of the Delaware General Corporation Law (DGCL) allows corporations to protect present and former directors and officers from expenses incurred in connection with proceedings arising from actions taken in service to the company or at the company's direction.

Corporations § 144. Interested directors; quorum. (3) The contract or transaction is fair as to the corporation as of the time it is authorized, approved or ratified, by the board of directors, a committee or the stockholders.

§ 174. Liability of directors for unlawful payment of dividend or unlawful stock purchase or redemption; exoneration from liability; contribution among directors; subrogation.