The Delaware Agreement to Arbitrate Disputed Open Account is an essential legal document used in commercial transactions to resolve disputes related to open accounts. This agreement establishes the terms and conditions under which disputes arising from open accounts will be settled through arbitration rather than court litigation. By opting for arbitration, the parties involved agree to resolve their disputes outside the traditional legal system, promoting a more efficient and streamlined process. This agreement is particularly applicable in the state of Delaware, known for its business-friendly environment and advanced legal framework. Some relevant keywords to describe the Delaware Agreement to Arbitrate Disputed Open Account include: 1. Open Account: It refers to a type of credit agreement where a buyer can purchase goods or services from a seller on credit, with payment due at a later date, usually within a specified period. 2. Disputes: This term denotes conflicts, disagreements, or differences of opinion that may arise between parties concerning various aspects of an open account, such as payment terms, delivery, quality of goods, or service. 3. Arbitration: It is the process of resolving disputes outside the court system, using a neutral third party, usually called an arbitrator, who assesses the evidence presented by both parties and makes a binding decision. The purpose of arbitration is to provide a faster, cost-effective, and private alternative to traditional courtroom litigation. 4. Legal Framework: Refers to the system of laws, regulations, and accepted legal principles specific to Delaware, which provides the foundation for drafting and enforcing the Delaware Agreement to Arbitrate Disputed Open Account. It's worth mentioning that there may not be different types of Delaware Agreement to Arbitrate Disputed Open Account per se, as its content can be customized to suit the needs and preferences of the parties involved. However, variations may exist based on the specific industry, business size, or nature of the open account.

Delaware Agreement to Arbitrate Disputed Open Account

Description

How to fill out Delaware Agreement To Arbitrate Disputed Open Account?

You are able to spend several hours online trying to find the lawful document format that meets the federal and state requirements you need. US Legal Forms gives 1000s of lawful types that are evaluated by pros. You can easily download or produce the Delaware Agreement to Arbitrate Disputed Open Account from my assistance.

If you already have a US Legal Forms accounts, you can log in and then click the Acquire switch. Afterward, you can complete, change, produce, or signal the Delaware Agreement to Arbitrate Disputed Open Account. Every lawful document format you get is yours forever. To have yet another version of any obtained develop, check out the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms site initially, adhere to the straightforward recommendations under:

- Initial, make sure that you have chosen the right document format for your area/area of your choosing. Read the develop description to ensure you have picked the proper develop. If accessible, make use of the Preview switch to appear from the document format too.

- In order to get yet another edition of your develop, make use of the Search industry to obtain the format that meets your requirements and requirements.

- Upon having located the format you need, click Acquire now to proceed.

- Find the rates plan you need, enter your references, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your credit card or PayPal accounts to pay for the lawful develop.

- Find the format of your document and download it to the product.

- Make changes to the document if needed. You are able to complete, change and signal and produce Delaware Agreement to Arbitrate Disputed Open Account.

Acquire and produce 1000s of document layouts making use of the US Legal Forms Internet site, that offers the biggest selection of lawful types. Use expert and state-particular layouts to tackle your company or specific needs.

Form popularity

FAQ

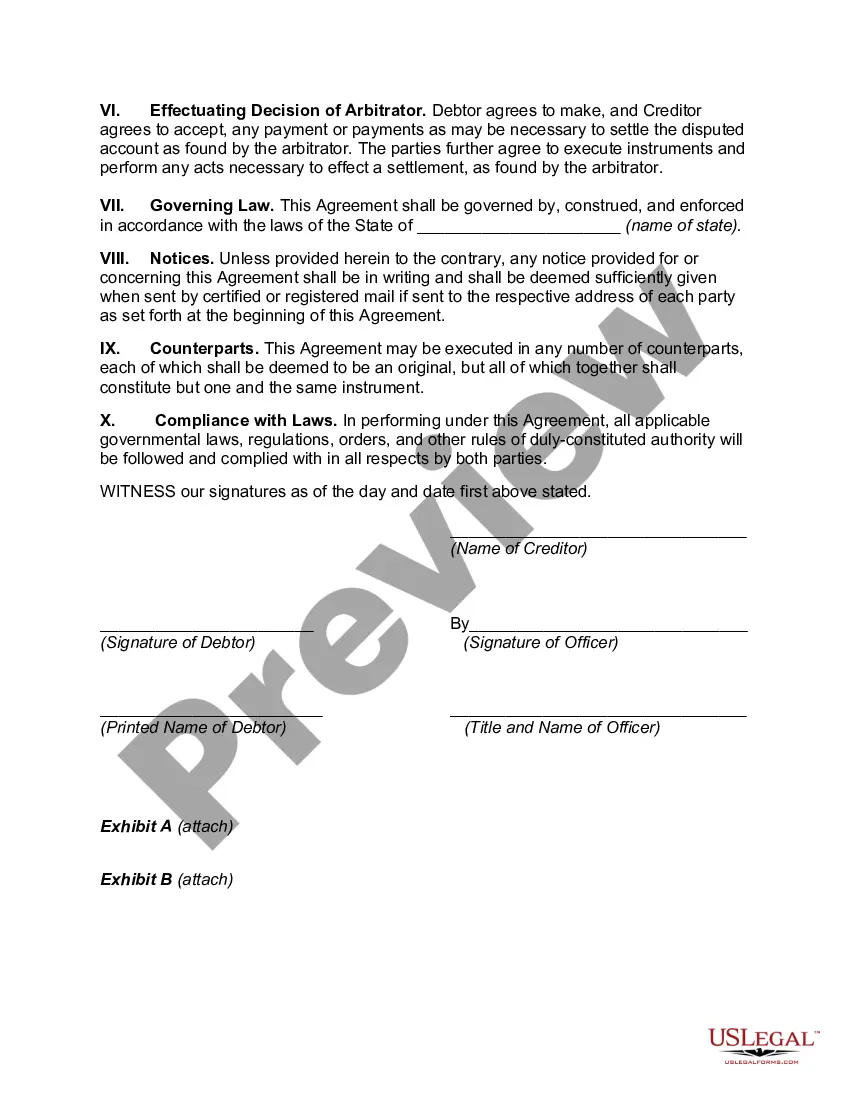

The place of the arbitration shall be city, state, and state law shall apply. We further agree that we will faithfully observe this agreement and the rules, that we will abide by and perform any award rendered by the arbitrator(s), and that a judgment of any court having jurisdiction may be entered on the award.

A mandatory arbitration agreement should identify the rules, procedures, and evidentiary guidelines to be applied. Many agreements opt for a particular forum's rules and procedures. If there are any rules that the parties want to opt out of (e.g., a limitation on discovery), state as much in the arbitration agreement.

Civil disputesCommercial disputes involving business disputes, consumer transactions, boundary disputes and tortious claims are arbitrable and fall under the jurisdiction of the arbitration.

2. Arbitration. In arbitration, a neutral third party serves as a judge who is responsible for resolving the dispute. The arbitrator listens as each side argues its case and presents relevant evidence, then renders a binding decision.

There is no right to appeal in arbitration like there is in court. If the parties agree to use the AAA to handle the appeal, the AAA will treat the appeal like a new case filing and more fees would have to be paid. Under federal and state laws, there are only a few ways to challenge an arbitrator's award.

A Arbitration is an out-of-court method to settle commercial disputes through a binding decision. It is a private, highly flexible method of dispute resolution, where the parties select the arbitrators, the place where the hearings will be held, the rules, language and type of procedure.

Furthermore, you usually can't appeal an arbitration agreement. Therefore, if you feel like the arbitrator's decision is unfair or wrong, you don't have the right to have the appellate court take a second look at it. You are bound by the decision of the arbitrator.

Arbitration is a procedure in which a dispute is submitted, by agreement of the parties, to one or more arbitrators who make a binding decision on the dispute. In choosing arbitration, the parties opt for a private dispute resolution procedure instead of going to court.

Civil disputesCommercial disputes involving business disputes, consumer transactions, boundary disputes and tortious claims are arbitrable and fall under the jurisdiction of the arbitration.

Under the Armendariz standards, an arbitration agreement will not be enforced in California if it is both "procedurally unconscionable" and "substantively unconscionable." Any arbitration agreement required as a condition of employment (i.e., any mandatory arbitration agreement) is automatically considered procedurally