Delaware Monthly Retirement Planning is a comprehensive financial management service specifically designed to assist individuals in the state of Delaware with their retirement goals and needs. Whether you are nearing retirement or just starting to plan for it, this service offers professional guidance and customized solutions to ensure a financially secure future. Key phrases: Delaware Monthly Retirement Planning, retirement goals, financial management service, retirement needs, retirement solutions, retirement planning, financially secure future. Types of Delaware Monthly Retirement Planning: 1. Individual Retirement Account (IRA) Planning: This type of retirement planning focuses on helping individuals maximize their IRA contributions, optimize investment options, and create a balanced portfolio tailored to their specific retirement goals. It includes strategies such as contribution planning, asset allocation, and risk management. 2. Social Security Optimization: This aspect of Delaware Monthly Retirement Planning aims to assist individuals in understanding and maximizing their Social Security benefits. The service analyzes various claiming strategies, considering factors such as age, income, and marital status, to help individuals make informed decisions and achieve optimal benefits. 3. Estate Planning: This type of retirement planning involves creating a comprehensive estate plan that ensures an efficient transfer of wealth to your loved ones while minimizing tax implications. It includes strategies like wills, trusts, power of attorney, and beneficiary designations, among others, to safeguard your assets and ensure your legacy. 4. Medicare and Health Insurance Planning: Delaware Monthly Retirement Planning also focuses on helping individuals navigate through the complex realm of Medicare and health insurance. Professionals provide expert advice on Medicare enrollment, choosing the right Medicare plan, and understanding health insurance options, ensuring comprehensive coverage for medical expenses during retirement. 5. Long-Term Care Planning: This aspect of Delaware Monthly Retirement Planning assists individuals in preparing for potential long-term care needs. Professionals help evaluate long-term care insurance options, discuss Medicaid planning, and develop a personalized strategy to cover the costs associated with extended healthcare services and support. By offering these different types of retirement planning services, Delaware Monthly Retirement Planning ensures that individuals in Delaware have access to comprehensive guidance tailored to their unique needs and goals.

Delaware Monthly Retirement Planning

Description

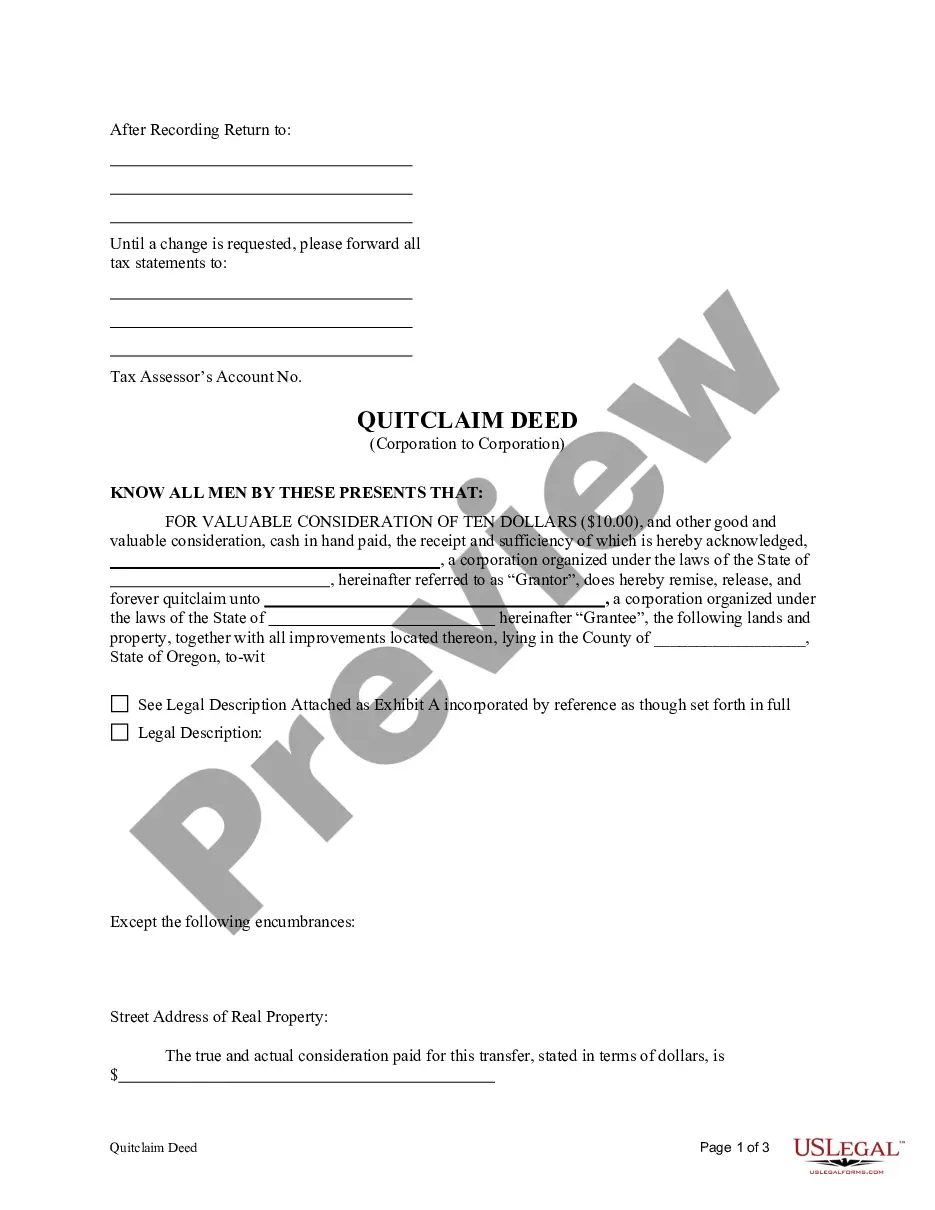

How to fill out Delaware Monthly Retirement Planning?

Are you in a place where you will need files for possibly business or specific purposes virtually every day? There are a variety of legal file themes accessible on the Internet, but getting types you can depend on is not easy. US Legal Forms provides a large number of form themes, much like the Delaware Monthly Retirement Planning, that are published to fulfill federal and state demands.

If you are previously informed about US Legal Forms website and have a merchant account, basically log in. Afterward, you may obtain the Delaware Monthly Retirement Planning format.

If you do not come with an account and need to start using US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for that right metropolis/state.

- Use the Preview switch to analyze the form.

- Browse the outline to actually have chosen the right form.

- In the event the form is not what you are looking for, utilize the Research discipline to discover the form that suits you and demands.

- If you obtain the right form, click Acquire now.

- Pick the rates strategy you desire, complete the necessary information and facts to create your money, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a convenient data file file format and obtain your duplicate.

Get each of the file themes you possess purchased in the My Forms food list. You may get a further duplicate of Delaware Monthly Retirement Planning at any time, if needed. Just click the needed form to obtain or print the file format.

Use US Legal Forms, the most considerable collection of legal types, in order to save efforts and avoid blunders. The support provides professionally produced legal file themes which can be used for a variety of purposes. Make a merchant account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

The Plan is a voluntary plan available to all pension-eligible employees (Casual-Seasonal employees are not eligible). There are no age or length of service requirements.

A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

As an employee of the State of Delaware, you contribute a certain percentage of each paycheck to the State's pension fund. Employees hired prior to January 1, 2012 contribute 3% of that portion of their monthly compensation which exceeds $6,000 per year.

You will usually need at least 10 qualifying years on your National Insurance record to get any State Pension.

Is Delaware a retirement friendly state? Delaware has a favorable tax code for retirees. Delaware has no state sales tax, no taxes on social security income, and allows a $12,500 deduction for income from pensions.

Changes the normal retirement age to: age 65 with 10 consecutive years of pension creditable service; age 60 with 20 years of pension creditable service; 30 years of pension creditable service at any age; increases vesting from 5 years to 10 years.

Your traditional pension plan is designed to provide you with a steady stream of income once you retire. That's why your pension benefits are normally paid in the form of lifetime monthly payments. Increasingly, employers are making available to their employees a one-time payment for all or a portion of their pension.

The annual contribution limits for 401(k) plans are identical to those allowed for 457(b) plans. However, it's more common for employers to make matching contributions to these accounts. With a 401(k) match, the employer can determine what percentage of employees' income to match.