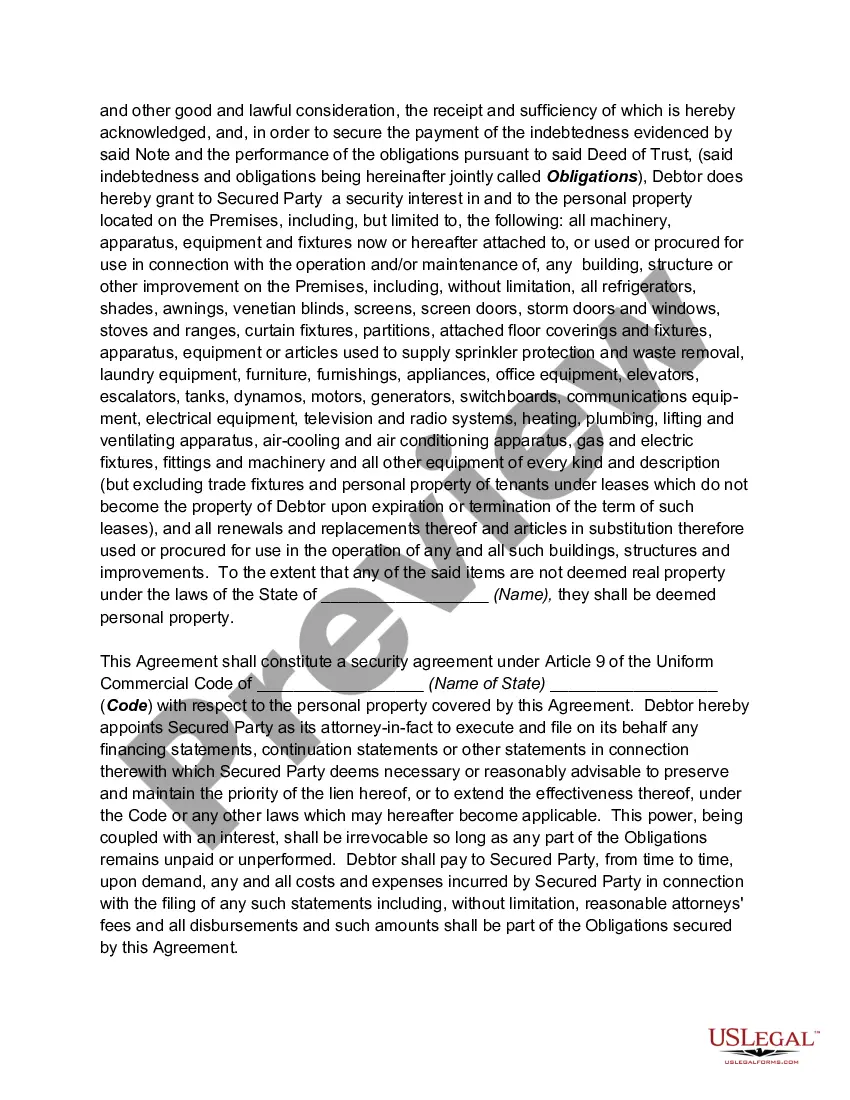

Delaware Security Agreement in Personal Property Fixtures is a legally binding document that serves as collateral for securing a commercial loan. It outlines the rights and responsibilities of both the creditor and debtor in relation to the personal property used as collateral. The use of relevant keywords can help highlight specific elements and types of Delaware Security Agreements. Here is a detailed description: A Delaware Security Agreement in Personal Property Fixtures is an essential component of securing a commercial loan, providing lenders with recourse in case of default. In this context, personal property refers to movable assets such as equipment, machinery, inventory, vehicles, or any other tangible assets that are not considered real estate. Fixtures refer to personal property items affixed or attached to real estate, making them part of the property. This agreement establishes a legal claim or lien on the personal property fixtures, ensuring that the lender has priority in recovering the loaned funds before other creditors in case of default or bankruptcy. The debtor, often a business entity, agrees to grant the lender a security interest in the collateral, thereby allowing the lender to take possession or sell the assets to recover the outstanding loan amount. The Delaware Security Agreement in Personal Property Fixtures specifies various crucial aspects: 1. Identification of the Parties: The agreement identifies the creditor, the debtor, and any additional stakeholders involved in the loan transaction. 2. Description of Collateral: The agreement provides a detailed description of the personal property fixtures being used as collateral. It identifies the assets by listing their individual characteristics, such as serial numbers, make, model, and location. 3. Perfection of Security Interest: To ensure the lender's claim takes priority over other creditors, the agreement often requires the debtor to file a Uniform Commercial Code (UCC) Financing Statement. This filing establishes the public record of the lender's interest in the collateral. 4. Rights and Obligations: The document outlines the rights and responsibilities of both the lender and the debtor. This includes restrictions on the debtor's ability to sell or dispose of the collateral without the lender's consent, ongoing maintenance obligations, and requirements to provide insurance coverage on the assets. 5. Default and Remedies: The agreement sets forth the conditions under which the loan is considered in default, such as missed payments or violations of the agreement's terms. It also provides details on the remedies available to the lender, which may include repossession and foreclosure of the collateral. Various types of Delaware Security Agreements in Personal Property Fixtures may exist, tailored to specific industries or circumstances. For example: 1. Equipment Financing Security Agreement: This agreement specifically covers equipment or machinery used as collateral to secure a commercial loan. 2. Inventory Financing Security Agreement: Targeting businesses that have substantial inventory as valuable collateral, this agreement focuses on securing loans by pledging inventory stock. 3. Vehicle Financing Security Agreement: Specifically designed for businesses that need to secure loans by using vehicles, such as fleets or specialized transportation equipment. In conclusion, a Delaware Security Agreement in Personal Property Fixtures is an indispensable legal document used in securing a commercial loan. Its purpose is to establish a lender's interest in movable assets as collateral, ensuring repayment in case of default. By understanding the key elements and types of security agreements, borrowers and lenders can protect their respective interests when entering into a loan transaction.

Delaware Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Delaware Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

US Legal Forms - one of the largest libraries of authorized kinds in the United States - gives a wide range of authorized file web templates you are able to download or produce. Using the site, you can get 1000s of kinds for organization and specific reasons, categorized by categories, states, or key phrases.You will discover the latest types of kinds like the Delaware Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan in seconds.

If you already possess a subscription, log in and download Delaware Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan in the US Legal Forms library. The Obtain button will show up on every type you view. You have access to all earlier acquired kinds in the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed here are simple directions to obtain started out:

- Be sure you have picked the right type for your area/region. Click on the Review button to check the form`s content. See the type description to ensure that you have selected the proper type.

- In the event the type does not fit your demands, use the Research area towards the top of the display to obtain the one that does.

- When you are satisfied with the form, verify your decision by visiting the Purchase now button. Then, opt for the rates plan you favor and give your credentials to register for an bank account.

- Procedure the deal. Utilize your bank card or PayPal bank account to complete the deal.

- Choose the format and download the form in your system.

- Make changes. Load, modify and produce and indicator the acquired Delaware Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Each design you put into your account lacks an expiry time and is yours forever. So, if you want to download or produce another version, just go to the My Forms area and click on the type you will need.

Get access to the Delaware Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan with US Legal Forms, one of the most extensive library of authorized file web templates. Use 1000s of professional and express-specific web templates that fulfill your organization or specific requires and demands.

Form popularity

FAQ

(a) Article 9 definitions. ? In this Article: (1) ?Accession? means goods that are physically united with other goods in such a manner that the identity of the original goods is not lost. The term includes controllable accounts and health-care-insurance receivables.

Security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Secured party is a lender, seller, or other person in whose favor a security interest exists.

Security Interest: An interest in personal property or fixtures -- i.e., improvements to real property -- which secures payment or performance of an obligation. Security Agreement: An agreement creating or memorializing a security interest granted by a debtor to a secured party.

UCC § 9-203 sets forth the requirements for attachment and enforceability of security interests. In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

This section specifies when a secured party must cause the secured party of record to file or send to the debtor a termination statement for a financing statement.

The Uniform Commercial Code (UCC) is organized into nine substantive articles, each article governing a separate area of the law. UCC Article 9 governs secured transactions in personal property. The 2010 amendments provide greater guidance as to the form of a name on listed on a financing statement.

Article 9 of the Uniform Commercial Code requires a financing statement to include the name of the debtor. It is important to set forth the exact legal name of the debtor in any filings that are made.