Delaware Accident Policy

Description

How to fill out Accident Policy?

Finding the suitable legal document template can be a challenge. Indeed, there are numerous formats available online, but how can you identify the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Delaware Accident Policy, which can be applied for personal and business purposes.

All forms are vetted by experts and comply with state and federal regulations.

If the form does not meet your requirements, take advantage of the Search area to find the correct form. Once you confirm that the form is accurate, click the Buy now button to obtain the document. Select the pricing plan you desire and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Fill out, modify, print, and sign the obtained Delaware Accident Policy. US Legal Forms boasts the largest collection of legal templates, where you can find various document formats. Utilize the service to download professionally created paperwork that adheres to state requirements.

- If you are already a registered user, Log In to your account and click the Download option to access the Delaware Accident Policy.

- Use your account to review the legal documents you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have chosen the right form for your locality.

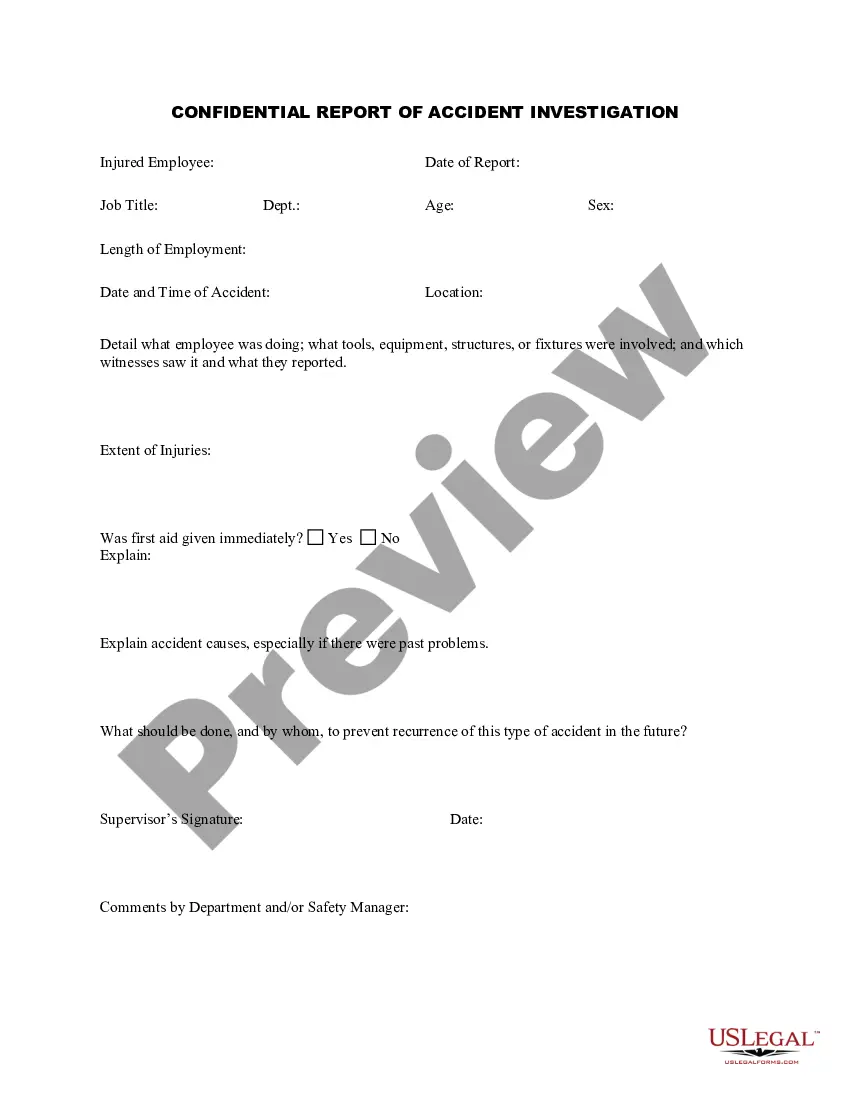

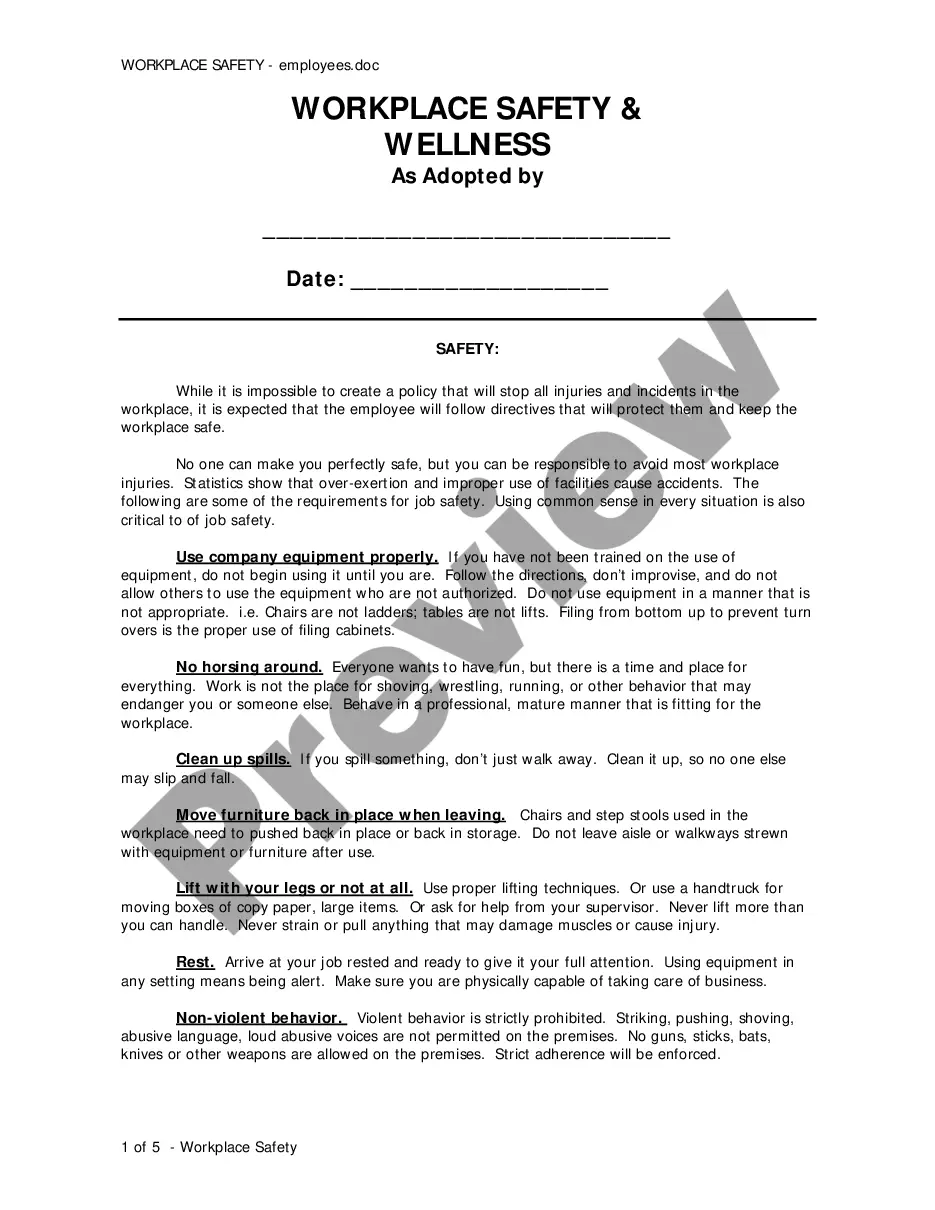

- You can review the form using the Preview option and read the form details to confirm it is suitable for your needs.

Form popularity

FAQ

(a) The person in charge of any garage or repair shop to which is brought any motor vehicle which shows evidence of having been involved in a serious collision or struck by any bullet shall report to the nearest police station or sheriff's office within 24 hours after such motor vehicle is received, giving the engine

Delaware requires all vehicle owners to carry personal injury protection (PIP) insurance, which provides coverage for injuries sustained in a car accident. PIP insurance is first-party coverage, meaning it pays for your own injuries and lost income if you're injured.

The penalties for driving without insurance in Delaware include fines and the suspension of your driver's license. You can avoid these consequences by meeting Delaware's proof of financial responsibility requirements.

No-Fault Insurance Law This is because Delaware is a no-fault state for car insurance purposes. This means that your insurance company will pay a portion of your medical bills, property damage, and lost wages up to the limits of your auto insurance policyregardless of who caused your crash.

The deemer statute applies to any out of state driver who drives their car in New Jersey and gets into an accident. Therefore, the statute will apply to residents of Pennsylvania, New York, Delaware, Maryland, etc.

All vehicles registered in the State of Delaware are required to have the minimum Delaware liability insurance coverage of $25,000/$50,000/$10,000 and a PIP (Personal Injury Protection) minimum of $15,000 for any 1 person and $30,000 for all persons injured in any 1 accident.

After being involved in a car accident, you should report it to your car insurance provider as soon as you can. Many insurers specify that you need to inform them about an accident within 24 hours of the incident.

How Much Time Do I Have to File an Automobile Accident Lawsuit in Delaware? In Delaware, unlike some other states, you have only two years from the date of the accident to file a lawsuit for personal damages or injury.

Delaware has a form of no-fault automobile insurance called Personal Injury Protection or PIP, which pays for your medical bills and lost wages, but not for your pain and suffering. Delaware no-fault law allows you to sue the person who caused the car accident and your injuries for pain and suffering.