Delaware Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

How to fill out Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Have you been inside a placement that you need documents for either organization or personal functions nearly every time? There are a variety of legitimate document web templates accessible on the Internet, but locating versions you can trust isn`t effortless. US Legal Forms delivers 1000s of form web templates, like the Delaware Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, which are composed to fulfill federal and state specifications.

In case you are previously acquainted with US Legal Forms web site and also have a merchant account, simply log in. Next, it is possible to down load the Delaware Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance format.

If you do not provide an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you need and make sure it is for that appropriate metropolis/area.

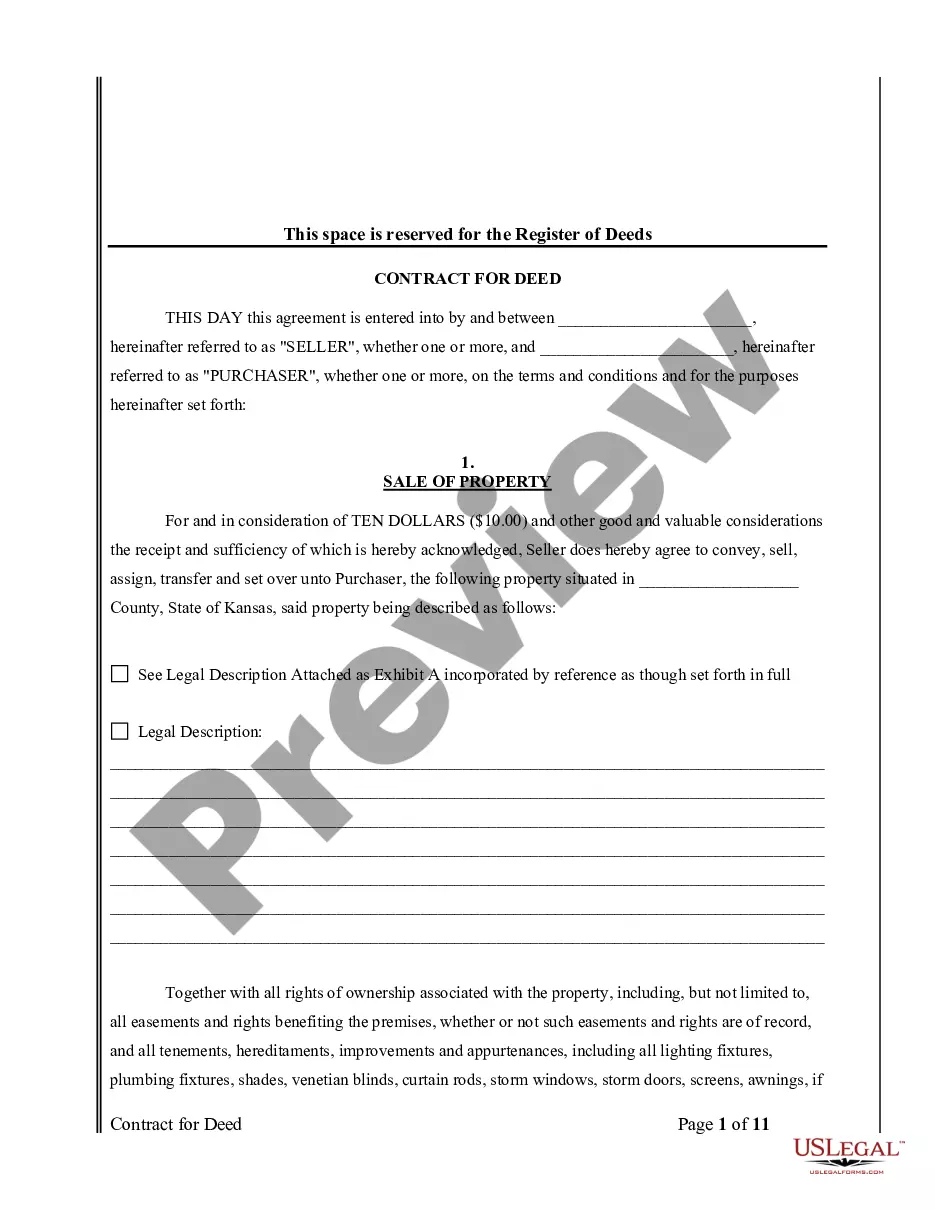

- Take advantage of the Preview button to analyze the shape.

- Look at the description to ensure that you have selected the correct form.

- If the form isn`t what you are searching for, make use of the Lookup discipline to get the form that fits your needs and specifications.

- Once you obtain the appropriate form, simply click Acquire now.

- Pick the pricing plan you want, complete the necessary info to generate your bank account, and pay money for the order with your PayPal or charge card.

- Decide on a handy paper formatting and down load your version.

Find all of the document web templates you may have bought in the My Forms menu. You may get a more version of Delaware Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance any time, if necessary. Just click on the required form to down load or produce the document format.

Use US Legal Forms, probably the most extensive collection of legitimate forms, in order to save time and avoid blunders. The service delivers expertly made legitimate document web templates that can be used for a range of functions. Generate a merchant account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

A nonqualified plan does not fall under ERISA guidelines so it does not receive the same tax advantages. They are considered to be assets of the employer and can be seized by creditors of the company. If the employee quits, they will likely lose the benefits of the nonqualified plan.

A NQDC plan is unfunded if either assets have not been set aside by your employer to pay plan benefits (that is, your employer pays benefits from its general assets on a "pay as you go" basis), or assets have been set aside but those assets remain subject to the claims of your employer's creditors (often referred to as

What Retirement Plans Are Not Covered by ERISA?Individual retirement arrangements (IRA)State managed retirement savings programs such as CalSavers.Rollover IRA accounts.Government employee retirement plans.Social Security.Church plans.

A qualified retirement plan is a retirement plan recognized by the IRS where investment income accumulates tax-deferred. Common examples include individual retirement accounts (IRAs), pension plans and Keogh plans. Most retirement plans offered through your job are qualified plans.

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

A qualified benefit plan also: Qualifies for certain tax benefits and government protection, including tax breaks for employers and tax credits for businesses with these plans in place.

ERISA's rules cover most private-sector, employer-sponsored retirement plans, like 401(k)s, pensions, profit-sharing plans and individual retirement accounts (IRAs) offered by employers, such as SEP IRAs and SIMPLE IRAs.

Although the Internal Revenue Code itself does not expressly state that a plan must be permanent to be qualified under Code Section 401(a), the applicable Treasury regulations state that the term plan implies a permanent, as distinct from a temporary, program.

Using life insurance in a qualified plan does offer several advantages, including: The ability to use pre-tax dollars to pay premiums that would otherwise not be tax-deductible. Fully funding the retirement benefit at the premature death of the plan participant.

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.