Delaware Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

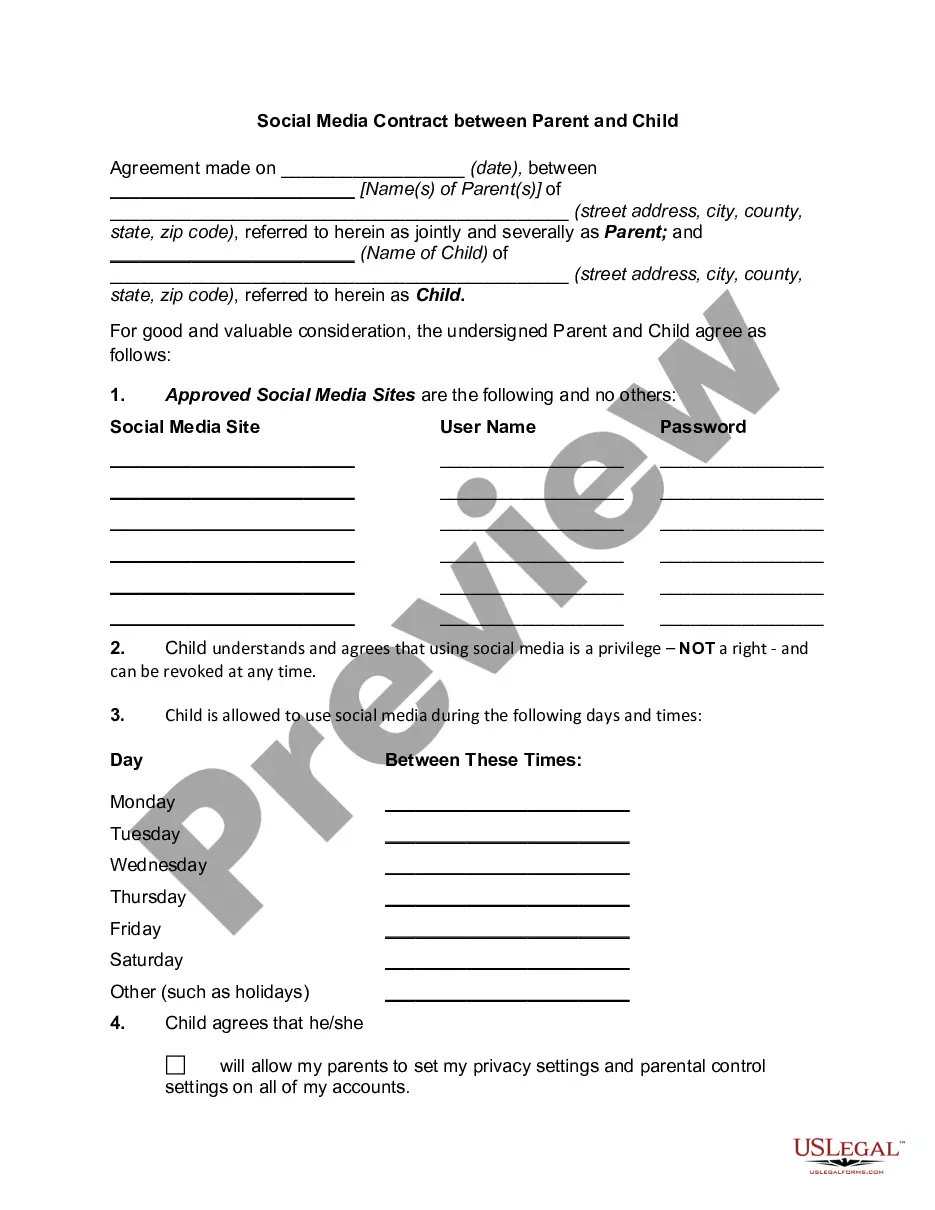

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

You might invest several hours online attempting to locate the legal document template that aligns with the requirements of state and federal regulations you need.

US Legal Forms provides thousands of legal documents that are assessed by experts.

You can easily download or print the Delaware Agreement to Sell Real Property Owned by Partnership to One of the Partners from our service.

To find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Delaware Agreement to Sell Real Property Owned by Partnership to One of the Partners.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any acquired form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city you choose.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

An LP must have at least one limited partner. LLCs also have greater flexibility for tax reporting. Often, the general partner of an LP will be structured as an LLC to help provide personal liability protection, as LLC managers are typically not held personally responsible for the businesses' liabilities.

Termination when only one partner remains The partnership form also ceases to exist if a transfer of partnership interests occurs and only one partner remains. For example, a partnership terminates when a 60% partner acquires the interests of two other partners who each have a 20% interest in the partnership (Regs.

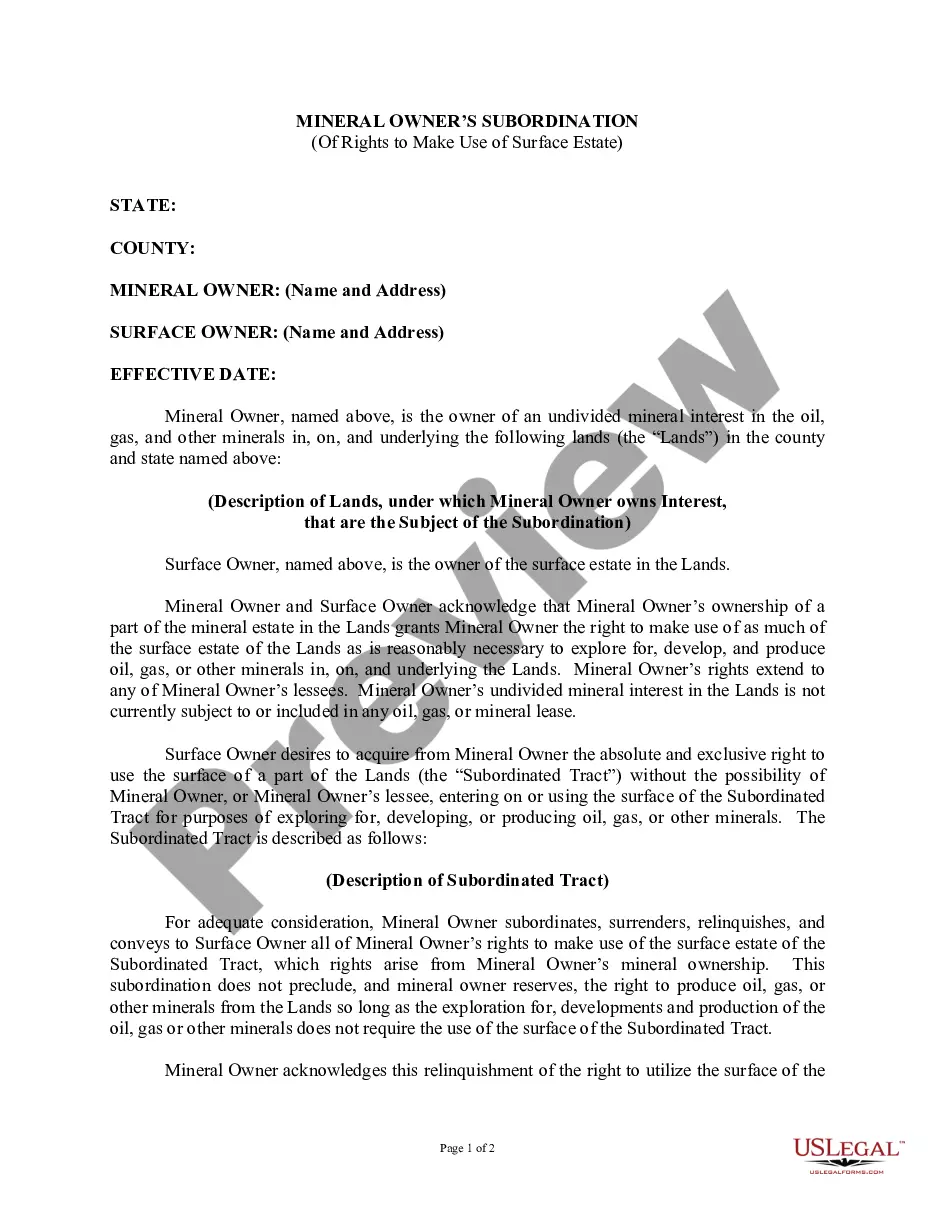

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners. The Land Registry will allow up to four property owning partners to be named at the Land Registry as legal owners.

In limited partnerships, the only entity legally capable of holding title to the real property is the general partner 29. A limited partner is entitled to a return of his or her contribution upon dissolution of the partnership.

Yes, immovable property can be acquired on behalf of a partnership firm in India.

A limited partnership (LP) is a form of partnership similar to a general partnership except that while a general partnership must have at least two general partners (GPs), a limited partnership must have at least one GP and at least one limited partner.

Despite being a business entity, a partnership is permitted to own property as if it were an individual person.

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners.

A limited partnership must have at least one general partner and at least one limited partner. The principal distinguishing feature of a limited partnership is that the limited partners are not personally liable for the debts and obligations of the partnership. The general partner remains fully liable.

According to section 15, the partnership property should be held and used exclusively for the purpose of the firm. While all partners have a community of interest in the property, during the subsistence of the partnership no partner has a proprietary interest in the assets of the firm.