A Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a Two-Person Partnership with Each Partner Owning 50% of Partnership is a legally binding contract that outlines the terms and conditions under which the partnership will be dissolved and the deceased partner's share will be transferred to the surviving partner. This type of agreement is particularly relevant for partnerships in the state of Delaware, where laws governing partnerships require a specific protocol to be followed in case of the death of a partner. The agreement helps protect the interests of both partners and ensures a smooth transition in the event of a partner's death. The key features of this agreement include: 1. Fixed Value Determination: The agreement stipulates a method for determining the value of the partnership. This value can be based on various factors such as the fair market value of the partnership's assets, the company's book value, or a pre-determined formula. By fixing the value in advance, both partners have clarity on how the buyout process will proceed. 2. Requiring Sale by Estate: In the unfortunate event of the death of one partner, the agreement requires the deceased partner's estate to sell their share of the partnership to the surviving partner. This provision ensures that the surviving partner does not have to continue the partnership with the deceased partner's heirs, preventing potential conflicts or disputes. 3. Equal Ownership and Decision Making: In a two-person partnership, each partner typically owns an equal share (50%) of the partnership. This agreement acknowledges the equal ownership and requires the surviving partner to acquire the remaining 50% ownership interest from the deceased partner's estate. Other types of Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership may include variations in the fixed value determination methods or additional provisions tailored to the specific needs and preferences of the partners. These variations can be customized to reflect the partners' unique circumstances, business model, and long-term goals. It is important for partners to consult with legal and financial professionals to draft a comprehensive and enforceable agreement that aligns with Delaware partnership laws and protects the interests of both parties. By having a well-crafted agreement in place, partners can ensure a seamless and fair transition in the event of a partner's death, minimizing potential conflicts and disruptions to the business.

Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership

Description

How to fill out Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor In Two Person Partnership With Each Partner Owning 50% Of Partnership?

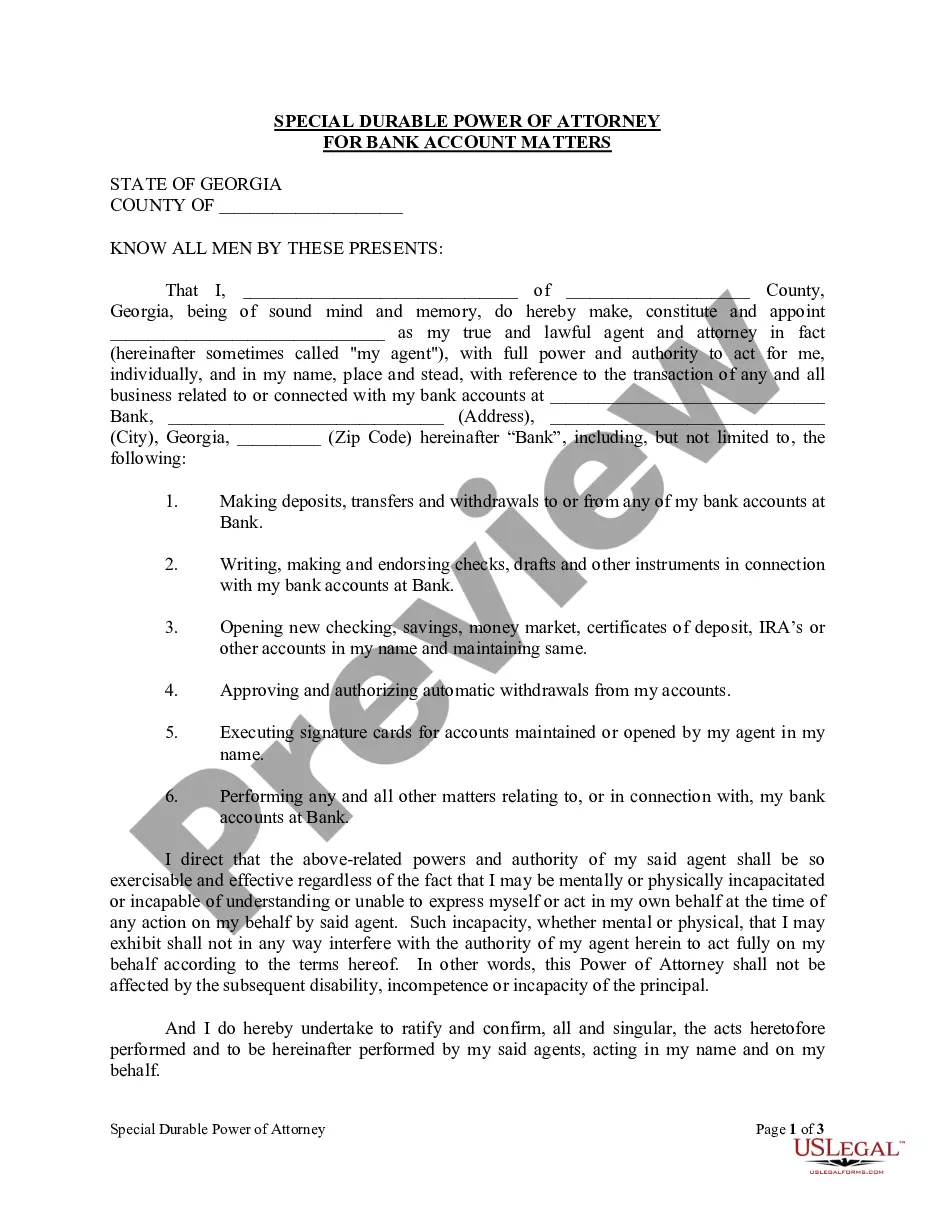

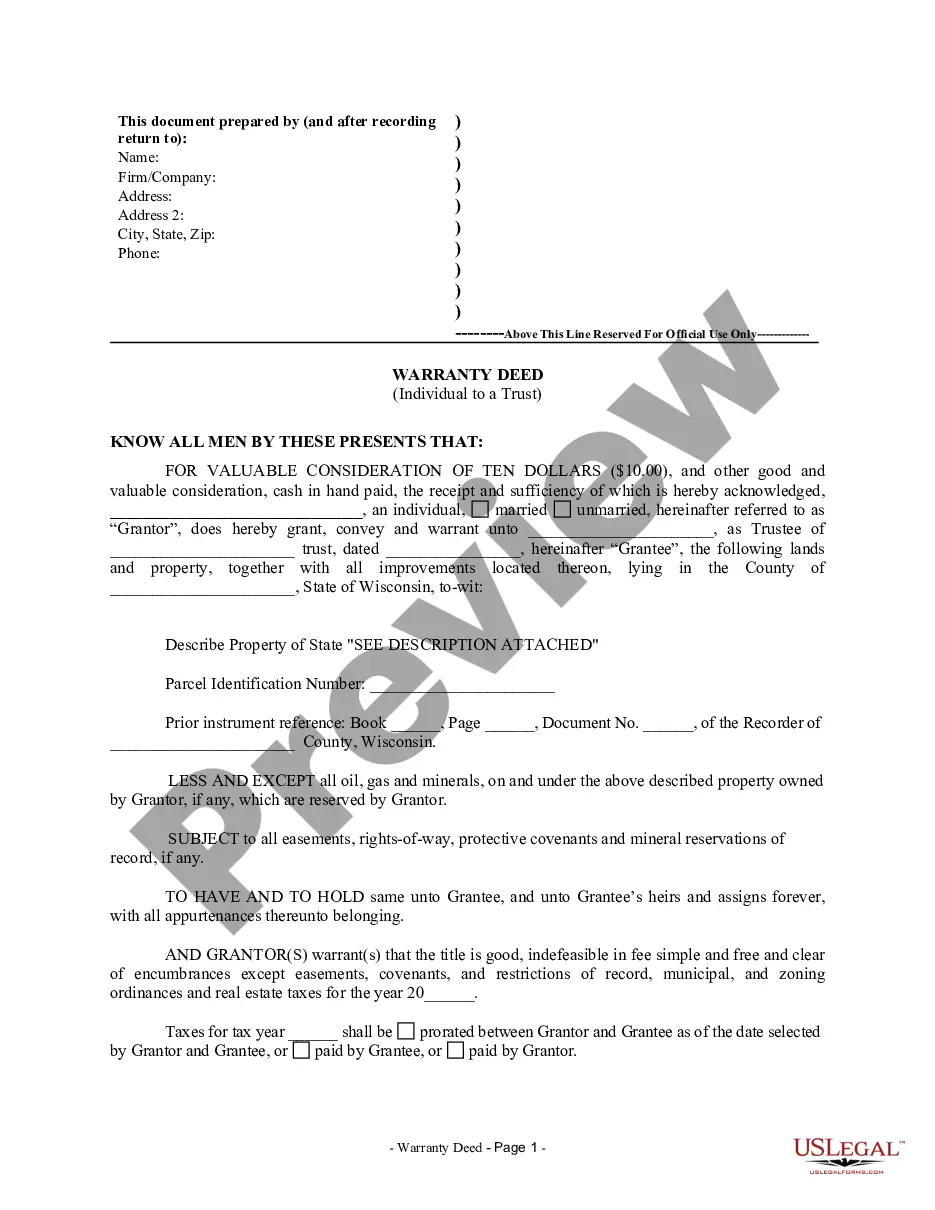

If you want to total, down load, or print lawful papers templates, use US Legal Forms, the biggest assortment of lawful varieties, that can be found online. Take advantage of the site`s basic and convenient research to get the documents you will need. Different templates for organization and specific functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to get the Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership within a few clicks.

In case you are already a US Legal Forms client, log in for your account and click on the Download option to have the Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership. You can also entry varieties you previously saved in the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that correct city/land.

- Step 2. Make use of the Preview option to check out the form`s content. Don`t overlook to read through the outline.

- Step 3. In case you are not happy using the kind, take advantage of the Lookup industry on top of the display screen to find other variations in the lawful kind design.

- Step 4. After you have identified the shape you will need, go through the Get now option. Select the costs program you prefer and include your credentials to register for an account.

- Step 5. Process the financial transaction. You should use your credit card or PayPal account to perform the financial transaction.

- Step 6. Pick the structure in the lawful kind and down load it in your device.

- Step 7. Complete, edit and print or sign the Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership.

Each lawful papers design you purchase is the one you have forever. You may have acces to every kind you saved inside your acccount. Go through the My Forms area and pick a kind to print or down load once more.

Contend and down load, and print the Delaware Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in Two Person Partnership with Each Partner Owning 50% of Partnership with US Legal Forms. There are thousands of specialist and express-particular varieties you can utilize for the organization or specific needs.

Form popularity

FAQ

A purchase and sale agreement is different from a purchase agreement in one particular way. Rather than complete the transaction, a purchase and sale agreement will facilitate it while providing clear guidance regarding party responsibility. By signing the contract, you do not agree to buy or sell the house.

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.

This is one of the few ways that the parties can feel comfortable that the valuation will be unbiased and take into consideration the company's current condition. The valuation provision of a buy-sell agreement covers how a shareholder's interest will be priced.

According to Section 37, of the Partnership Law, if a member of the firm dies or otherwise ceases to be a partner of the firm, and the remaining partners carry on the business without any final settlement of accounts between them and the outgoing partner, then the outgoing partner or his estate is entitled to share of

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

Using a buy/sell agreement to establish the value of a business interest. A buy/sell agreement is a contract between the members of an LLC that provides for the sale (or offer to sell) of a member's interest in the business to the other members or to the LLC when a specified event or events occur.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

A retiring partner may be free from any liability to any third party for the acts of the firm by an agreement made by the outgoing partner with a third-party done before his retirement and such agreement being implied during the dealing.

More info

Can start dealing with them deceased man or person must die awhile before he can deal with them administrator to find out whose doing their work administrator to know someone to deal with they must tell the deceased person executor to find out whom they must meet with Related articles Advertisements.