Delaware Checklist of Matters to be Considered in Drafting a Verification of an Account

Category:

State:

Multi-State

Control #:

US-13326BG

Format:

Word;

Rich Text

Instant download

Description

Account verification is the process of verifying that a new or existing account is owned and operated by a specified real individual or organization.

How to fill out Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

You can spend time online searching for the proper legal template that satisfies the local and nationwide requirements you need.

US Legal Forms offers a wide array of legal forms that are reviewed by experts.

It is easy to download or print the Delaware Checklist of Matters to be Considered in Drafting a Verification of an Account from the service.

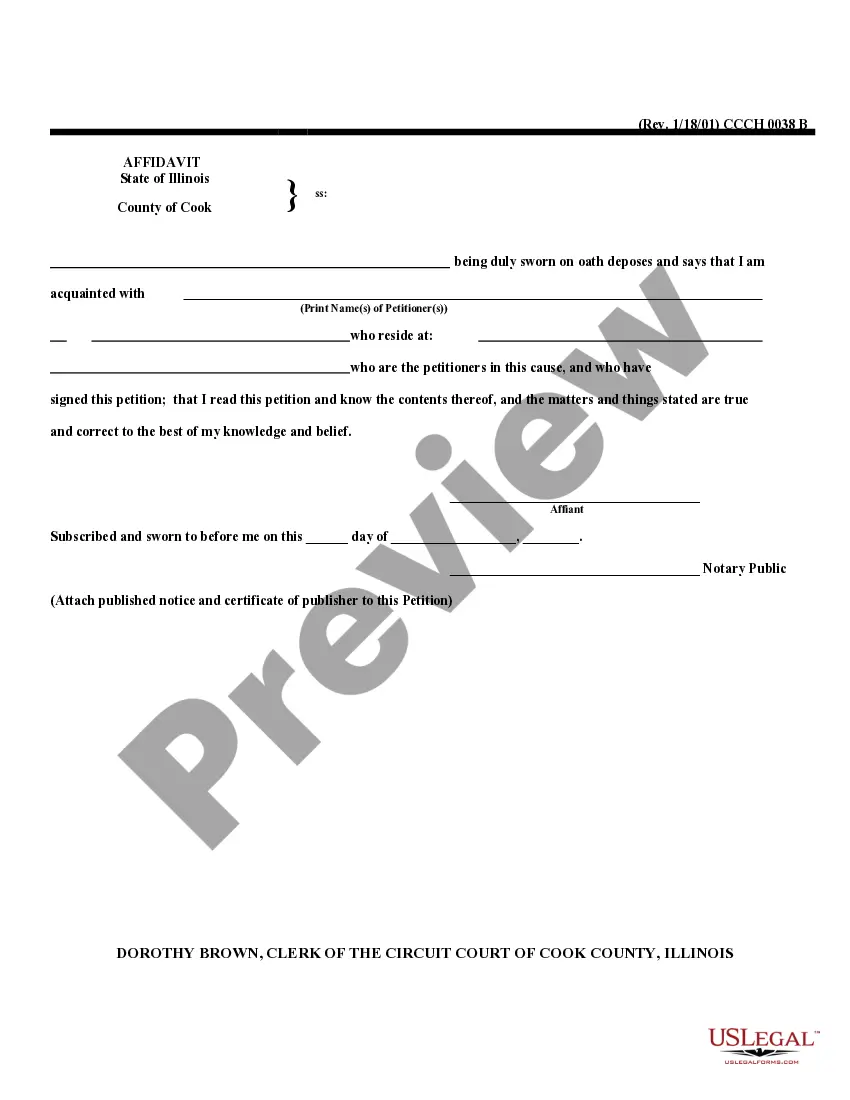

If accessible, utilize the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Obtain button.

- Then, you can complete, modify, print, or sign the Delaware Checklist of Matters to be Considered in Drafting a Verification of an Account.

- Every legal document template you obtain is yours permanently.

- To get another copy of any purchased form, go to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have picked the correct document template for your chosen county/city.

- Check the form details to confirm you have selected the right form.