Delaware Employment of Chief Executive Officer with Stock Incentives When it comes to attracting top-level executive talent, companies often turn to stock incentives as a way to align the interests of the chief executive officer (CEO) with the long-term success of the organization. In Delaware, a state with a business-friendly legal framework, the employment of a CEO with stock incentives can be an advantageous approach for both the company and the executive. Delaware boasts a robust corporate law that provides flexibility and certainty for businesses, making it an attractive state for companies to incorporate. The Delaware Employment of CEO with Stock Incentives allows businesses to structure executive compensation packages that include stock-based incentives, aiming to motivate CEOs in driving organizational growth, increasing shareholder value, and achieving strategic objectives. Stock incentives typically come in the form of stock options, restricted stock units (RSS), or performance-based grants. These equity-based compensation tools provide CEOs with a financial stake in the company's success, promoting a stronger sense of ownership and alignment with shareholders' interests. By offering stock-based incentives, companies entice CEOs to focus on long-term value creation, as the value of these awards depends on the company's stock performance over time. Delaware recognizes different types of employment agreements wherein CEOs can benefit from stock incentives. One common arrangement is the "Employment Agreement with Performance-Based Stock Incentives." Under this model, the CEO's compensation package incorporates performance metrics, such as revenue growth, earnings per share (EPS), or total shareholder return (TSR). If these predetermined milestones are met or exceeded, the CEO may receive additional stock-based rewards. Another alternative is the "Employment Agreement with Stock Options." In this scenario, the CEO is granted the right to purchase company stock at a predetermined price, known as the exercise price. Stock options often have a vesting period, during which the CEO must remain with the company to become eligible to buy the specified number of shares. As the company's stock price rises, the CEO can exercise the options and potentially realize a profit. Delaware's legal framework ensures that stock incentives are designed within reasonable bounds, protecting the interests of both the company and its shareholders. While stock incentives can be a powerful tool to attract and retain top talent, companies must ensure that CEO compensation remains aligned with organizational performance and shareholders' expectations. In conclusion, the Delaware Employment of CEO with Stock Incentives is an effective mechanism for companies to attract and retain high-performing executives. By offering stock options, RSS, or performance-based grants, companies encourage long-term value creation and foster CEO accountability. Delaware's business-friendly environment provides the ideal legal framework for deploying such compensation strategies, allowing businesses to optimize their executive talent and drive growth and profitability.

Delaware Employment of Chief Executive Officer with Stock Incentives

Description

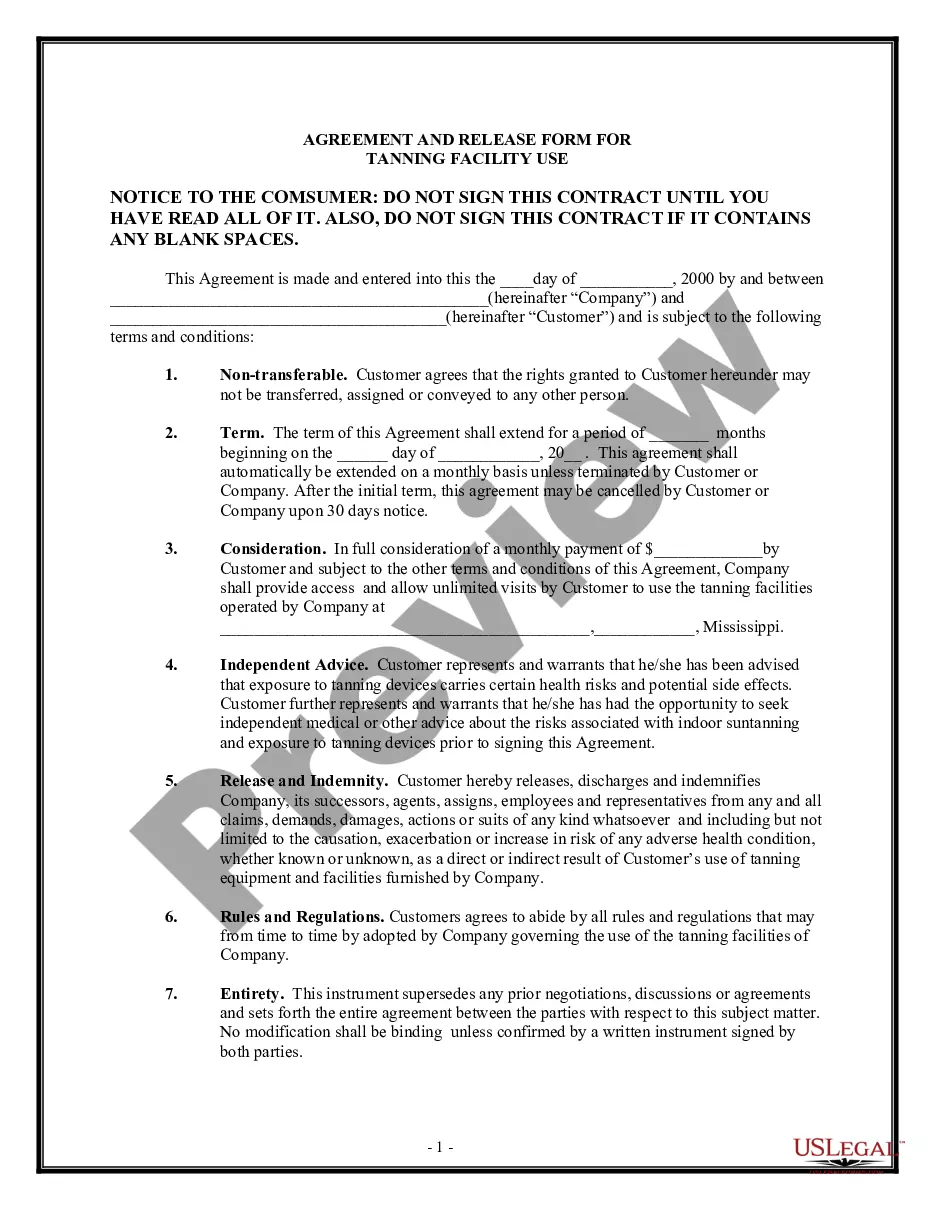

How to fill out Delaware Employment Of Chief Executive Officer With Stock Incentives?

Are you currently in the position where you need paperwork for both company or personal functions nearly every day time? There are plenty of lawful file themes available online, but finding types you can rely on isn`t straightforward. US Legal Forms provides thousands of kind themes, much like the Delaware Employment of Chief Executive Officer with Stock Incentives, which can be written to fulfill state and federal demands.

If you are presently knowledgeable about US Legal Forms internet site and have your account, basically log in. Next, you are able to down load the Delaware Employment of Chief Executive Officer with Stock Incentives format.

Unless you offer an account and would like to begin to use US Legal Forms, follow these steps:

- Get the kind you want and make sure it is for the correct town/area.

- Make use of the Preview option to examine the form.

- Browse the explanation to actually have selected the right kind.

- In case the kind isn`t what you`re seeking, utilize the Search area to obtain the kind that fits your needs and demands.

- Whenever you get the correct kind, just click Purchase now.

- Choose the pricing prepare you want, submit the desired info to generate your money, and buy your order with your PayPal or bank card.

- Choose a convenient document file format and down load your backup.

Discover all the file themes you possess purchased in the My Forms food selection. You can aquire a further backup of Delaware Employment of Chief Executive Officer with Stock Incentives any time, if necessary. Just select the needed kind to down load or print the file format.

Use US Legal Forms, one of the most considerable assortment of lawful varieties, to save lots of time and prevent blunders. The support provides skillfully manufactured lawful file themes which you can use for a selection of functions. Generate your account on US Legal Forms and start producing your life easier.