A Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legally binding contract specifically designed for professional partnerships, ensuring a smooth transfer of ownership and financial stability in the event of a partner's death. This agreement outlines the terms and conditions that govern the sale and purchase of a deceased partner's interest in the partnership using life insurance proceeds. Keywords: Delaware Buy-Sell Agreement, Life Insurance, Fund Purchase, Deceased Partner's Interest, Professional Partnership. Different types of Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership may include: 1. Cross-Purchase Agreement: In this type of agreement, each partner enters into separate agreements to purchase the deceased partner's interest. If a partner passes away, the surviving partners use the life insurance proceeds to buy the deceased partner's share. 2. Entity or Stock Redemption Agreement: In this arrangement, the professional partnership entity itself buys the deceased partner's interest. The entity acquires a life insurance policy on each partner's life, and the death benefit is utilized to purchase the deceased partner's share. 3. Hybrid or Wait-and-See Agreement: This hybrid agreement combines elements of both cross-purchase and entity redemption agreements. Initially, the surviving partners have the first option to purchase the deceased partner's interest. If they decline or are unable to do so, the partnership entity steps in and buys the interest. By incorporating a Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, business owners can safeguard their financial interests and ensure a seamless transition of ownership, avoiding potential disputes and financial strain. It is crucial for professionals engaged in partnerships to consult legal experts to draft an agreement that aligns with their specific needs and state regulations.

Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

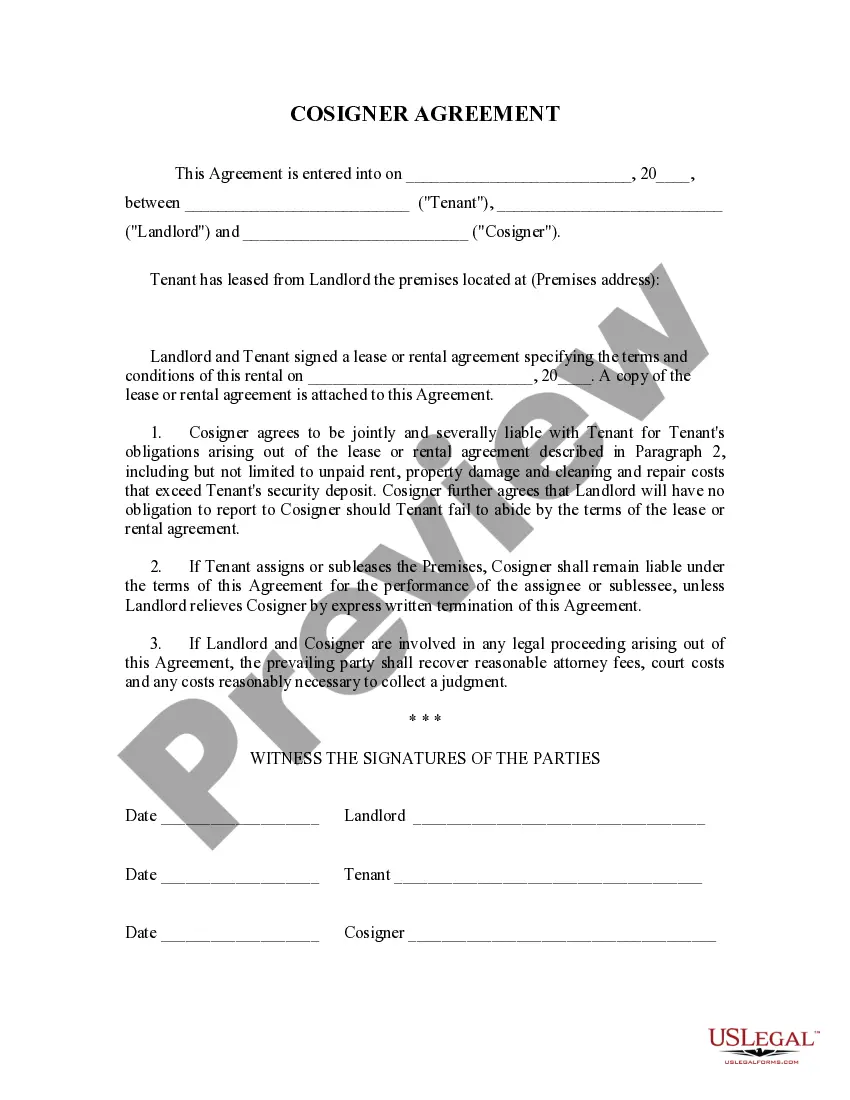

How to fill out Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal template formats that you can download or print.

By utilizing the website, you can access thousands of templates for commercial and personal purposes, organized by categories, states, or keywords. You can quickly obtain the latest versions of documents like the Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership.

If you already possess a membership, sign in and download the Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership from the US Legal Forms library. The Acquire button will be present on every document you examine. You can access all previously downloaded documents from the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the payment.

Select the format and download the document to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership. Each template you added to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the document you need. Access the Delaware Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct document for the city/state.

- Click the Preview button to review the document's content.

- Read the document description to confirm you have chosen the appropriate document.

- If the document does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your selection by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Using Life Insurance To Fund a Buy-Sell Agreement Life insurance is one of the most popular methods to fund a buy-sell agreement. In this scenario, the company purchases insurance on the life of each of its owners.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

Types of buy-sell agreements include cross-purchase agreements, redemption agreements, hybrid buy-sell agreements, company purchase agreements, and asset purchase agreements . Consider your options carefully when engaging in a buy-sell agreement and speak with corporate lawyers to learn about your legal rights.

Assume your business is a corporation or is taxed as one. When one of your co-owners dies, his or her estate becomes the owner of the insurance policies covering you and the other co-owners of the business in a cross-purchase agreement.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.

Life insurance proceeds provide liquidity for ordinary living expenses and estate tax liability. Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

Interesting Questions

More info

By accessing this website, you agree to the Privacy Policy. Monster will use the information collected to provide you with a personalized experience throughout the Monster Application process. You may unsubscribe from receiving future email communications at any time by following to unsubscribe instructions found on every job posting. By submitting a job, you represent and warrant to Monster that you have the legal capacity to form contracts of employment and that you have full legal authority to execute this offer to hire, and that you are an eligible worker. You may not post any job until your eligibility has been vetted. Monster will never sell or rent out your personal information to third parties. You will not use Monster as a job site, or for any other reason, without Monster's written consent. Monster will not be liable for any action you take as a result of using the application or website.