The Delaware Notice of Disputed Account is a legal document that individuals or businesses in Delaware used to notify a financial institution of a dispute regarding their account. This notice is crucial in protecting the consumer's rights and ensuring a fair resolution of disputed transactions. It serves as a formal communication, enabling the individual or business to assert their objections and request a thorough investigation into the matter. When filing a Delaware Notice of Disputed Account, it is important to provide specific details about the transaction(s) in question, including the date, amount, and any relevant supporting documents. This helps the financial institution better understand the nature of the dispute and conduct an accurate investigation. There are various types of Delaware Notice of Disputed Account that consumers might encounter, based on the nature of the dispute or the specific area of finance involved. Some common types include: 1. Delaware Notice of Disputed Credit Card Account: This form is used when there is a disagreement regarding credit card charges, such as fraudulent transactions or unauthorized purchases. Individuals can assert their objections and request the removal of disputed charges from their account. 2. Delaware Notice of Disputed Bank Account: If there is a discrepancy in a bank account statement or suspicious activity, individuals can utilize this notice to inform their bank about the disputed transactions. This helps initiate an investigation and potentially recover any lost funds. 3. Delaware Notice of Disputed Loan Account: Individuals who have taken out loans and encounter issues related to interest rates, repayment terms, or any other aspect of the loan agreement can file this notice to formally dispute the loan account. This enables borrowers to seek clarification, negotiate modifications, or address any other concerns. In all cases, it is advisable to send the Delaware Notice of Disputed Account via certified mail with a return receipt requested to ensure proper documentation of the dispute process. Additionally, keeping copies of all correspondence, relevant evidence, and communication with the financial institution is crucial for future reference. By utilizing the Delaware Notice of Disputed Account, consumers in Delaware can protect themselves from fraudulent or incorrect charges, resolve disputes promptly, and ensure their financial well-being. It is essential to understand the specific requirements and guidelines for filing such notices, as they may vary depending on the financial institution and the type of account involved.

Delaware Notice of Disputed Account

Description

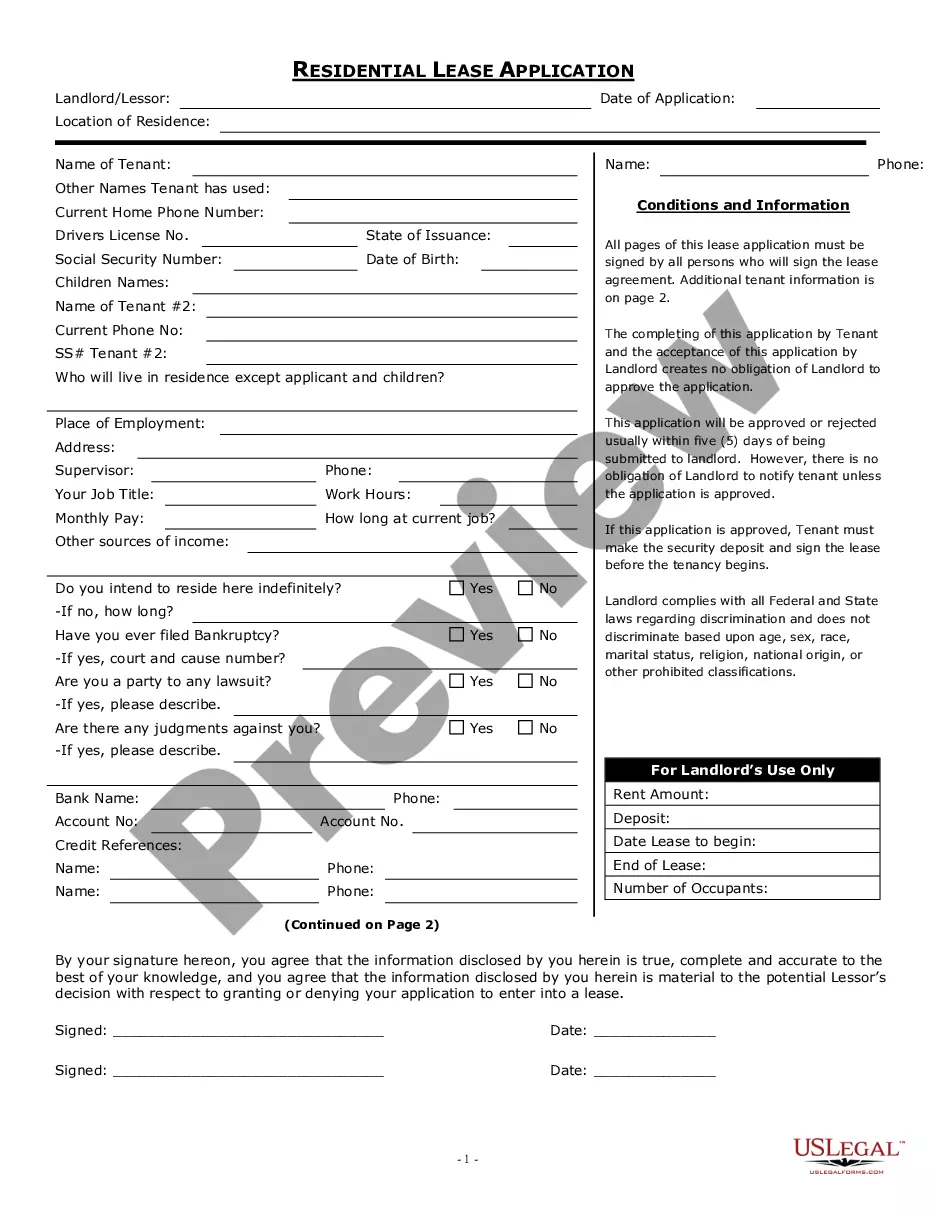

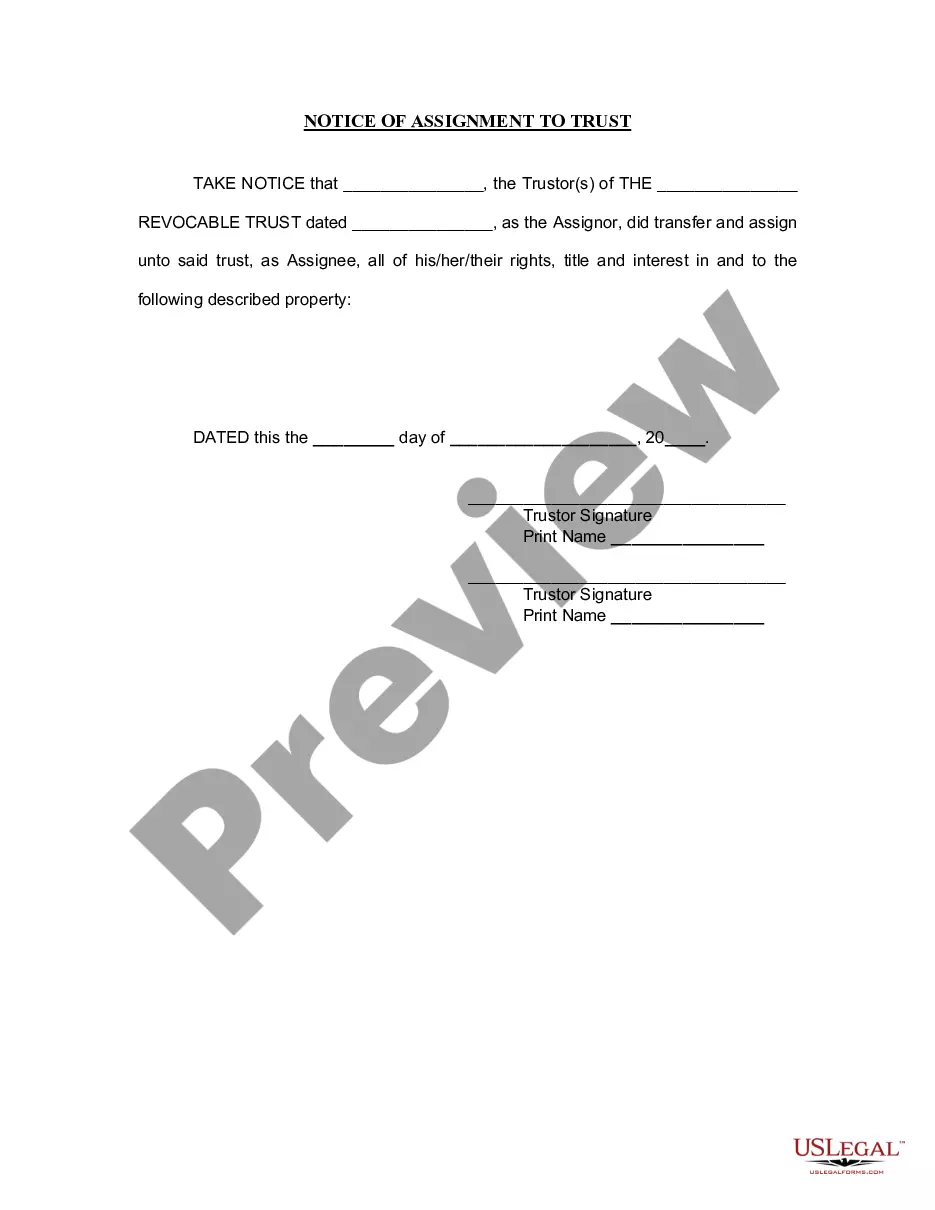

How to fill out Delaware Notice Of Disputed Account?

You may spend hours online trying to locate the authentic file template that meets the state and federal requirements you need.

US Legal Forms offers thousands of authentic forms that can be reviewed by professionals.

It is easy to obtain or print the Delaware Notice of Disputed Account from our service.

If available, utilize the Preview option to view the file template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can complete, modify, print, or sign the Delaware Notice of Disputed Account.

- Every authentic file template you acquire is your personal property for an extended period.

- To obtain another copy of any purchased form, go to the My documents section and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, ensure that you have chosen the correct file template for your state/region.

- Review the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

Before filing a consumer complaint, gather all relevant documentation related to your issue, such as receipts, emails, or contracts. Review company policies and attempt direct communication to resolve the matter first. If the problem persists, consider using a Delaware Notice of Disputed Account to clearly outline the specifics of your issue and strengthen your complaint.

To shut down a business in Delaware, you must file a Certificate of Cancellation with the Delaware Division of Corporations. You'll also need to settle any outstanding taxes and debts. If you've encountered payment disputes, documenting those with a Delaware Notice of Disputed Account could simplify the cancellation process.

To file a consumer complaint in Delaware, you should contact the Delaware Department of Justice’s Consumer Protection Unit. They guide you through the process and ensure that your complaint is taken seriously. Remember, if your issue involves a disputed account, using a Delaware Notice of Disputed Account can streamline your communication with businesses.

If you need to complain about a local business, consider starting with the Better Business Bureau (BBB) in your area. Additionally, you can file a complaint with your state's consumer protection office. For issues involving billing disputes, a Delaware Notice of Disputed Account may help you clarify and resolve your concerns effectively.

To email the attorney general of Delaware, you can find the official email address on the attorney general's website. When reaching out, clearly state your concern, especially if it pertains to a Delaware Notice of Disputed Account. This will help ensure your message reaches the right department for timely attention.

The Delaware attorney general serves as the chief legal officer of the state, protecting the interests of citizens. This includes enforcing consumer protection laws and addressing issues related to financial disputes, like a Delaware Notice of Disputed Account. The attorney general's office works to ensure fair practices in business and supports consumers in resolving their complaints.

To file a complaint against a company in Delaware, you should collect all relevant documents and information related to your issue. You can submit your complaint online through the Delaware attorney general's website, highlighting specifics such as a Delaware Notice of Disputed Account. This will assist the authorities in addressing your concerns effectively.

The response time from the attorney general’s office in Delaware can vary, but typically, you can expect a response within a few weeks. After submitting your complaint, especially regarding a Delaware Notice of Disputed Account, the office will review your information and reach out with any necessary updates. Patience is important during this process.

Filing a complaint with the attorney general in Delaware is straightforward. You can do this through the attorney general's website, where you will find a dedicated section for consumer complaints. Be sure to include key information, such as your Delaware Notice of Disputed Account, to help expedite the review of your case.

To file a complaint in Delaware, you can visit the consumer protection agency's website and follow the instructions provided. Generally, you will need to provide details about the issue, such as a Delaware Notice of Disputed Account, and any supporting documents. This ensures that your complaint is processed efficiently and that you receive the necessary support.

Interesting Questions

More info

Gold Placements Justin Elevate Websites Blogs Justin Amplify Management Google Business Profile Social Media Justin Onward Blog Title Commerce Trade CHAPTER BUILDING CONSTRUCTION PAYMENTS Procedure dispute Title Commerce Trade CHAPTER BUILDING CONSTRUCTION PAYMENTS Procedure dispute claims Delaware Code Statutes Justin Sign Find Lawyer Research Schools Laws Reg's Newsletters Marketing Solutions Justin Connect Membership Basic Membership Justin Lawyer Directory Platinum Placements Gold Placements Justin Elevate Websites Blogs Justin Amplify Management Google Business Profile Social Media Justin Onward Blog Title Commerce Trade CHAPTER BUILDING CONSTRUCTION PAYMENTS Procedure dispute claims Delaware Code Statutes Justin Sign Find Lawyer Research Schools Laws Reg's Newsletters Marketing Solutions Justin Connect Membership Basic Membership Justin Lawyer Directory Platinum Placements Gold Placements Justin Elevate Websites Blogs Justin Amplify Management Google Business Profile Social Media