Title: Understanding Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases Introduction: Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases is a legally binding contract between an executive and their employer in the state of Delaware, outlining the terms and conditions for the executive's employment, deferred compensation, and cost-of-living adjustments. This detailed description aims to shed light on the essential aspects and different types of such agreements, incorporating relevant keywords for a comprehensive understanding. 1. Purpose of the Delaware Employment Agreement of Executive: The primary purpose of this agreement is to ensure a mutually beneficial employment arrangement between the executive and the company while providing the executive with deferred compensation options and periodic adjustments to compensate for the rising cost of living. 2. Deferred Compensation: Deferred compensation refers to a portion of the executive's salary or bonus that is set aside and paid out at a later date, typically when the executive terminates their employment or upon retirement. This arrangement often helps executives plan for long-term financial stability and incentivizes loyalty towards the organization. 3. Cost-of-Living Increases: Cost-of-living increases are provisions within the agreement that ensure the executive's compensation keeps pace with inflation and the rising cost of goods and services. These adjustments are typically based on a predetermined index, such as the Consumer Price Index (CPI), and are meant to maintain the executive's purchasing power over time. 4. Types of Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases: a. Standard Delaware Employment Agreement: This is the most common type of agreement that outlines the general terms and conditions of employment, deferred compensation options, and cost-of-living adjustments, according to state and federal regulations. b. Performance-based Delaware Employment Agreement: This type of agreement includes provisions that link the executive's deferred compensation and cost-of-living increases to specific performance metrics or targets. It motivates the executive to achieve predetermined goals, aligning their interests with the company's success. c. Change-in-Control Delaware Employment Agreement: This specialized agreement is triggered in the event of a change in the company's ownership or control, entitling the executive to additional compensation and benefits. Deferred compensation and cost-of-living increases may be revised to accommodate the uncertainty associated with such organizational transitions. d. Long-term Incentive Delaware Employment Agreement: This form of agreement focuses on providing deferred compensation through non-cash incentives, such as stock options, restricted stock units, or performance shares. Cost-of-living increases are still applicable, but the emphasis lies on long-term financial growth and alignment with shareholder interests. Conclusion: Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases aims to establish a transparent and mutually beneficial employment relationship between executives and their employers in Delaware. It offers deferred compensation options to secure the executive's future financial well-being and includes cost-of-living increases to account for inflationary pressures. Different types of such agreements, including standard, performance-based, change-in-control, and long-term incentive agreements, cater to various circumstances and objectives. Understanding these key components is crucial for both executives and employers seeking to establish fair and comprehensive compensation arrangements.

Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases

Description

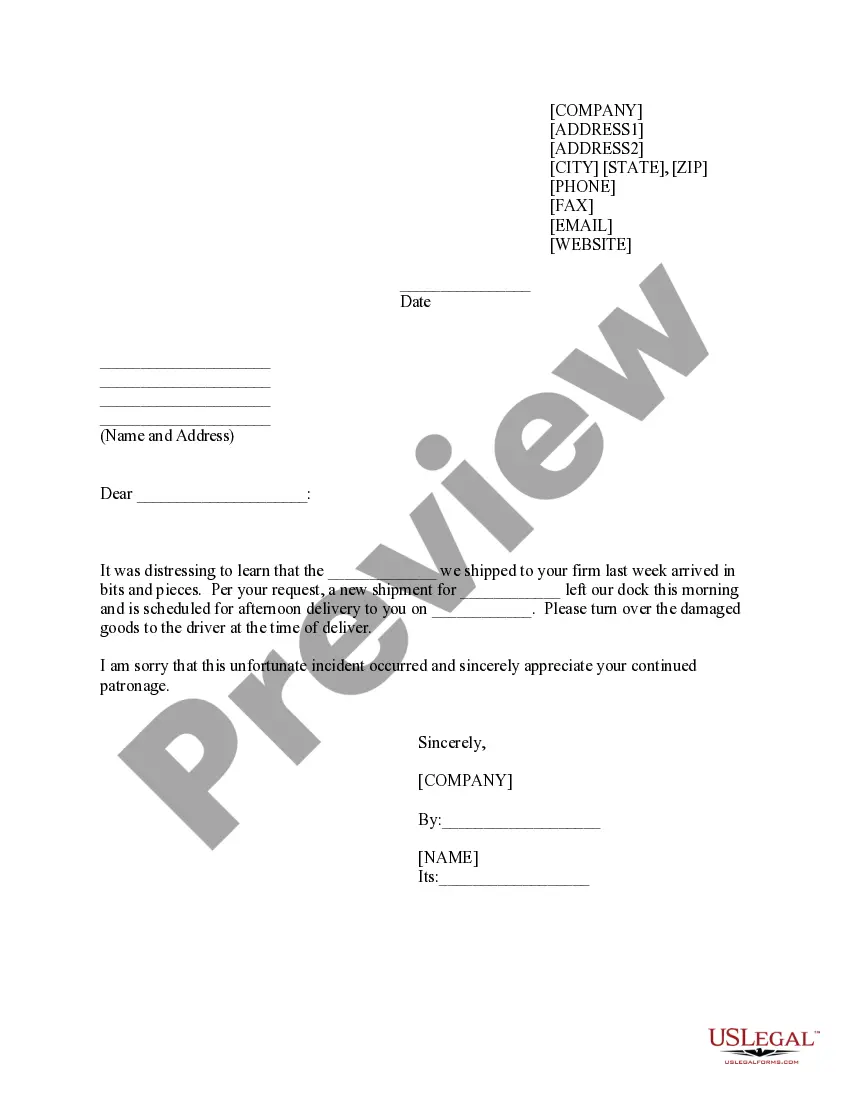

How to fill out Delaware Employment Agreement Of Executive With Deferred Compensation And Cost-of-Living Increases?

If you have to total, download, or printing lawful document themes, use US Legal Forms, the biggest assortment of lawful kinds, which can be found on the web. Take advantage of the site`s easy and hassle-free research to obtain the files you require. Numerous themes for business and person uses are categorized by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases in just a handful of clicks.

Should you be already a US Legal Forms buyer, log in to the profile and then click the Obtain key to get the Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases. You may also access kinds you previously delivered electronically from the My Forms tab of your respective profile.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for the correct town/nation.

- Step 2. Use the Review option to look through the form`s content material. Do not forget about to see the explanation.

- Step 3. Should you be unhappy using the form, utilize the Look for industry towards the top of the screen to get other versions from the lawful form template.

- Step 4. When you have identified the form you require, select the Get now key. Pick the pricing plan you prefer and include your accreditations to register for an profile.

- Step 5. Process the transaction. You can utilize your charge card or PayPal profile to complete the transaction.

- Step 6. Find the formatting from the lawful form and download it on the system.

- Step 7. Full, revise and printing or signal the Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases.

Every lawful document template you get is your own permanently. You may have acces to each form you delivered electronically in your acccount. Select the My Forms segment and choose a form to printing or download once more.

Be competitive and download, and printing the Delaware Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases with US Legal Forms. There are thousands of professional and state-specific kinds you can use for your personal business or person requires.