Title: A Comprehensive Guide to the Delaware Checklist of Matters to be Considered in Drafting an Agreement for the Sale of Corporate Assets Introduction: When engaging in the sale of corporate assets in Delaware, it is crucial to follow a checklist of matters to ensure a smooth and legally compliant transaction. This article aims to provide a detailed description of the key considerations that should be included in an agreement for the sale of corporate assets in Delaware. Keywords: Delaware, checklist, matters to be considered, drafting, agreement, sale, corporate assets. I. Parties and Background Information: 1. Identification of the buyer and seller: Clearly state the legal names and addresses of the parties involved in the transaction. 2. Organizational information: Provide the details of the buyer and seller's legal entity type (corporation, limited liability company, etc.), jurisdiction of formation, and any necessary representations and warranties. II. Asset Description and Purchase Price: 1. Assets included: Clearly define the assets being sold, including real estate, tangible property, intellectual property, contracts, permits, licenses, and any other relevant items. 2. Purchase price and payment terms: Specify the agreed-upon purchase price, payment schedule, and any potential adjustments, installments, or contingent payments. III. Representations and Warranties: 1. Seller representations: Outlining the representations and warranties made by the seller regarding their authority to sell the assets, the accuracy of financial statements, the absence of undisclosed liabilities, etc. 2. Buyer representations: Including buyer's representations regarding their ability to fulfill payment obligations, the legal capacity to enter into the agreement, and any necessary approvals required. IV. Due Diligence and Closing Conditions: 1. Due diligence period: Provide a time frame for the buyer to conduct due diligence on the assets, allowing for the examination of financial records, contracts, permits, and any other relevant documents. 2. Required consents and approvals: Identify any necessary third-party approvals, consents, or notifications required to complete the transaction (such as regulatory, contractual, or governmental consents). 3. Closing conditions: Specify the conditions that must be satisfied before closing, such as obtaining necessary approvals, valid permits, and the absence of any material adverse effects on the assets. V. Confidentiality, Non-Compete, and Indemnification: 1. Confidentiality provisions: Include clauses that protect sensitive information shared during the transaction. 2. Non-compete restrictions: Specify any non-compete obligations for the seller post-closing, preventing them from engaging in competing business activities within a specified time frame. 3. Indemnification provisions: Define the responsibilities of each party in terms of financial compensation for any breaches of warranties, representations, or covenants. VI. Governing Law and Dispute Resolution: 1. Choice of law: Determine the governing law that will apply to the interpretation and enforcement of the agreement. 2. Dispute resolution: Establish the mechanism for resolving disputes, such as mediation, arbitration, or litigation, along with any necessary venue or jurisdiction provisions. Conclusion: Considering the Delaware checklist of matters when drafting an agreement for the sale of corporate assets is crucial to ensure a legally sound transaction. By addressing the key considerations mentioned above, both the buyer and seller can navigate the sale process in Delaware with confidence. Alternate Types of Delaware Checklists for Drafting Agreements for Sale of Corporate Assets: 1. Simplified Checklist: A condensed version suitable for smaller asset sales or less complex transactions. 2. Acquirer-specific Checklist: Tailored specifically to the buyer, focusing on their requirements, due diligence, and compliance issues. 3. Seller-specific Checklist: Geared towards the seller, emphasizing their representations, warranties, and necessary disclosures. 4. Industry-Specific Checklist: Catered towards unique industries or sectors with specific regulations and considerations for asset sales. Keywords: Delaware checklist, matters to be considered, drafting, agreement, sale, corporate assets, simplified checklist, acquirer-specific checklist, seller-specific checklist, industry-specific checklist.

Delaware Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Delaware Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

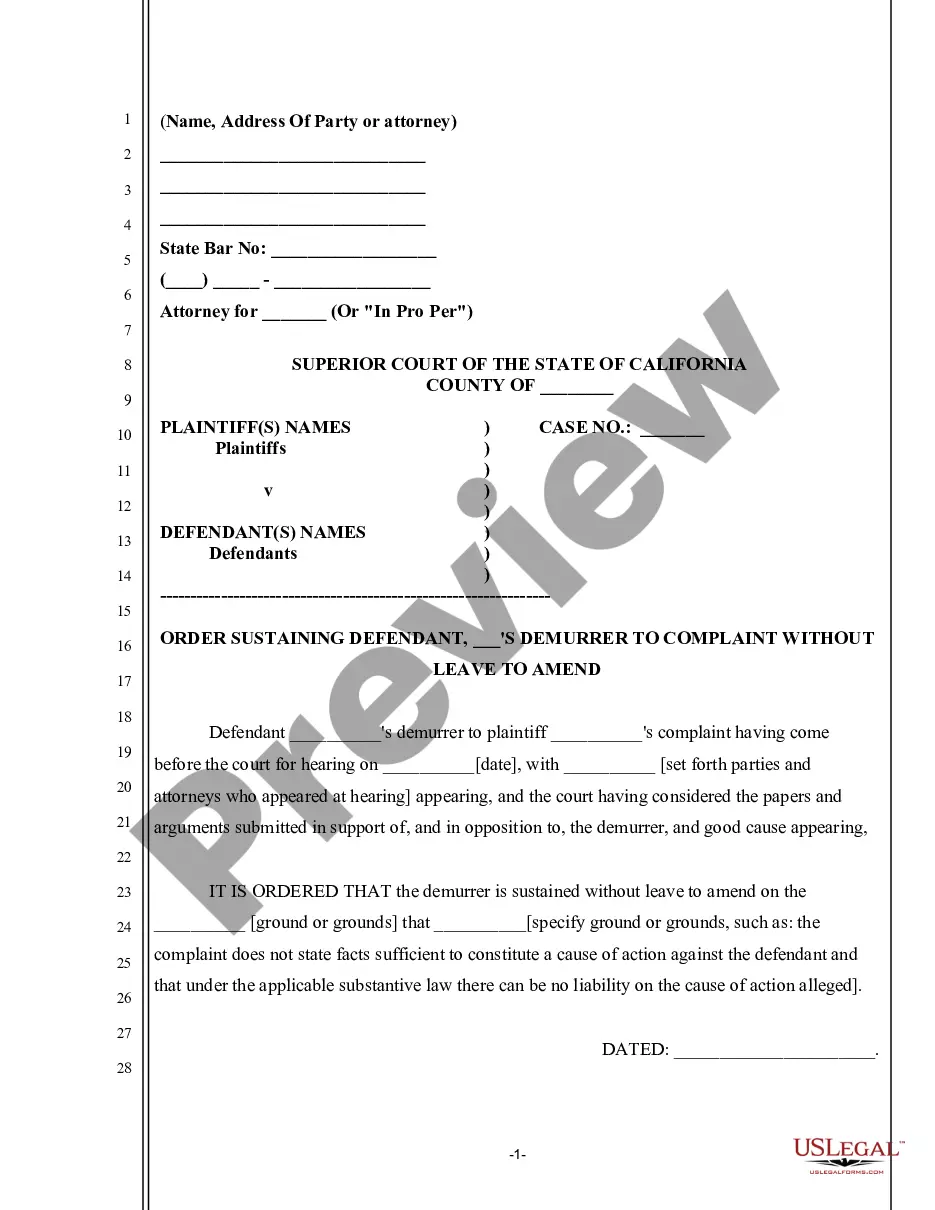

It is possible to commit hours online attempting to find the lawful document template which fits the federal and state needs you require. US Legal Forms offers a large number of lawful forms that happen to be evaluated by professionals. You can actually download or print the Delaware Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from my service.

If you already possess a US Legal Forms account, you may log in and click on the Acquire switch. Next, you may full, edit, print, or signal the Delaware Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets. Each lawful document template you purchase is the one you have forever. To acquire one more backup of the purchased kind, visit the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms website initially, stick to the easy directions beneath:

- Initially, make certain you have selected the correct document template for the state/town of your choice. Look at the kind information to ensure you have selected the appropriate kind. If available, make use of the Preview switch to check from the document template as well.

- If you wish to discover one more variation of your kind, make use of the Search field to get the template that fits your needs and needs.

- Once you have identified the template you would like, simply click Get now to continue.

- Pick the costs plan you would like, type in your qualifications, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal account to pay for the lawful kind.

- Pick the format of your document and download it to the product.

- Make changes to the document if needed. It is possible to full, edit and signal and print Delaware Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

Acquire and print a large number of document themes while using US Legal Forms Internet site, that provides the biggest assortment of lawful forms. Use skilled and condition-distinct themes to deal with your organization or person needs.