Delaware Repossession Services Agreement for Automobiles

Description

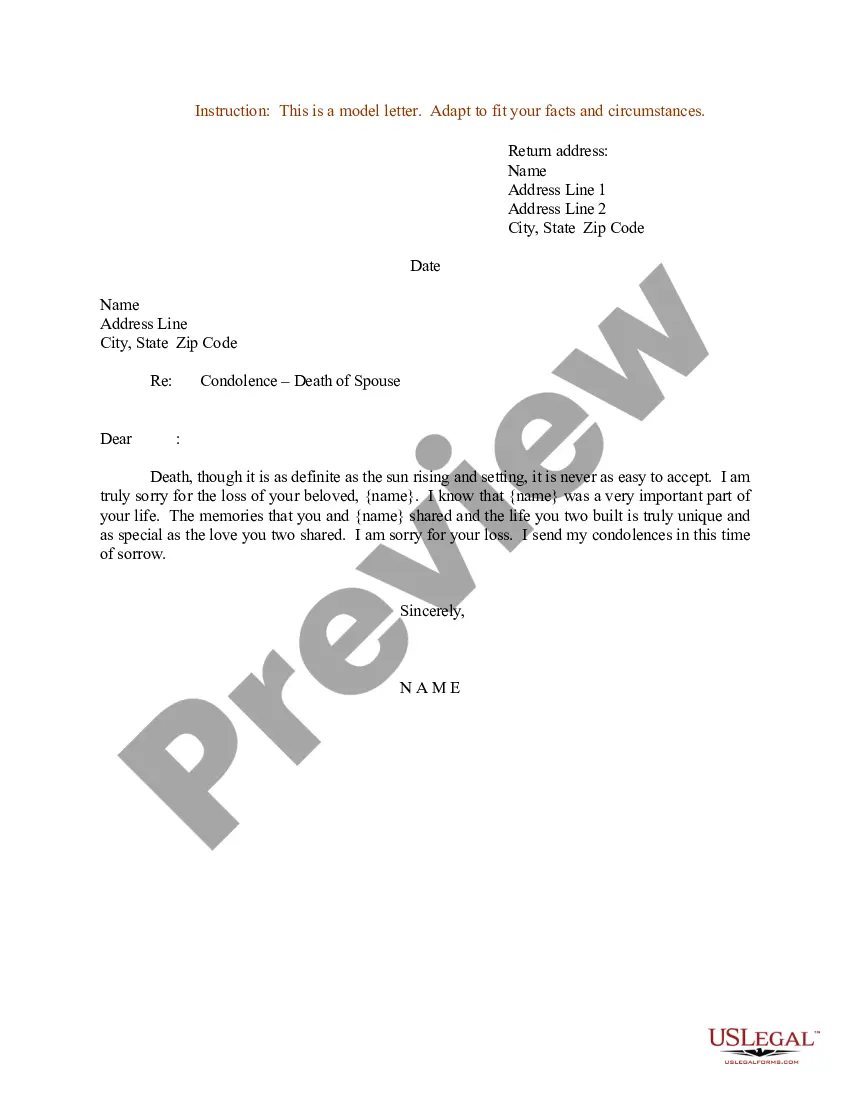

How to fill out Repossession Services Agreement For Automobiles?

US Legal Forms - one of the largest libraries of lawful varieties in America - offers a wide array of lawful papers themes it is possible to download or printing. Making use of the site, you may get thousands of varieties for enterprise and specific uses, categorized by classes, suggests, or keywords.You will find the latest models of varieties such as the Delaware Repossession Services Agreement for Automobiles in seconds.

If you already have a subscription, log in and download Delaware Repossession Services Agreement for Automobiles through the US Legal Forms library. The Down load button will show up on every single form you view. You have access to all formerly delivered electronically varieties in the My Forms tab of the account.

In order to use US Legal Forms the very first time, here are simple guidelines to help you started out:

- Ensure you have picked the right form for the metropolis/area. Go through the Review button to examine the form`s articles. Read the form description to actually have selected the correct form.

- If the form doesn`t satisfy your requirements, make use of the Research field near the top of the display screen to find the one that does.

- Should you be content with the form, validate your decision by simply clicking the Acquire now button. Then, choose the costs program you like and provide your accreditations to sign up for the account.

- Process the transaction. Use your bank card or PayPal account to accomplish the transaction.

- Choose the format and download the form on the product.

- Make changes. Fill up, edit and printing and indication the delivered electronically Delaware Repossession Services Agreement for Automobiles.

Every format you added to your bank account does not have an expiration time and it is yours forever. So, if you would like download or printing an additional backup, just proceed to the My Forms portion and then click in the form you need.

Gain access to the Delaware Repossession Services Agreement for Automobiles with US Legal Forms, the most substantial library of lawful papers themes. Use thousands of professional and status-specific themes that meet up with your organization or specific needs and requirements.

Form popularity

FAQ

Car title loans in Delaware are legal, and while there is no limit on the interest lenders can charge, Delaware has a number of regulations in place to ease the borrower's burden of deep indebtedness.

Repossession happens when your lender or leasing company takes your car away because you've missed payments on your loanand it can occur without warning if you've defaulted on your auto loan.

If your car or other property is repossessed, you might still owe the lender money on the contract. The amount you owe is called the "deficiency" or "deficiency balance."

Repossession happens when somebody stops paying their secured loans. When that happens, the creditor can take back the property securing the loan. The process of taking back this property is called repossession.

You only have the right to cure a default in Delaware if your installment contract provides for a balloon payment and this balloon payment is the one that you missed. A balloon payment means a final loan payment that is much larger than the regular payments.

If you've paid more than a third of the agreement, or if the goods are stored on private land or inside your home, your creditor will need a court order before they can repossess them.

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

Repossession is used to help lenders ensure that their debt is paid or as close to paid as is possible.

Example Repossessed because of previous owner's debt A few months later, the car is repossessed by the company who sold it to the previous owner, who owed money on it and had not been making payments.

In the absence of a court order, the only other way that moveable assets such as vehicles can be repossessed is if the customers voluntarily give the property back to the bank by signing a voluntary termination notice, she said.