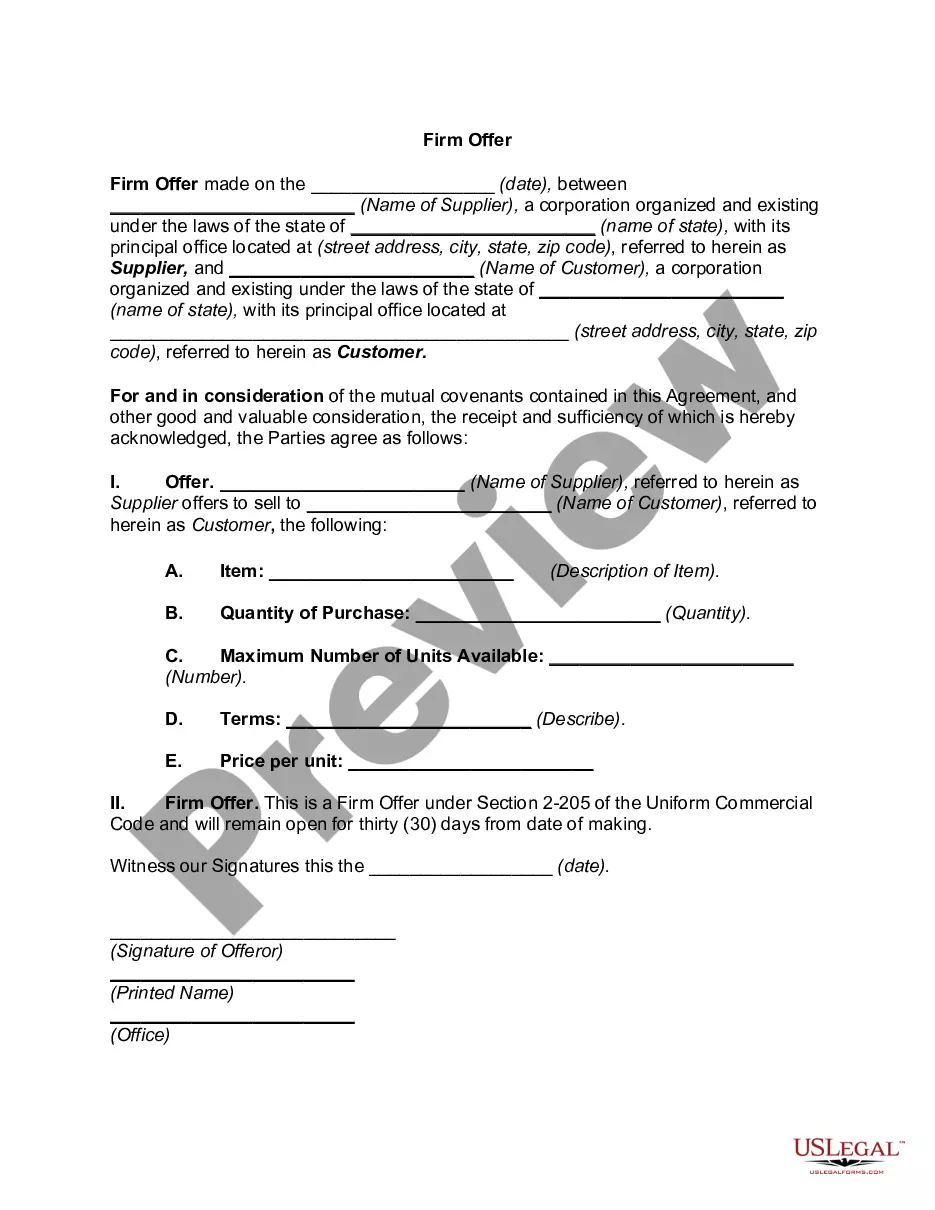

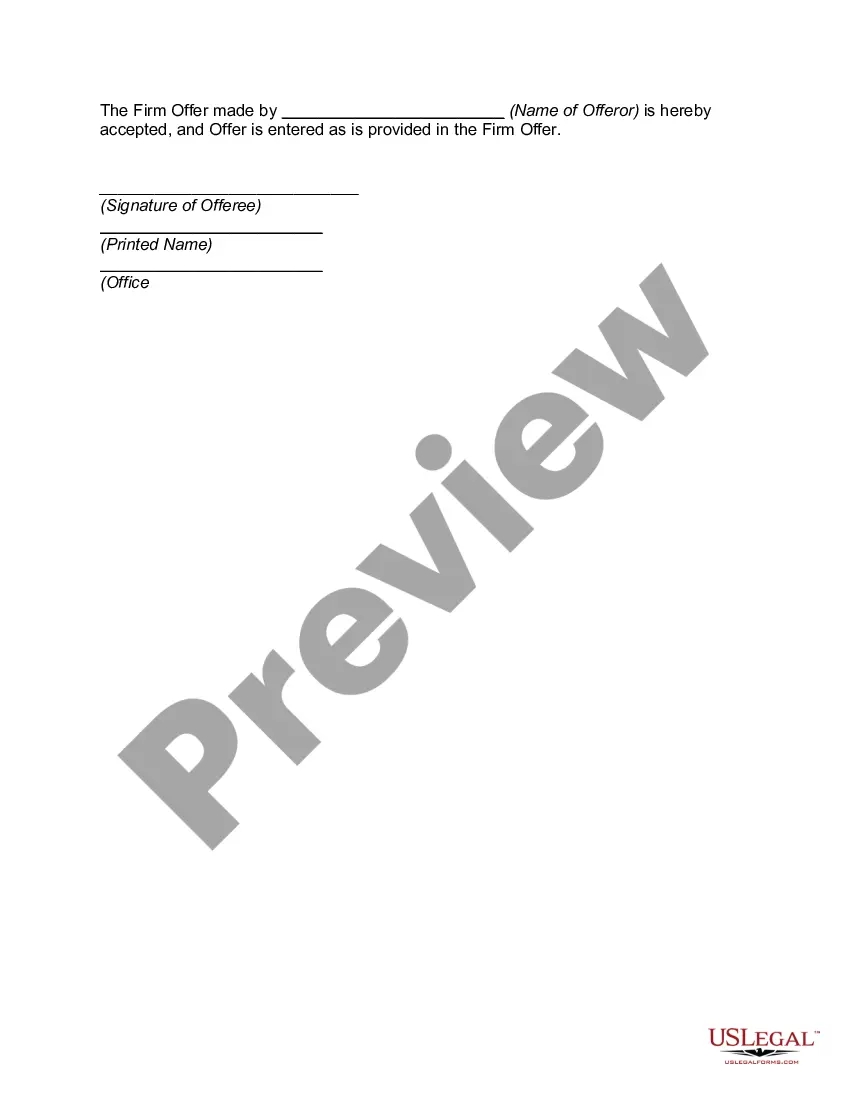

A Delaware Firm Offer is a legally binding commitment made by a corporation registered in the state of Delaware to sell a specified number of its shares to interested investors at a predetermined price. It is an essential element in corporate fundraising efforts, allowing companies to secure capital by issuing new shares directly to investors. Delaware, known for its business-friendly legal system, attracts numerous corporations due to its flexible corporate laws and the Delaware General Corporation Law (DCL), which provides a clear framework for corporate governance. The Delaware Firm Offer can take different forms based on the context and purpose of the transaction, including: 1. Initial Public Offering (IPO): This type of Firm Offer refers to the first sale of a company's shares to the public. It allows private companies to transition into publicly traded corporations, raising substantial funds for expansion, acquisitions, or debt repayment. 2. Follow-on Offering: When a publicly listed company issues additional shares to the public, it is known as a follow-on offering. This Firm Offer is commonly used by companies to raise additional capital for various purposes, such as financing new projects, strengthening working capital, or reducing debt. 3. Private Placement: In contrast to publicly offered shares, a private placement involves selling shares directly to a select group of investors. This type of Firm Offer bypasses the need for a public offering, making it an efficient and cost-effective way for companies to raise funds. It is often utilized by startup companies or small businesses seeking investments from venture capital firms, angel investors, or other institutional investors. 4. Rights Offering: In a rights offering, existing shareholders are given the opportunity to purchase additional shares of a company at a discounted price compared to the prevailing market price. This Firm Offer gives current shareholders the right but not the obligation to maintain their ownership percentage in the company and prevents dilution of their stake when the company issues new shares. The Delaware Firm Offer, regardless of its type, must comply with the relevant securities laws and regulations enforced by the U.S. Securities and Exchange Commission (SEC). It requires thorough due diligence, preparation of a prospectus, and filing necessary documents with the appropriate regulatory authorities to ensure transparency and protection for investors. Companies opting for a Delaware Firm Offer benefit from the state's corporate-friendly environment, legal system, and expertise in corporate governance matters. With the ability to choose from different types of Firm Offers, businesses can adapt their fundraising strategies depending on their specific goals, market conditions, and investor requirements.

Delaware Firm Offer

Description

How to fill out Delaware Firm Offer?

Finding the right legitimate file template can be a have difficulties. Naturally, there are plenty of themes available online, but how will you get the legitimate kind you need? Take advantage of the US Legal Forms web site. The support provides thousands of themes, such as the Delaware Firm Offer, which can be used for enterprise and private requirements. All the types are checked out by professionals and meet up with federal and state needs.

Should you be already listed, log in to your account and click the Download switch to get the Delaware Firm Offer. Make use of your account to appear throughout the legitimate types you might have ordered formerly. Proceed to the My Forms tab of your account and obtain another version from the file you need.

Should you be a fresh consumer of US Legal Forms, listed here are basic directions for you to comply with:

- Very first, make certain you have chosen the proper kind for your area/county. You can look over the form making use of the Preview switch and study the form outline to guarantee it will be the best for you.

- If the kind will not meet up with your needs, use the Seach industry to find the appropriate kind.

- When you are positive that the form is suitable, go through the Acquire now switch to get the kind.

- Choose the costs strategy you need and enter in the essential information and facts. Design your account and pay for the transaction using your PayPal account or charge card.

- Choose the data file structure and acquire the legitimate file template to your system.

- Total, revise and printing and indication the attained Delaware Firm Offer.

US Legal Forms may be the most significant catalogue of legitimate types that you can find numerous file themes. Take advantage of the service to acquire expertly-produced papers that comply with condition needs.