Delaware Charitable Gift Annuity (CGA) is a financial tool that allows individuals to make a charitable gift to a nonprofit organization while also receiving fixed payments for the rest of their lives. This type of annuity is popular among donors who wish to support a cause they care about while enjoying financial benefits. Under a Delaware Charitable Gift Annuity, the donor transfers assets, such as cash, stocks, or real estate, to a charitable organization. In return, the organization promises to pay the donor a fixed income for life. This income stream is usually determined based on the donor's age, the value of the donated assets, and the annuity rates defined by the organization. One of the key benefits of a Delaware CGA is the potential tax advantages it offers. Donors may be eligible for an immediate income tax deduction in the year they make the gift, which can help reduce their taxable income. Furthermore, a portion of the annuity payments received by the donor may be treated as tax-free return of principal. There are two main types of Delaware Charitable Gift Annuities: Immediate and Deferred Gas. Immediate CGA: As the name suggests, this type of annuity begins making payments shortly after the initial donation. Immediate Gas are suitable for individuals who want to start receiving income immediately. Deferred CGA: In contrast, deferred Gas delay the commencement of annuity payments until a future date chosen by the donor. This can be advantageous for donors looking to supplement retirement income or fulfill a future financial need. Delaware Charitable Gift Annuities provide an attractive option for donors who seek to support charitable causes, receive reliable income, and potentially enjoy tax benefits. It is essential for individuals considering a CGA to consult with their financial advisors or attorneys and engage with reputable nonprofit organizations to ensure the annuity aligns with their financial goals and philanthropic intentions.

Delaware Charitable Gift Annuity

Description

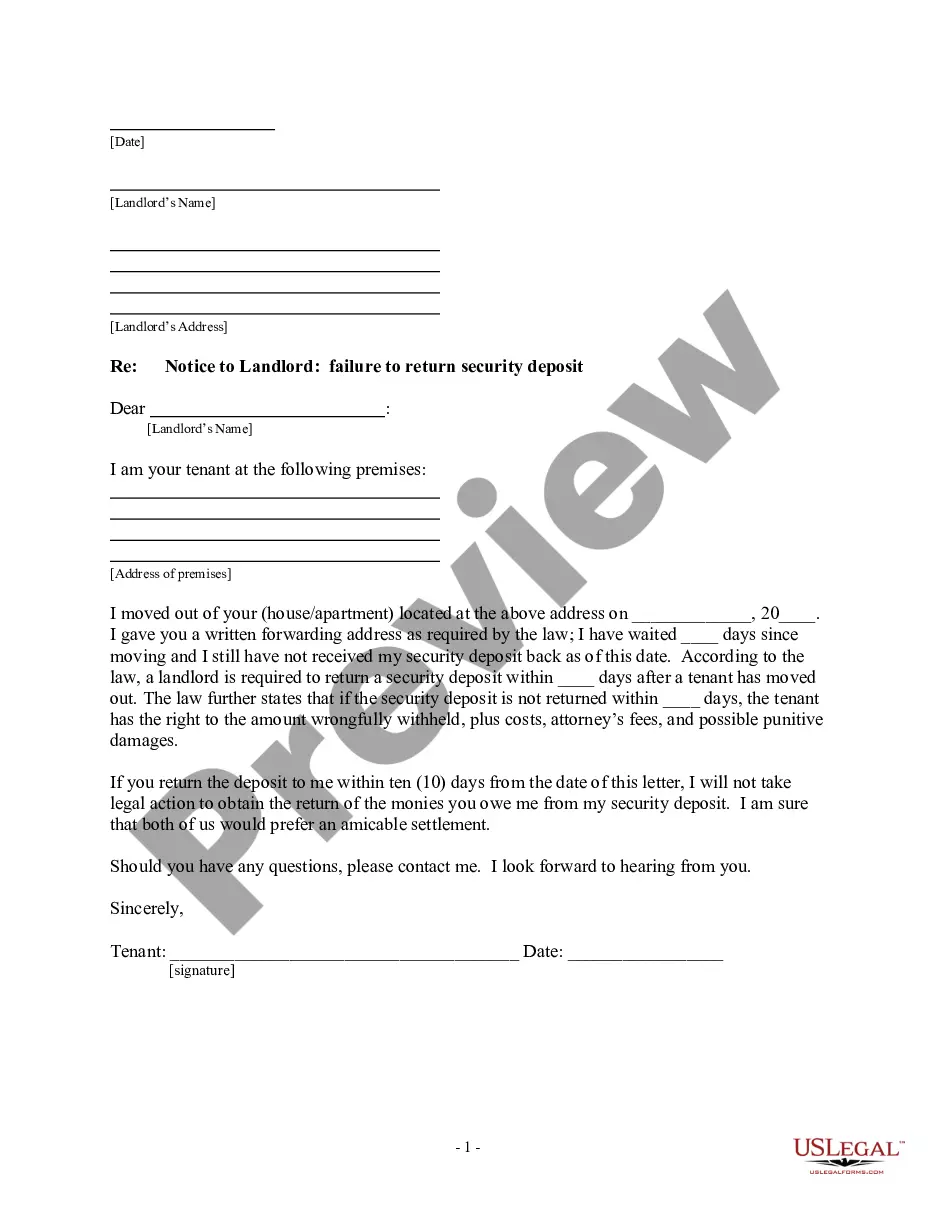

How to fill out Delaware Charitable Gift Annuity?

If you wish to full, acquire, or printing legitimate document layouts, use US Legal Forms, the biggest collection of legitimate varieties, which can be found on-line. Utilize the site`s simple and easy convenient lookup to obtain the paperwork you need. A variety of layouts for enterprise and individual functions are categorized by types and states, or key phrases. Use US Legal Forms to obtain the Delaware Charitable Gift Annuity in a handful of mouse clicks.

If you are previously a US Legal Forms customer, log in for your account and click the Obtain button to obtain the Delaware Charitable Gift Annuity. You can even access varieties you previously acquired from the My Forms tab of your account.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that appropriate area/nation.

- Step 2. Utilize the Review option to look through the form`s content material. Don`t forget about to read through the explanation.

- Step 3. If you are not happy together with the type, take advantage of the Search field near the top of the display screen to locate other versions of your legitimate type design.

- Step 4. When you have discovered the shape you need, go through the Buy now button. Opt for the rates program you favor and add your qualifications to register on an account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal account to finish the purchase.

- Step 6. Select the formatting of your legitimate type and acquire it on your own gadget.

- Step 7. Full, change and printing or indication the Delaware Charitable Gift Annuity.

Each and every legitimate document design you buy is yours forever. You might have acces to each type you acquired with your acccount. Select the My Forms portion and decide on a type to printing or acquire again.

Contend and acquire, and printing the Delaware Charitable Gift Annuity with US Legal Forms. There are millions of skilled and express-specific varieties you can use for the enterprise or individual requires.