Delaware Guaranty without Pledged Collateral Definition: Delaware Guaranty without Pledged Collateral is a legal agreement in which a party (the guarantor) agrees to assume the financial obligation and guarantee repayment of a loan or debt without any specific pledged assets as collateral. This type of guarantee provides additional security to lenders when direct collateral is not available or insufficient. Benefits of Delaware Guaranty without Pledged Collateral: 1. Enhanced Lender Protection: By offering a guaranty without pledged collateral, lenders can mitigate risks associated with lending funds without the presence of tangible assets as security. This type of guarantee ensures that the guarantor has a financial stake in the success of the borrower's obligation. 2. Flexible Financing: Delaware Guaranty without Pledged Collateral allows borrowers to secure loans or credit lines even if they lack substantial assets. This flexibility promotes access to financing for small businesses, startups, and individuals who may not have sufficient collateral to offer. Types of Delaware Guaranty without Pledged Collateral: 1. Unlimited Guaranty: In an unlimited guaranty, the guarantor becomes liable for the entire outstanding balance of the loan or debt, including interest and fees. This type of guaranty places a broad obligation on the guarantor, covering any potential defaults by the borrower. 2. Limited Guaranty: A limited guaranty implies that the guarantor's liability is capped at a specific amount. This type of guaranty sets a maximum limit on the guarantor's responsibility and protects them from excessive financial exposure. 3. Absolute Guaranty: An absolute guaranty places an unconditional obligation on the guarantor, making them fully liable for the borrower's debt, even if the borrower goes bankrupt or fails to repay the loan. This type of guaranty provides the highest level of assurance to lenders. 4. Conditional Guaranty: Unlike absolute guaranty, a conditional guaranty requires the occurrence of specific events or conditions before the guarantor becomes obligated for the debt. These conditions might include default by the borrower, non-payment, or other agreed-upon triggers. Overall, Delaware Guaranty without Pledged Collateral serves as an effective tool for lenders to safeguard their interests and provides borrowers with the opportunity to secure financing even without tangible assets. The various types of guaranties cater to different circumstances and offer lenders and guarantors flexibility in determining the extent of liability and protection.

Delaware Guaranty without Pledged Collateral

Description

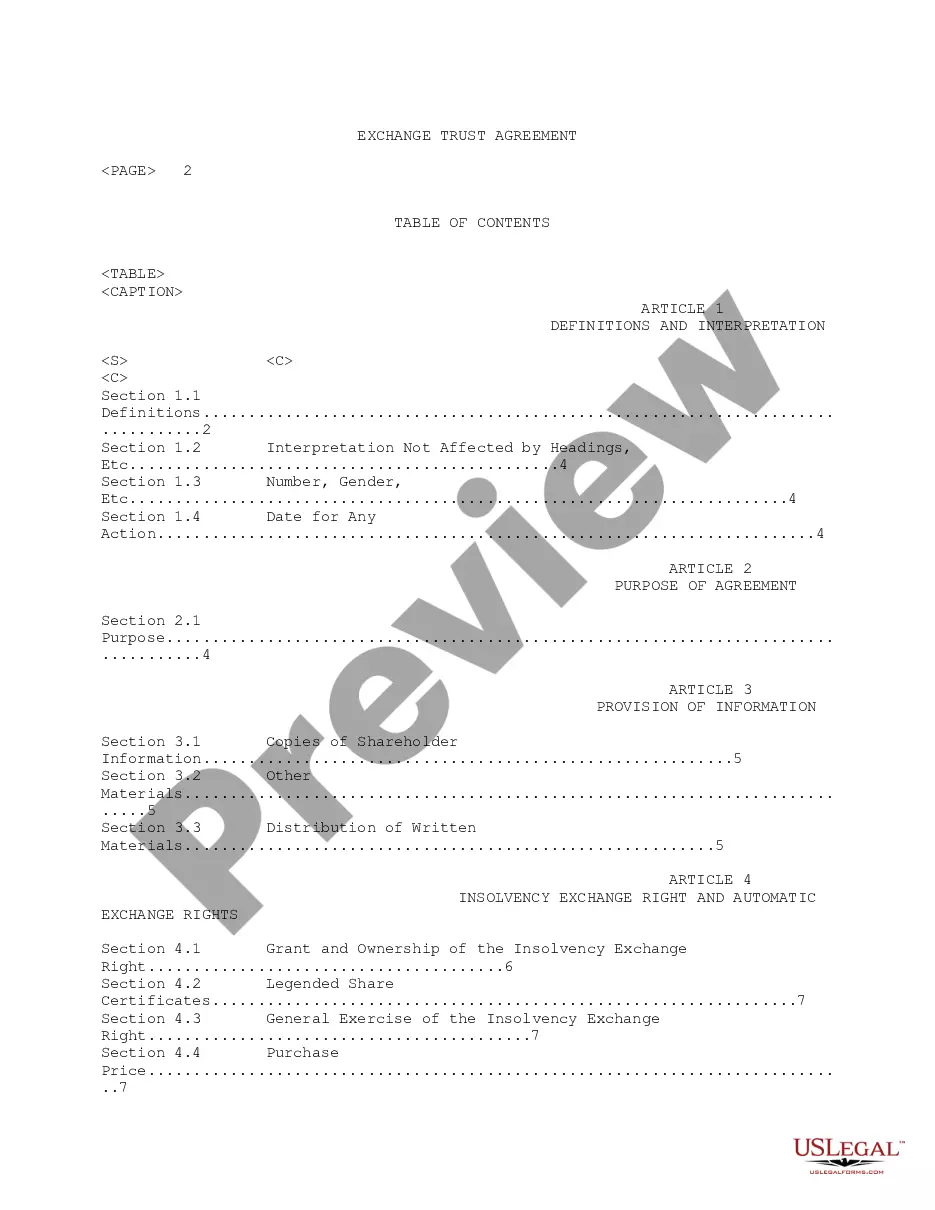

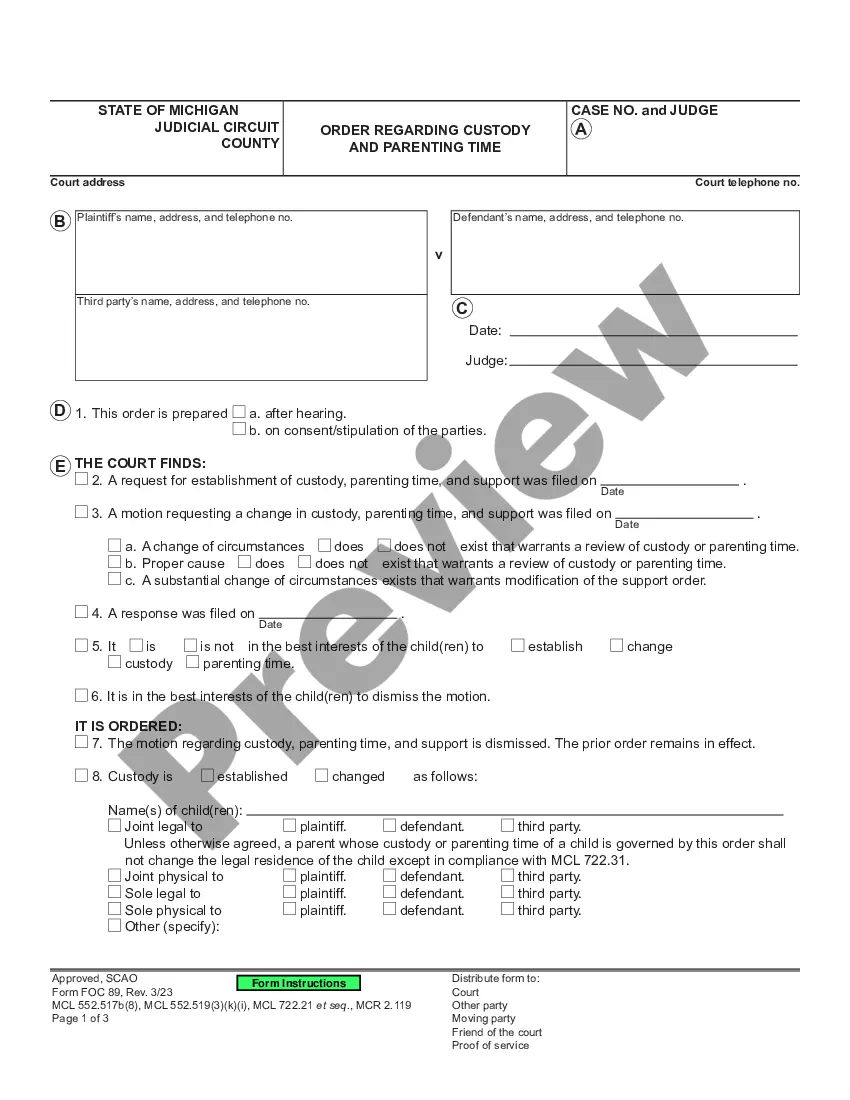

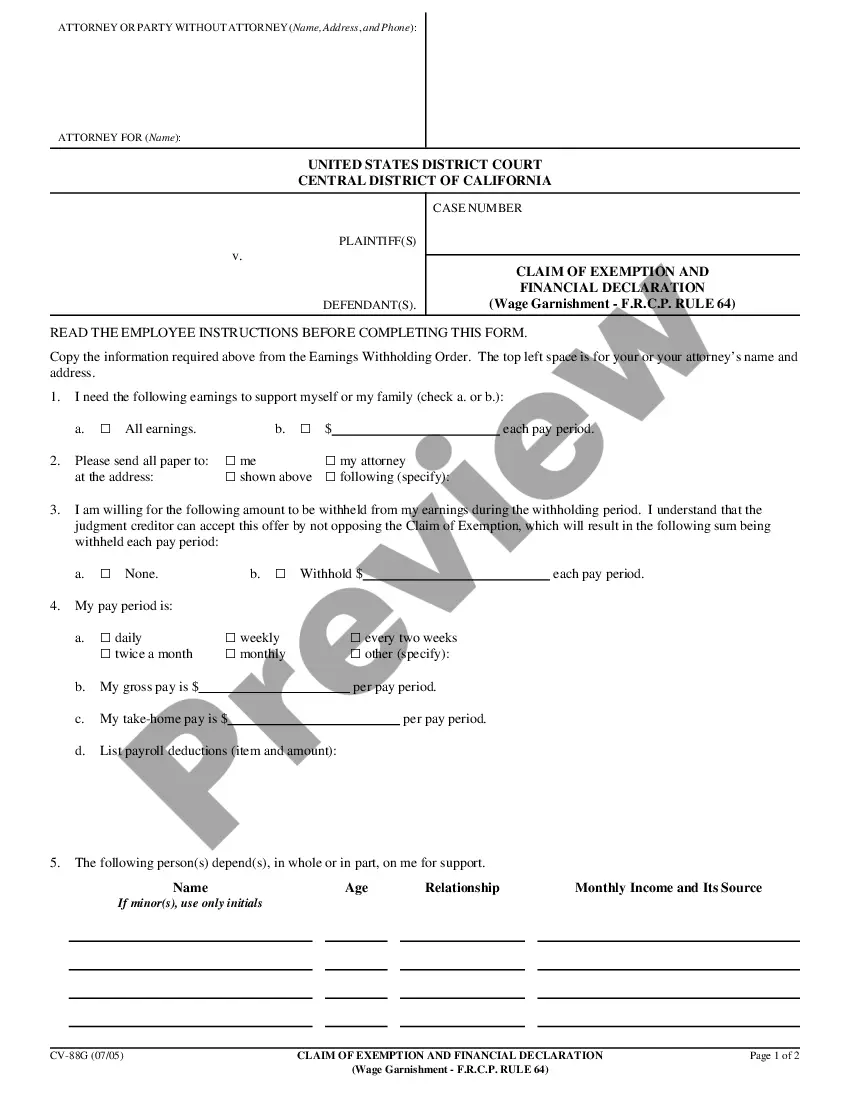

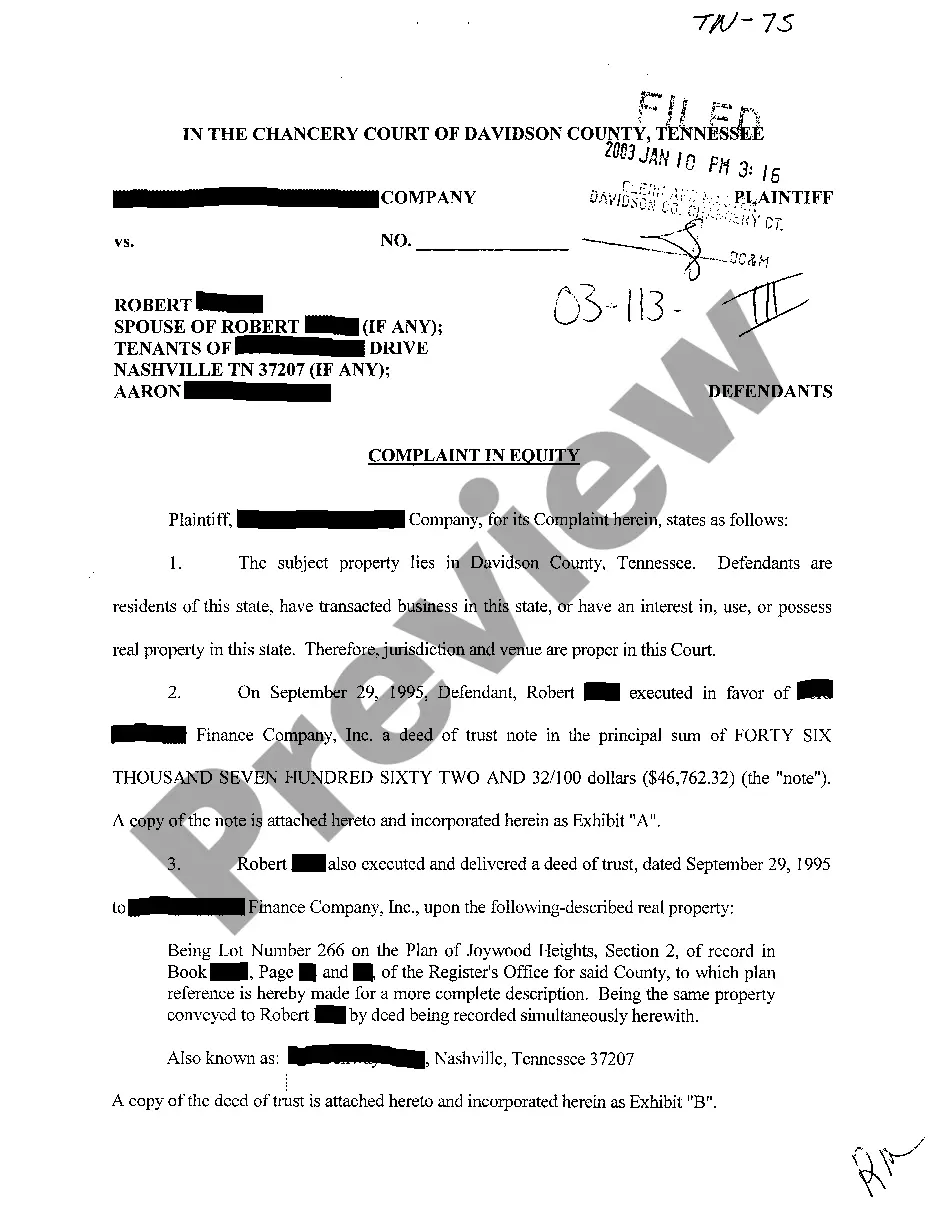

How to fill out Delaware Guaranty Without Pledged Collateral?

Are you in a placement in which you need papers for either business or person uses nearly every day? There are a lot of legitimate file web templates available on the net, but locating kinds you can rely is not easy. US Legal Forms delivers a huge number of kind web templates, much like the Delaware Guaranty without Pledged Collateral, which are published in order to meet federal and state needs.

In case you are already knowledgeable about US Legal Forms site and possess your account, simply log in. After that, you are able to acquire the Delaware Guaranty without Pledged Collateral design.

If you do not provide an account and would like to start using US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is for your proper area/area.

- Use the Preview switch to examine the shape.

- See the information to ensure that you have chosen the proper kind.

- If the kind is not what you`re looking for, take advantage of the Look for discipline to find the kind that suits you and needs.

- When you find the proper kind, click Buy now.

- Pick the pricing strategy you desire, fill out the necessary information to produce your money, and pay money for the order utilizing your PayPal or charge card.

- Pick a practical document structure and acquire your copy.

Find all the file web templates you possess bought in the My Forms food list. You may get a further copy of Delaware Guaranty without Pledged Collateral at any time, if needed. Just click the required kind to acquire or produce the file design.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save lots of time and stay away from blunders. The services delivers appropriately created legitimate file web templates which can be used for an array of uses. Produce your account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

A reaffirmation of guaranty from a guarantor of the tenant's obligations under a lease can be as simple as a few sentences appended to the end of the lease amendment, whereby the guarantor certifies that it consents to the terms and conditions of the amendment, and affirms that its obligations under the guaranty remain

Guarantor unconditionally guarantees payment to Lender of all amounts owing under the Note. This Guarantee remains in effect until the Note is paid in full. Guarantor must pay all amounts due under the Note when Lender makes written demand upon Guarantor.

Personal guarantee: This is a signed promise that states that you will pay back your loan through personal assets that aren't legally protected from creditors. Collateral: If a business defaults or goes bankrupt, collateral is a particular asset or assets that are pledged as security for repaying the borrowed loan.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Understanding Financial GuaranteesGuarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Pledge TypesActive Pledge. Active pledge is defined as a pledge that is active, regardless if it has a payment schedule or not.Annual Fund Pledge.Conditional Pledge.Open Pledge.Pledge Intention.Straight Pledge.Will Commitment.