Delaware Guaranty with Pledged Collateral is a legal arrangement that offers security to lenders by allowing them to acquire specific assets if a borrower defaults on their loan obligations. This type of guarantee utilizes collateral as a means of ensuring repayment, providing greater protection to lenders in Delaware. The Delaware Guaranty with Pledged Collateral is a widely recognized instrument in the financial industry, aiding lenders in managing their risk exposure. By requesting borrowers to pledge certain assets as collateral, lenders secure a form of repayment in the event of default. This collateral can range from real estate properties, vehicles, machinery, or other valuable assets deemed acceptable by the lender. One of the notable types of Delaware Guaranty with Pledged Collateral is mortgage collateral. In mortgage agreements, the borrower pledges the property being financed as collateral to the lender. In case of default, the lender can initiate foreclosure proceedings to recoup the outstanding loan amount by selling the mortgaged property. This ensures the lender has a legal claim on the property until the loan is fully repaid. Another variant is business collateral, where borrowers pledge their business assets, such as inventory, equipment, or accounts receivable, to secure a loan. This collateral acts as a safety net for lenders, ensuring their ability to recover funds in situations where the business fails to meet its financial obligations. Delaware Guaranty with Pledged Collateral is not limited to physical assets alone. Intellectual property, such as copyrights, patents, or trademarks, can also be pledged as collateral. This allows lenders to have a legal right to these valuable intangible assets in the event of default, enabling them to pursue avenues such as licensing or selling to recover the outstanding loan amount. Furthermore, Delaware Guaranty with Pledged Collateral may extend to securities, where borrowers pledge stocks, bonds, or other financial instruments as collateral. By taking possession of these assets, lenders can liquidate them to retrieve their investment if the borrower fails to repay the loan. In summary, Delaware Guaranty with Pledged Collateral is a powerful financial instrument that provides lenders with added security when extending credit or loans. By requiring borrowers to pledge valuable assets as collateral, lenders mitigate their risk exposure, allowing them to recover their investment in case of default. Different types include mortgage collateral, business collateral, intellectual property collateral, and securities collateral, each offering lenders distinct avenues for recovering their funds.

Delaware Guaranty with Pledged Collateral

Description

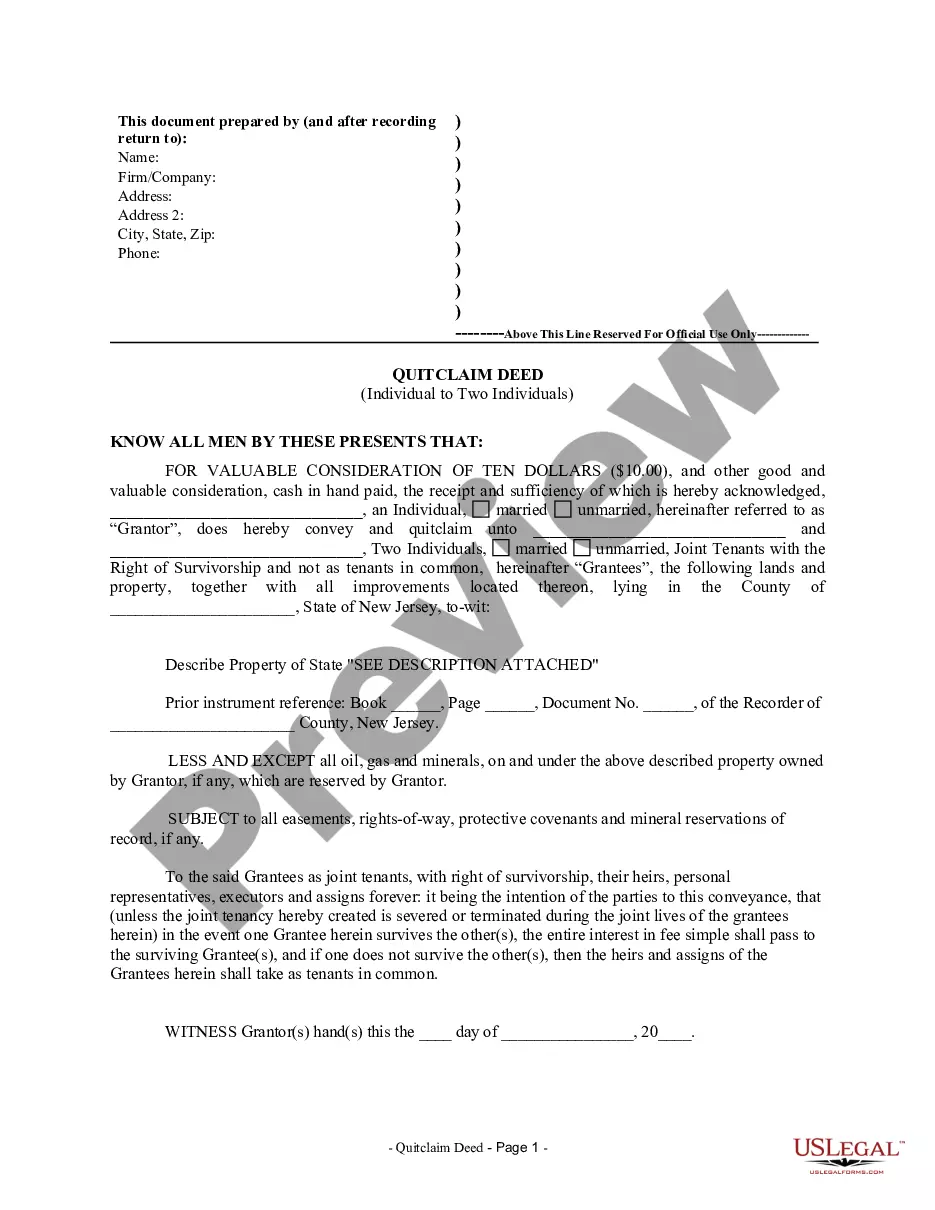

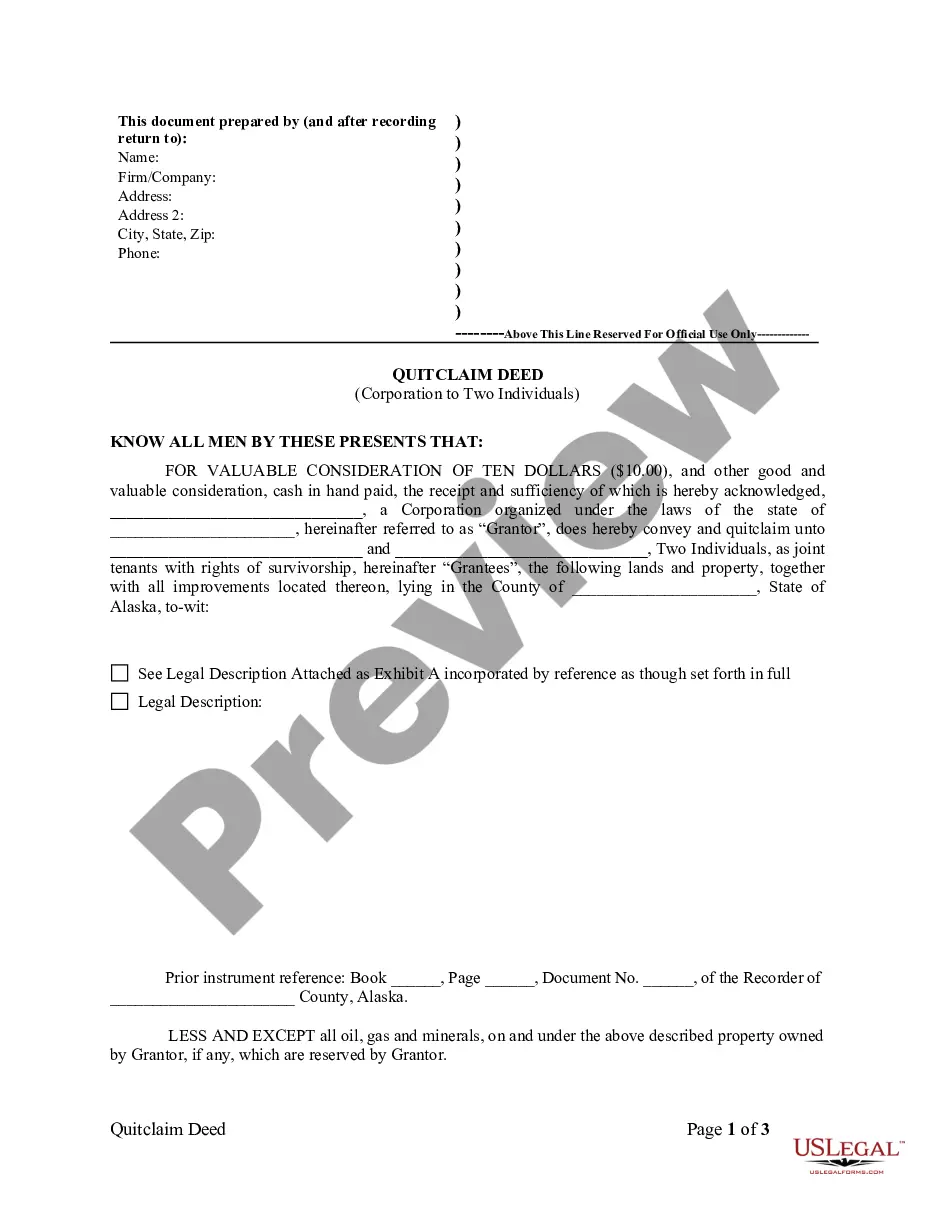

How to fill out Delaware Guaranty With Pledged Collateral?

US Legal Forms - among the largest libraries of authorized kinds in the States - offers a variety of authorized file themes it is possible to down load or print. Utilizing the website, you may get thousands of kinds for business and specific functions, sorted by types, claims, or search phrases.You can find the most recent versions of kinds just like the Delaware Guaranty with Pledged Collateral within minutes.

If you have a registration, log in and down load Delaware Guaranty with Pledged Collateral from your US Legal Forms local library. The Down load switch will appear on each and every develop you look at. You have access to all previously downloaded kinds in the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, here are simple directions to help you began:

- Ensure you have picked the best develop for the area/county. Select the Review switch to analyze the form`s information. Browse the develop explanation to actually have chosen the right develop.

- In the event the develop doesn`t suit your needs, take advantage of the Look for discipline towards the top of the screen to get the the one that does.

- In case you are content with the shape, verify your option by clicking the Get now switch. Then, select the pricing strategy you want and provide your references to sign up for the profile.

- Procedure the transaction. Make use of charge card or PayPal profile to perform the transaction.

- Choose the format and down load the shape in your system.

- Make changes. Complete, modify and print and indicator the downloaded Delaware Guaranty with Pledged Collateral.

Every single template you put into your money does not have an expiration particular date and it is your own property forever. So, if you wish to down load or print one more copy, just proceed to the My Forms section and then click around the develop you require.

Get access to the Delaware Guaranty with Pledged Collateral with US Legal Forms, the most extensive local library of authorized file themes. Use thousands of expert and state-particular themes that meet your small business or specific requirements and needs.

Form popularity

FAQ

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. Collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

Pledge means bailment of goods as security against the loan. Hypothecation is creation of charge on movable property without delivering them to the lender. It is transfer of an interest in specific immovable property as security against loan.

With a pledge, your lender has possession of your collateral and can sell off the asset should you default on your loan. With hypothecation, you always remain in possession of your collateral.

The Bottom Line For example, when you secure a mortgage, you technically own your home. But it is also collateral for that loan. That means lenders can reposses it if you default on payments. Rehypothecation is when a lender uses an investor's collateral as collateral for one of their own obligations.

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

Pledging cash collateral to secure a loan means that the business can continue to operate without having to pay off an entire loan whenever it sells inventory or collects an account receivable.