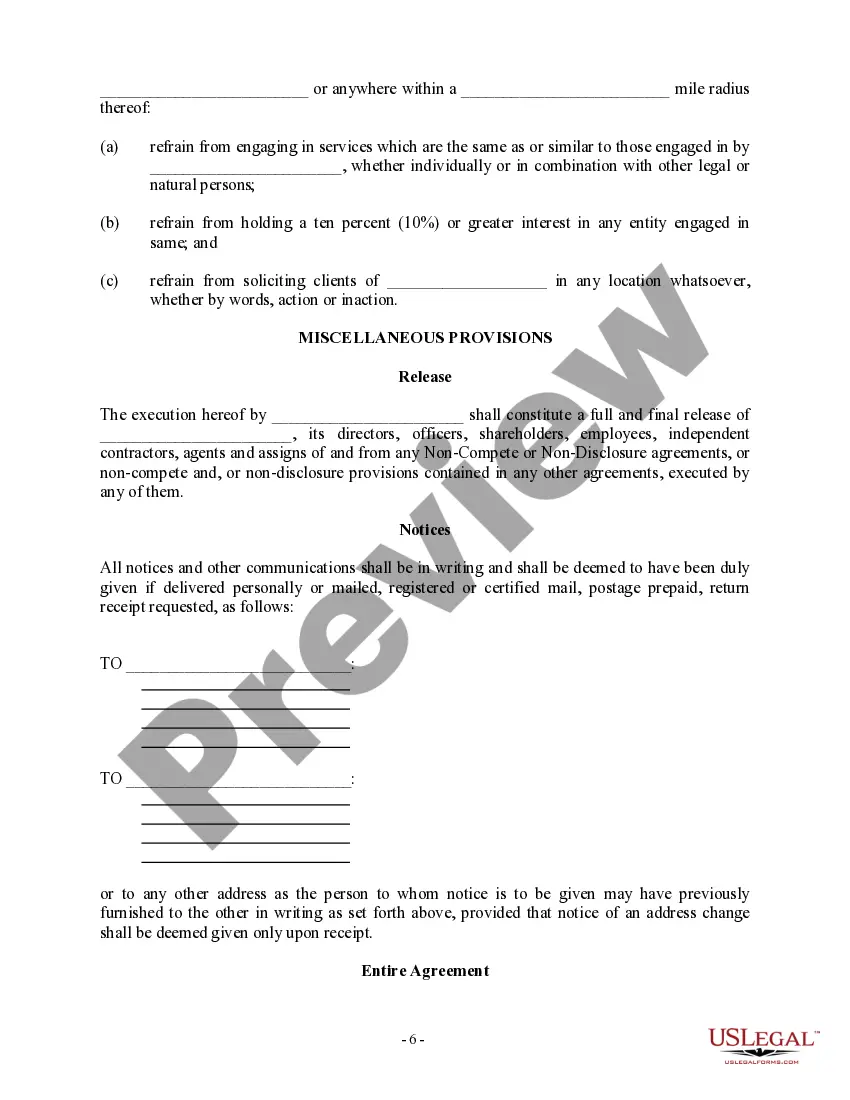

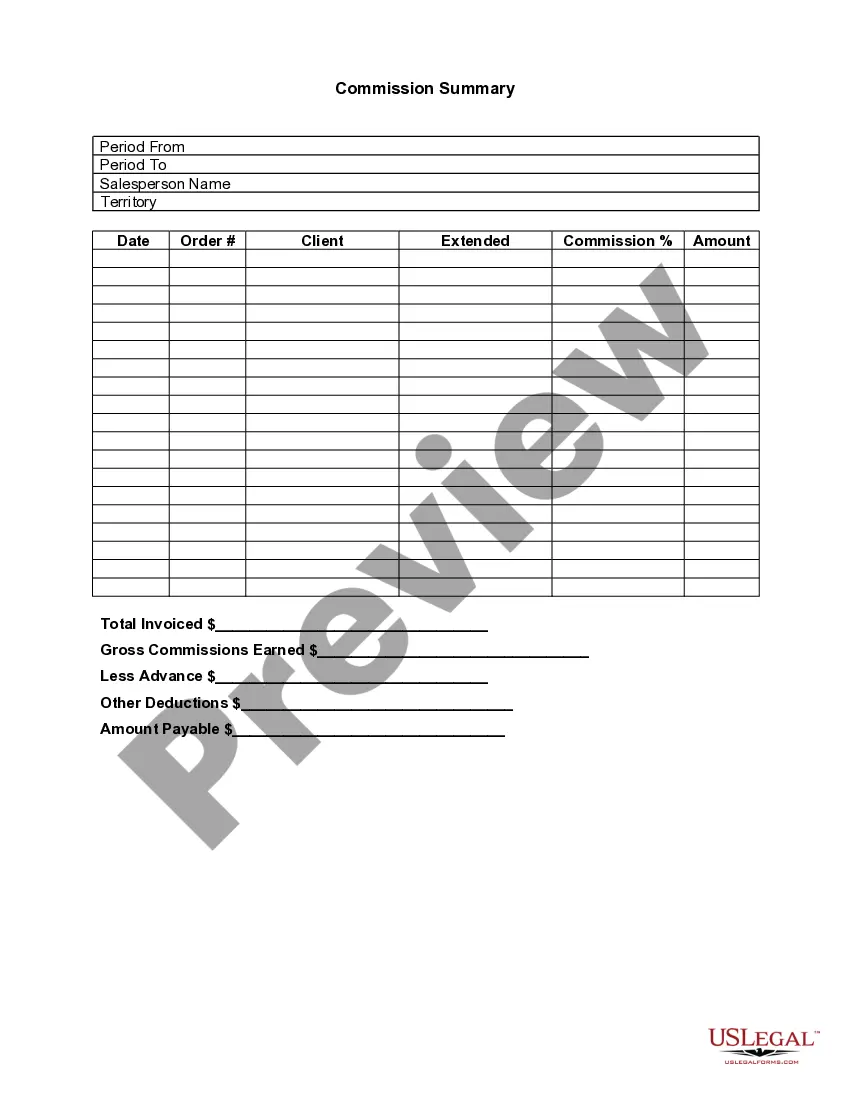

A Delaware self-employed independent contractor consulting agreement is a legally binding document that outlines the terms and conditions between a consultant (the self-employed independent contractor) and a client for the provision of consulting services in the state of Delaware. This agreement ensures that both parties understand their rights, responsibilities, and expectations, promoting a professional and harmonious working relationship. The agreement typically includes several key components, such as: 1. Parties Involved: The agreement clearly identifies the consultant (the self-employed independent contractor) and the client, providing their legal names, addresses, and contact information. 2. Scope of Services: This section details the specific consulting services that the contractor will provide to the client. It outlines the project's objectives, tasks, deliverables, and any specific timeframes or deadlines. 3. Compensation: The agreement specifies how the consultant will be paid for their services. It includes the agreed-upon fees, payment schedule, and any additional expenses or reimbursements the consultant is entitled to. 4. Independent Contractor Status: This section clarifies that the consultant is an independent contractor and not an employee of the client. It outlines the respective rights and responsibilities of both parties, emphasizing that the consultant is solely responsible for their taxes, insurance, and other obligations. 5. Confidentiality: This section ensures that any sensitive or proprietary information shared between the client and the consultant remains confidential and is not disclosed to third parties without written consent. 6. Intellectual Property: This clause determines the ownership and usage rights of any intellectual property created or utilized during the consulting engagement. It clarifies whether the client or the consultant holds the rights to the work product. 7. Termination: The agreement outlines the circumstances under which either party can terminate the consulting relationship and the notice period required for termination. It also specifies any penalties or damages that may arise due to early termination. Different types of Delaware self-employed independent contractor consulting agreements may exist based on the nature of the consulting services. Some examples may include: 1. Marketing Consulting Agreement: This agreement focuses on marketing-related services such as market research, brand development, marketing strategy, or advertising campaigns. 2. IT Consulting Agreement: This type of agreement pertains to the provision of IT consulting services, including software development, system implementation, infrastructure setup, or technical support. 3. Financial Consulting Agreement: This agreement covers financial advisory services, such as tax planning, investment advice, financial analysis, or budgeting. 4. Human Resources Consulting Agreement: This agreement involves HR-related consulting services such as recruitment, employee training, performance management, or HR policy development. These are just a few examples, and consulting agreements can vary greatly based on the industry, specialization, and unique requirements of the client and consultant. It is crucial to seek legal counsel while drafting or entering into any contractual agreement to ensure compliance with Delaware state laws and to protect the rights of both parties involved.

Delaware Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Delaware Self-Employed Independent Contractor Consulting Agreement - Detailed?

If you wish to total, acquire, or print out legal file themes, use US Legal Forms, the biggest collection of legal kinds, which can be found on the Internet. Make use of the site`s easy and handy lookup to get the paperwork you will need. Numerous themes for enterprise and personal uses are categorized by groups and says, or search phrases. Use US Legal Forms to get the Delaware Self-Employed Independent Contractor Consulting Agreement - Detailed with a couple of click throughs.

When you are currently a US Legal Forms consumer, log in for your profile and click the Obtain option to obtain the Delaware Self-Employed Independent Contractor Consulting Agreement - Detailed. You may also entry kinds you in the past downloaded in the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for the right city/region.

- Step 2. Make use of the Review choice to examine the form`s content material. Don`t overlook to read the description.

- Step 3. When you are unhappy with all the kind, use the Lookup field towards the top of the monitor to find other versions in the legal kind web template.

- Step 4. Upon having discovered the form you will need, click the Buy now option. Choose the costs plan you like and include your references to register to have an profile.

- Step 5. Method the transaction. You may use your credit card or PayPal profile to finish the transaction.

- Step 6. Pick the format in the legal kind and acquire it on the device.

- Step 7. Comprehensive, revise and print out or signal the Delaware Self-Employed Independent Contractor Consulting Agreement - Detailed.

Every legal file web template you buy is the one you have permanently. You might have acces to every single kind you downloaded in your acccount. Go through the My Forms portion and pick a kind to print out or acquire once more.

Compete and acquire, and print out the Delaware Self-Employed Independent Contractor Consulting Agreement - Detailed with US Legal Forms. There are many expert and express-particular kinds you can use for your personal enterprise or personal demands.