Delaware Resolution of Meeting of LLC Members to Sell Assets

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Assets?

Are you in a position where you require documents for business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't easy.

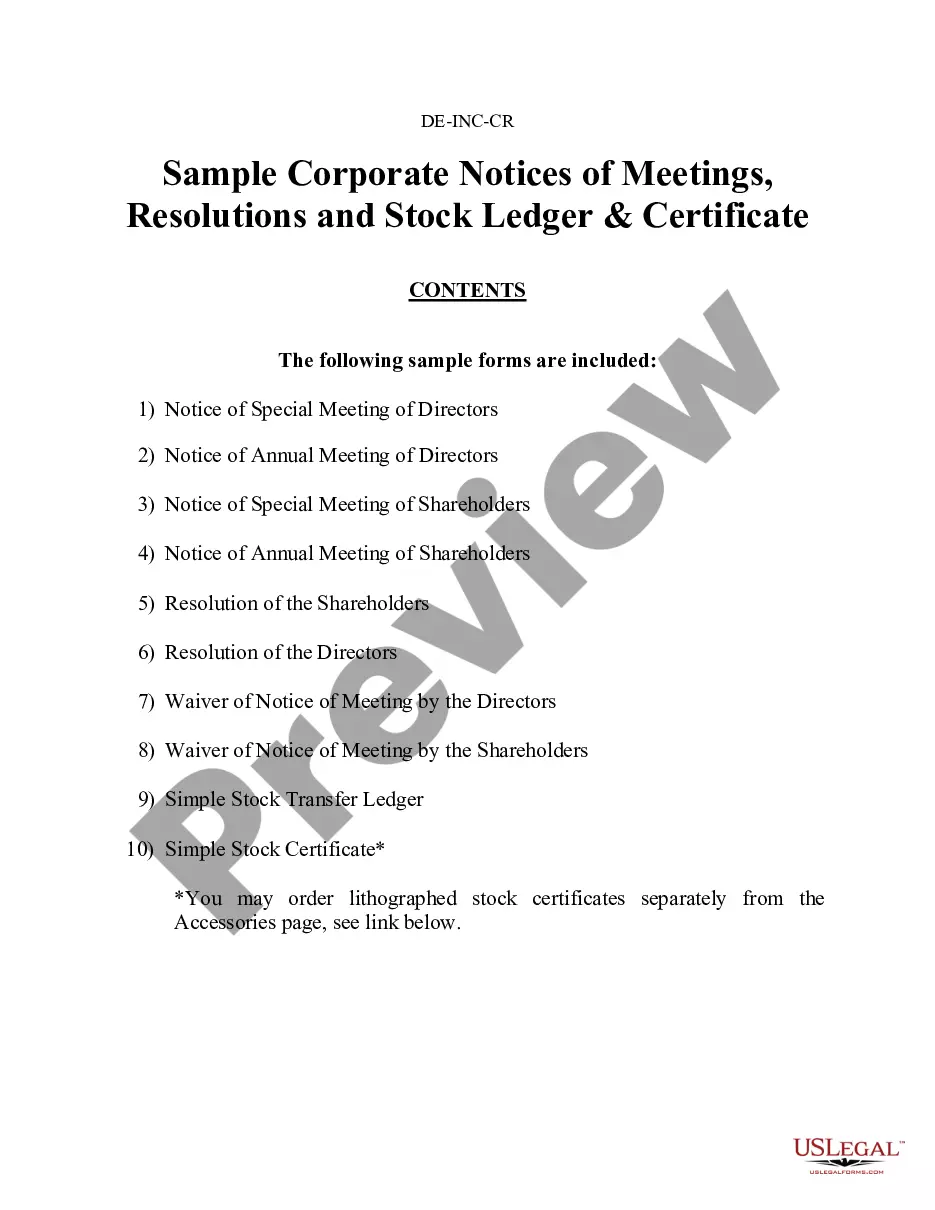

US Legal Forms offers a vast collection of template forms, such as the Delaware Resolution of Meeting of LLC Members to Sell Assets, which are drafted to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Delaware Resolution of Meeting of LLC Members to Sell Assets whenever needed. Just click on the form you want to download or print.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Resolution of Meeting of LLC Members to Sell Assets template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct state/region.

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form isn't what you are looking for, use the Search section to locate the form that meets your needs.

Form popularity

FAQ

An operating agreement is a foundational document that outlines the governance structure and operational procedures of an LLC. A resolution, on the other hand, is a formal decision made by members during a meeting. When discussing the Delaware Resolution of Meeting of LLC Members to Sell Assets, this resolution reflects specific agreements reached by the members concerning asset sales, serving as an action item aligned with the operating agreement.