Delaware Exempt Survey

Description

How to fill out Exempt Survey?

You can spend hours online trying to find the legal document template that meets the federal and state requirements you desire.

US Legal Forms offers a vast collection of legal forms that can be reviewed by experts.

You can download or print the Delaware Exempt Survey from our services.

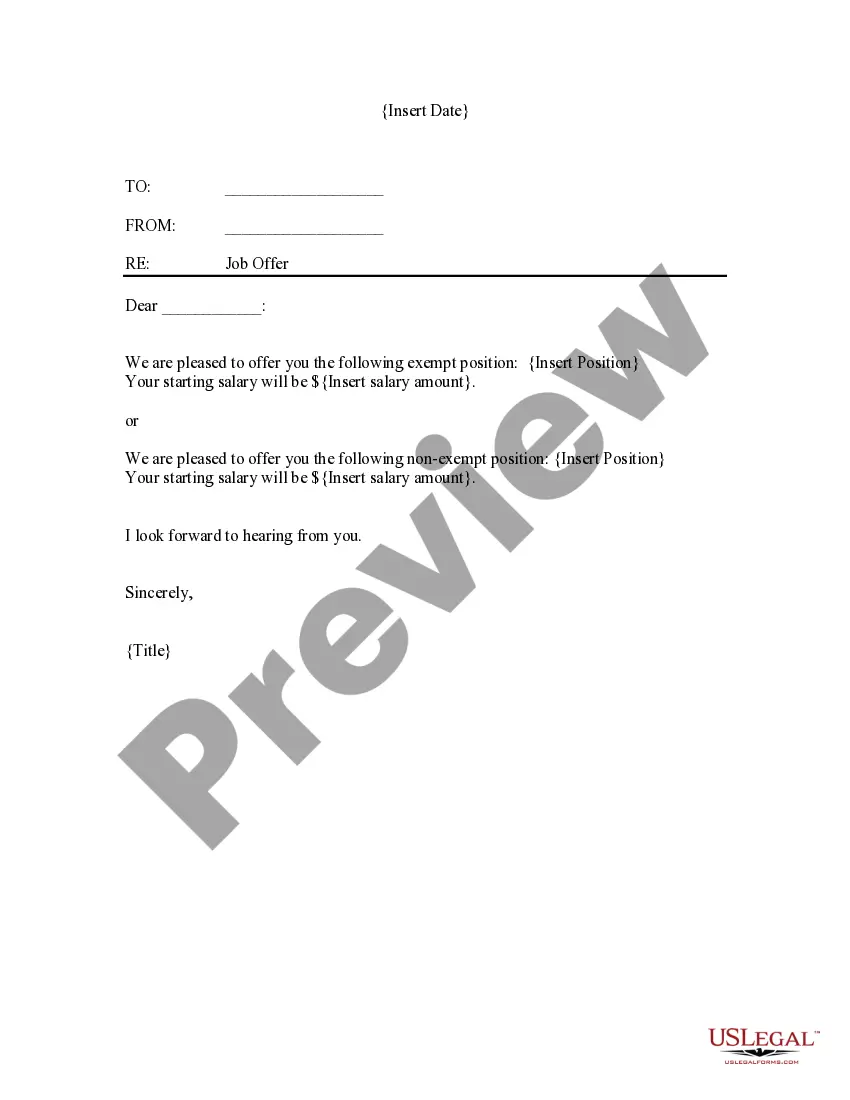

If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can complete, edit, print, or sign the Delaware Exempt Survey.

- Each legal document template you obtain is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the county/city of your choice.

- Check the form details to ensure you have selected the right one.

Form popularity

FAQ

A Delaware annual report is a document that contains specific business information. The Delaware annual report is a form that is submitted at the time of payment of the Delaware franchise tax. The information required by a Delaware annual report is: The address of the corporation's physical location.

Unlike most states, Delaware does not require LLCs to file annual reports. However, the state does require LLCs to pay an annual tax (see below).

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

Corporations Exempt from Income Tax in the PhilippinesLabor, agricultural or horticultural organization not organized principally for profit;Mutual savings bank not having a capital stock represented by shares, and cooperative bank without capital stock organized and operated for mutual purposes and without profit;More items...

All Delaware corporations, nonprofits, LLCs, LPs, and general partnerships must file a Delaware Annual Report and/or pay an annual franchise tax. Domestic corporations must file an annual report and pay a franchise tax. Foreign corporations and nonprofits are only required to file an annual report.

All corporations incorporated in the State of Delaware are required to file an Annual Report and to pay a franchise tax. Exempt domestic corporations do not pay a tax but must file an Annual Report.

Some of the most common types of exempt cor- poration are religious, charitable,-scientific, literary and educational organizations; community chests; chambers of commerce; boards of trade; social clubs; business and civic leagues; fraternal beneficiary societies, etc.

Is organized primarily or exclusively for religious or charitable purposes; or. (i) is organized not for profit and (ii) no part of its net earnings inures to the benefit of any member or individual.