Delaware Self-Employed Independent Contractor Employment Agreement — Commission for New Business In the state of Delaware, a Self-Employed Independent Contractor Employment Agreement is a legally binding contract that outlines the relationship between a self-employed individual and a company or client seeking their services. This agreement specifically focuses on the arrangement where the contractor is compensated through commission for bringing in new business. Keywords: Delaware, self-employed, independent contractor, employment agreement, commission, new business. This type of agreement is particularly suited for individuals who have their own business or work on a freelance basis but want to secure a formal arrangement with a company to receive commissions for the successful acquisition of new clients or customers. The terms and conditions of this agreement provide clarity and protection to both parties involved. There are variations of the Delaware Self-Employed Independent Contractor Employment Agreement that can be customized based on the specific needs and nature of the business. Some examples include: 1. Delaware Self-Employed Independent Contractor Employment Agreement — Commission only: This agreement specifies that the independent contractor will solely earn their income through commission-based compensation for generating new business for the company or client. It outlines the commission structure, payment terms, and any additional conditions related to the commission-only arrangement. 2. Delaware Self-Employed Independent Contractor Employment Agreement — Hybrid arrangement: This type of agreement incorporates both commission-based compensation and a fixed fee or hourly rate for the services provided by the independent contractor. It defines the split between commission and fixed compensation, ensuring clarity on how the contractor will be remunerated for new business and other projects or tasks. 3. Delaware Self-Employed Independent Contractor Employment Agreement — Exclusive commission for new business: This agreement outlines that the independent contractor is exclusively responsible for bringing in new business for the company or client. It typically includes terms related to geographical territories, non-competition clauses, and the commitment expected from the contractor to focus on generating new leads, clients, or customers. In conclusion, the Delaware Self-Employed Independent Contractor Employment Agreement — Commission for New Business is a comprehensive contract that solidifies the relationship between a self-employed individual and a company, specifically regarding compensation through commission for acquiring new business. It can be tailored to different scenarios, such as commission-only arrangements, hybrid structures, or exclusive responsibilities for new business acquisition.

Delaware Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

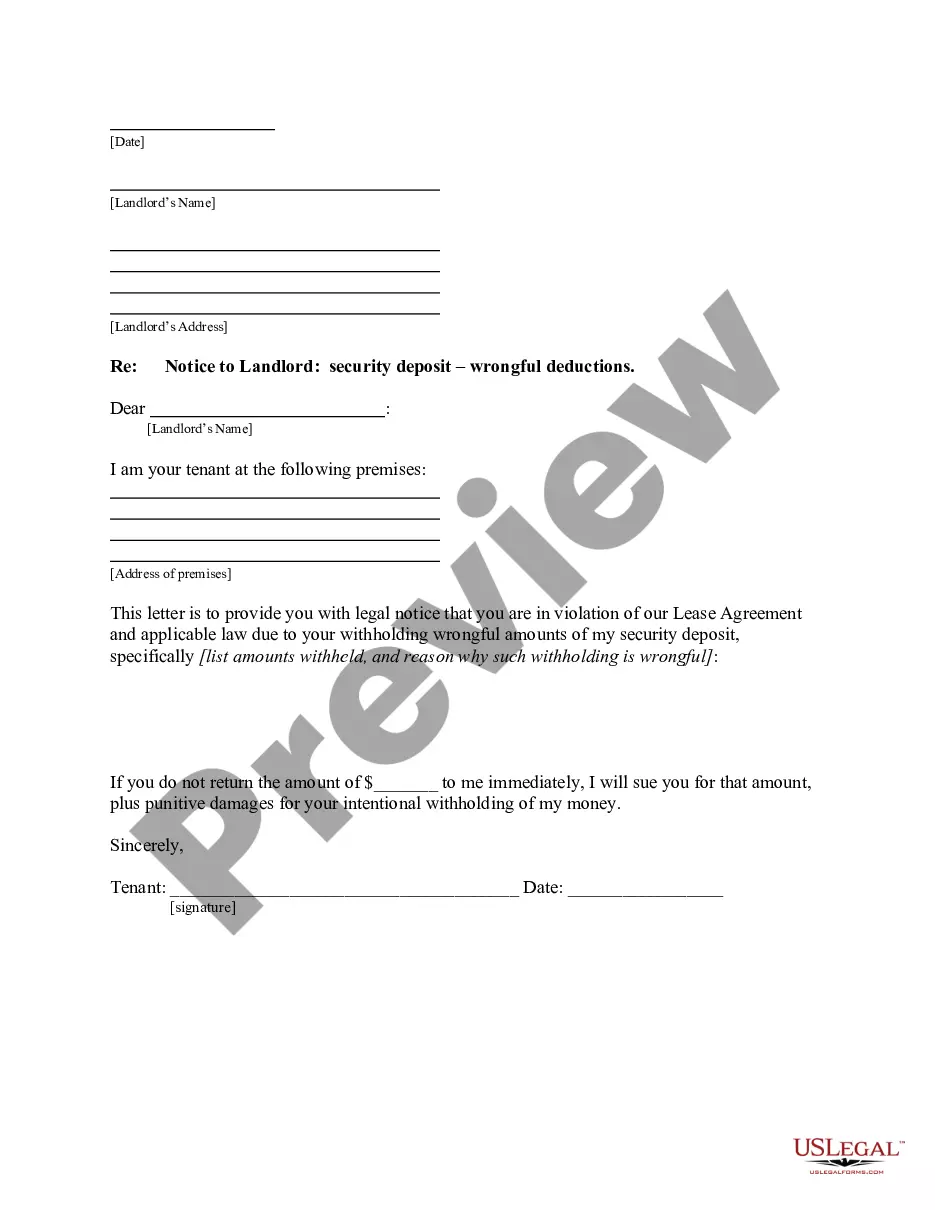

How to fill out Delaware Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

Are you presently inside a situation in which you will need paperwork for sometimes organization or person functions nearly every day time? There are a variety of legal record web templates available on the Internet, but discovering kinds you can rely on isn`t simple. US Legal Forms delivers 1000s of form web templates, just like the Delaware Self-Employed Independent Contractor Employment Agreement - commission for new business, which are composed in order to meet state and federal needs.

When you are currently acquainted with US Legal Forms web site and have an account, merely log in. After that, you may acquire the Delaware Self-Employed Independent Contractor Employment Agreement - commission for new business format.

Should you not come with an accounts and want to begin to use US Legal Forms, follow these steps:

- Get the form you need and ensure it is for the correct town/state.

- Utilize the Review option to review the form.

- Browse the description to ensure that you have selected the correct form.

- If the form isn`t what you`re searching for, use the Lookup discipline to discover the form that meets your needs and needs.

- When you discover the correct form, click Buy now.

- Opt for the prices program you would like, submit the required details to make your money, and buy your order with your PayPal or credit card.

- Select a handy data file formatting and acquire your version.

Discover all the record web templates you have bought in the My Forms menus. You can aquire a more version of Delaware Self-Employed Independent Contractor Employment Agreement - commission for new business any time, if needed. Just click on the essential form to acquire or print out the record format.

Use US Legal Forms, one of the most considerable assortment of legal forms, to conserve time and prevent faults. The service delivers skillfully made legal record web templates that can be used for a selection of functions. Generate an account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.