Delaware General Partnership for Business is a legal structure that allows two or more individuals to form a partnership for the purpose of conducting business activities in the state of Delaware. This type of partnership is governed by the Delaware Uniform Partnership Act (DUP). A Delaware General Partnership for Business offers numerous advantages to business partners, such as the ease of formation, minimal paperwork requirements, and flexible management. Partnerships are not required to file formation documents with the state, although it is recommended to draft a partnership agreement to outline the rights and responsibilities of each partner. This agreement can be oral or written, but a written agreement is always recommended avoiding potential disputes in the future. One of the key benefits of a Delaware General Partnership for Business is the pass-through taxation, where the partnership does not pay taxes on its income. Instead, profits or losses flow through to the individual partners, who report them on their personal tax returns. This allows partners to avoid double taxation that occurs with corporate entities. There are two main types of Delaware General Partnership for Business: 1. General Partnership: In this type of partnership, all partners share equal responsibility for managing the business and assume unlimited liability for any debts or obligations incurred by the partnership. Profits and losses are also evenly distributed among the partners unless stated otherwise in the partnership agreement. 2. Limited Partnership: A limited partnership consists of at least one general partner and one or more limited partners. General partners have unlimited liability and are responsible for managing the business, while limited partners have limited liability and are passive investors who do not participate in the business's daily operations. Limited partners are shielded from personal liability beyond their investment amount. It is important to note that Delaware General Partnership for Business does not provide limited liability protection to general partners. Any debts, legal obligations, or liabilities incurred by the partnership can be personally attributed to the partners, which means their personal assets are at risk. Overall, a Delaware General Partnership for Business can be an attractive option for entrepreneurs seeking a flexible business structure with simple governance and taxation requirements. However, partners should carefully consider the potential risks associated with unlimited liability and seek legal advice before forming a partnership.

Delaware General Partnership

Description

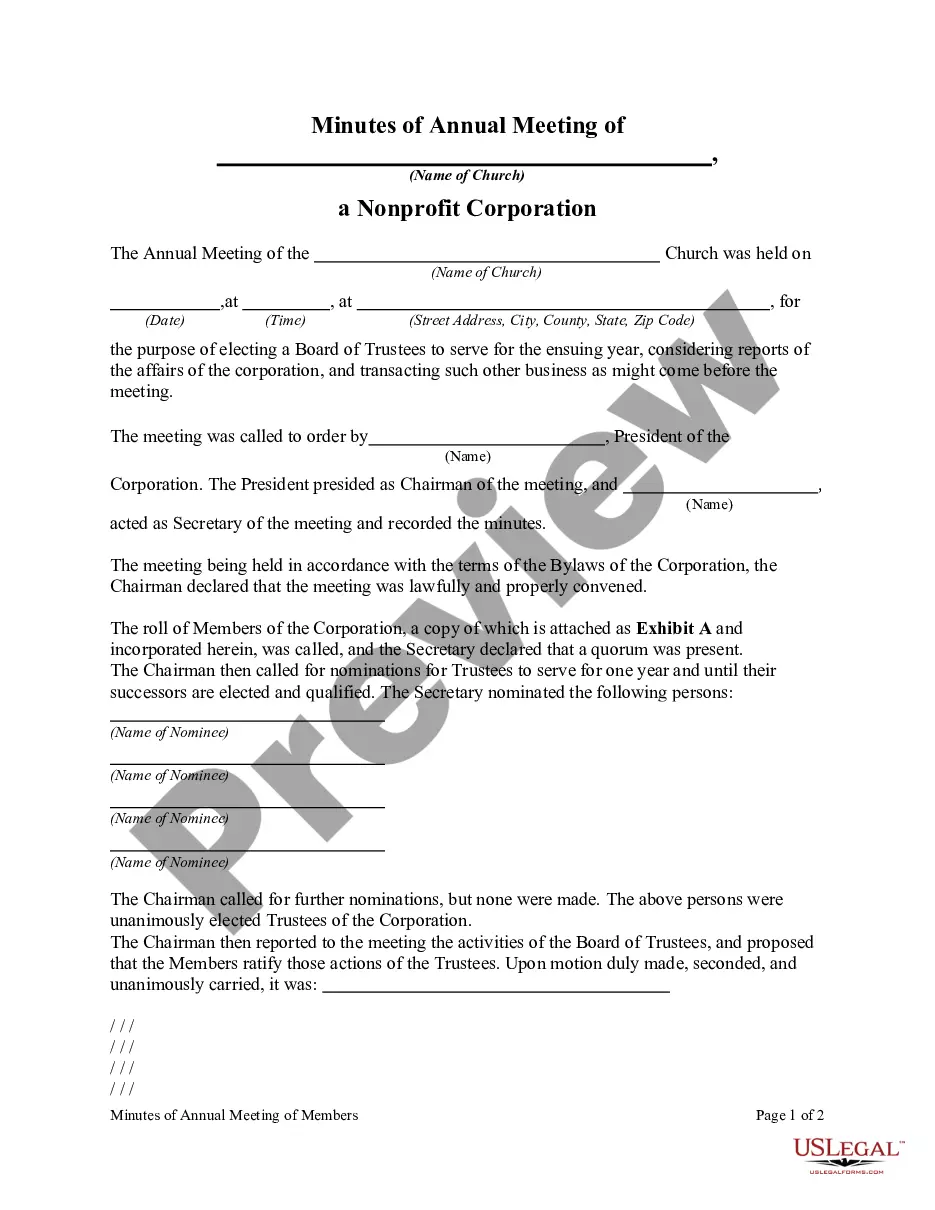

How to fill out Delaware General Partnership For Business?

Have you been inside a placement in which you will need documents for possibly company or person functions virtually every time? There are tons of legitimate document templates available online, but locating kinds you can trust is not straightforward. US Legal Forms gives thousands of kind templates, such as the Delaware General Partnership for Business, that happen to be created to fulfill state and federal specifications.

If you are presently knowledgeable about US Legal Forms web site and get your account, basically log in. After that, it is possible to down load the Delaware General Partnership for Business format.

Should you not have an profile and would like to start using US Legal Forms, abide by these steps:

- Find the kind you require and make sure it is to the correct area/state.

- Make use of the Preview switch to review the shape.

- Look at the description to ensure that you have selected the appropriate kind.

- In case the kind is not what you are trying to find, take advantage of the Search industry to obtain the kind that meets your requirements and specifications.

- When you obtain the correct kind, click Purchase now.

- Select the prices strategy you want, fill in the specified information and facts to make your money, and buy your order with your PayPal or charge card.

- Decide on a convenient document file format and down load your version.

Get each of the document templates you might have bought in the My Forms food selection. You may get a additional version of Delaware General Partnership for Business anytime, if required. Just select the needed kind to down load or produce the document format.

Use US Legal Forms, the most comprehensive assortment of legitimate types, in order to save time as well as stay away from blunders. The assistance gives professionally made legitimate document templates that you can use for a selection of functions. Make your account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

A Delaware Limited Partnership refers to a business entity in the state of Delaware that consists of at least one general partner and at least one limited partner. The general partner can be either an individual or an entity, such as a corporation.

General partnership disadvantages include:General Partners are Responsible for Other Partners' Actions. In a general partnership, each partner is liable for what the other does.You'll Have to Split the Profits.Disagreements Could Arise.Your Personal Assets are Vulnerable.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

Simplified taxes: The biggest advantage of a general partnership is the tax benefit. Businesses structured as partnerships do not pay income tax. Instead, all profits and losses are passed through to the individual partners.

How to Form a Delaware Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

Partnerships must file Form SS-4 with the Internal Revenue Service. Form SS-4 is used to get an employer identification number, also known as a federal tax ID number, from the IRS. The IRS allows a partnership to file Form SS-4 online using the IRS website, by telephone, by fax or by mail.

If you want to start a general partnership in the state of Delaware, there is no formal process to complete. Forming a general partnership in Delaware only requires you to work with your partner or partners. LLCs don't have any filing requirements like annual reports that corporations and nonprofits do.

To have a general partnership, two conditions must be true:The company must have two or more owners.All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.