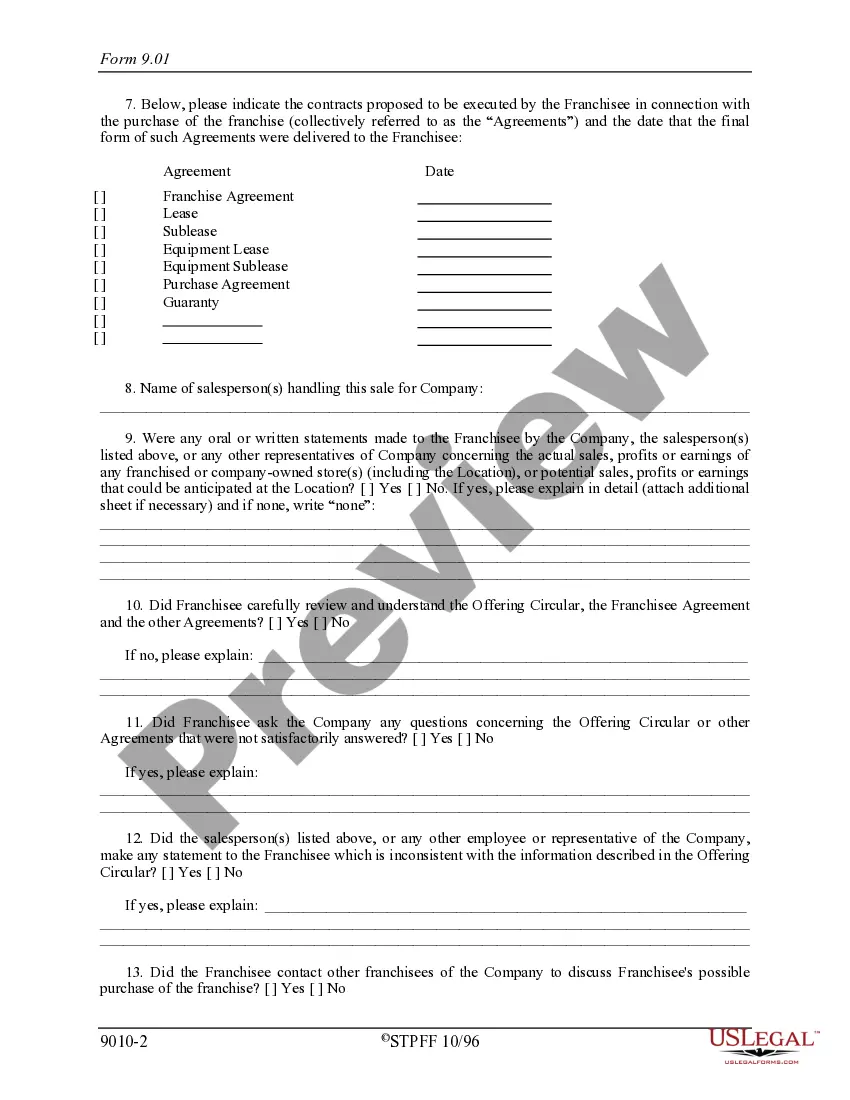

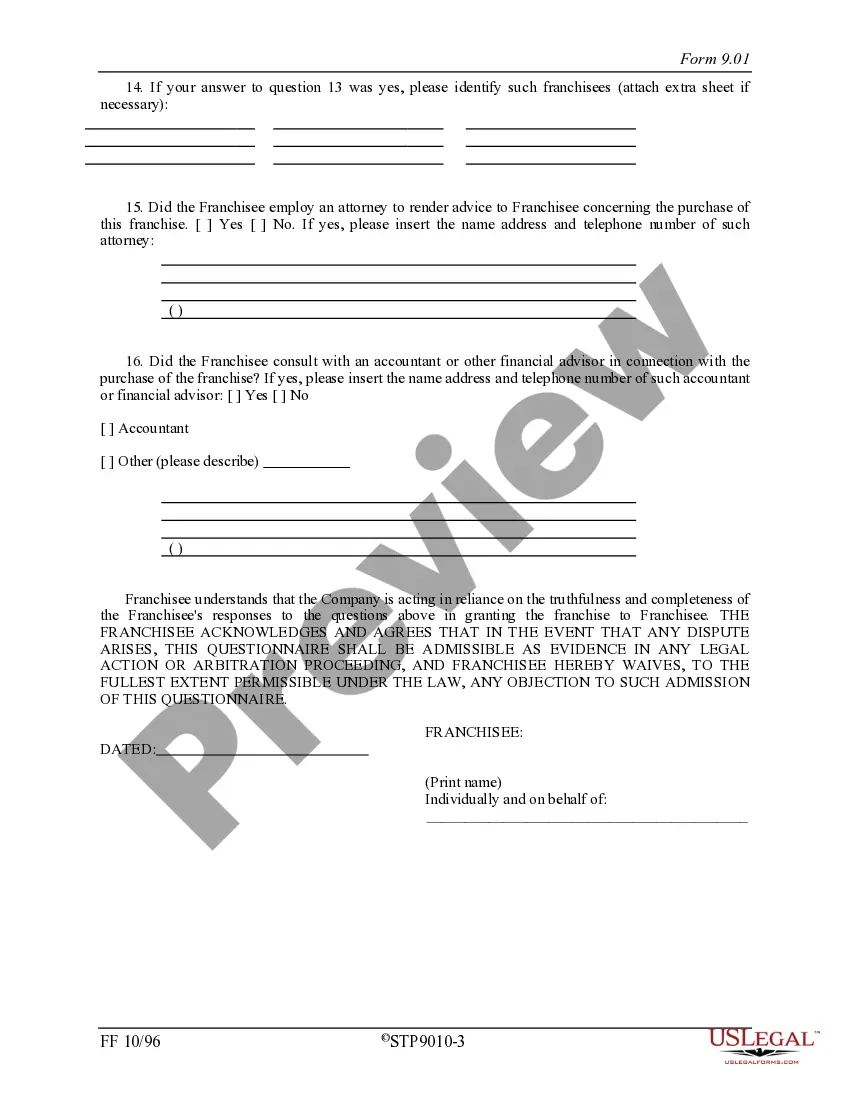

Delaware Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

Discovering the right lawful document web template can be a battle. Naturally, there are tons of templates accessible on the Internet, but how can you obtain the lawful kind you want? Utilize the US Legal Forms site. The support provides thousands of templates, including the Delaware Franchisee Closing Questionnaire, which can be used for enterprise and personal needs. Each of the kinds are inspected by experts and meet federal and state specifications.

If you are previously signed up, log in to the bank account and then click the Obtain option to find the Delaware Franchisee Closing Questionnaire. Make use of bank account to appear from the lawful kinds you possess ordered in the past. Visit the My Forms tab of the bank account and get yet another copy from the document you want.

If you are a fresh user of US Legal Forms, listed here are straightforward recommendations so that you can comply with:

- Initially, be sure you have chosen the correct kind for the area/state. You can examine the form utilizing the Preview option and read the form outline to make certain it is the right one for you.

- If the kind is not going to meet your preferences, take advantage of the Seach industry to discover the proper kind.

- Once you are certain that the form would work, go through the Get now option to find the kind.

- Opt for the prices plan you would like and enter the essential details. Build your bank account and buy an order making use of your PayPal bank account or bank card.

- Pick the document formatting and obtain the lawful document web template to the product.

- Total, revise and print and indicator the acquired Delaware Franchisee Closing Questionnaire.

US Legal Forms will be the biggest catalogue of lawful kinds in which you can discover a variety of document templates. Utilize the service to obtain expertly-made files that comply with express specifications.

Form popularity

FAQ

A company with 1 to 5,000 authorized shares is assessed a flat rate of $225 franchise tax; a company with 5,001-10,000 authorized shares is assessed $300 franchise tax; and a company with 10,001 shares or more will be assessed a minimum of $450 franchise tax. Delaware Franchise Tax is due by March 1st of each year.

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation.

If you would like to close your withholding tax account, you must first file a final year-end Withholding Tax Reconciliation form, and then complete the process by filing a Request for Change form indicating your account as closed.

The Delaware Department of Corporations defines total gross assets as "those 'total assets' reported on the U.S. Form 1120, Schedule L (Federal Return) relative to the company's fiscal year ending the calendar year of the report".

All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00.

If the corporation conducted any business in Delaware, you will need to notify the Delaware Division of Revenue of its dissolution by: 1) checking the ?Out of Business? box and 2) indicating the last day of business operations on both your final withholding and/or business license gross receipt coupon, as well as your ...

Total Gross Assets means the sum of: (1) unrestricted cash and marketable securities held by the Originator; plus (2) notes receivable (including all mortgage loans receivable) net of allowance for uncollectible notes (as shown on the Originator's balance sheet), plus (3) equipment loan receivable net of allowance for ...

Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware. Franchise Taxes and annual Reports are due no later than March 1st of each year.