Delaware Landlord Tenant Commercial Package refers to a comprehensive set of insurance policies tailored specifically for landlords and tenants in commercial properties in the state of Delaware. This package typically includes multiple types of coverage designed to protect both parties from various risks and liabilities that may arise during the course of their commercial lease agreement. One type of coverage commonly included in the Delaware Landlord Tenant Commercial Package is property insurance. This insurance safeguards the building and its contents against damage caused by natural disasters, fire, vandalism, or theft. It ensures that any repairs or replacements needed due to these incidents are covered financially. Liability insurance is another crucial component of the package. It provides protection to both the landlord and tenant in case of any injuries or property damage occurring on the premises. For example, if a customer slips and falls in a tenant's retail store, liability insurance would cover legal fees and potential settlements associated with the incident. In addition, the package may include coverage for business interruption. This type of insurance compensates the landlord or tenant for any lost income in the event that the property becomes uninhabitable due to covered incidents like fire or natural disasters. It helps minimize the financial impact of temporary closure or relocation. Furthermore, some Delaware Landlord Tenant Commercial Packages offer renter's insurance. This insurance is typically purchased by the tenant to protect their personal belongings such as inventory, furniture, or equipment within the leased space. It provides coverage against theft, fire, water damage, and other covered perils. Depending on the insurer and specific policy terms, there may be variations and different packages available. Some insurers may offer customizable packages, allowing landlords and tenants to tailor their coverage based on their specific needs and preferences. In summary, the Delaware Landlord Tenant Commercial Package is a comprehensive insurance solution designed to protect landlords and tenants in commercial properties. It typically includes property insurance, liability insurance, business interruption coverage, and optional renter's insurance. These packages can offer different variations and customizable options to accommodate the unique requirements of both parties involved in a commercial lease.

Delaware Landlord Tenant Commercial Package

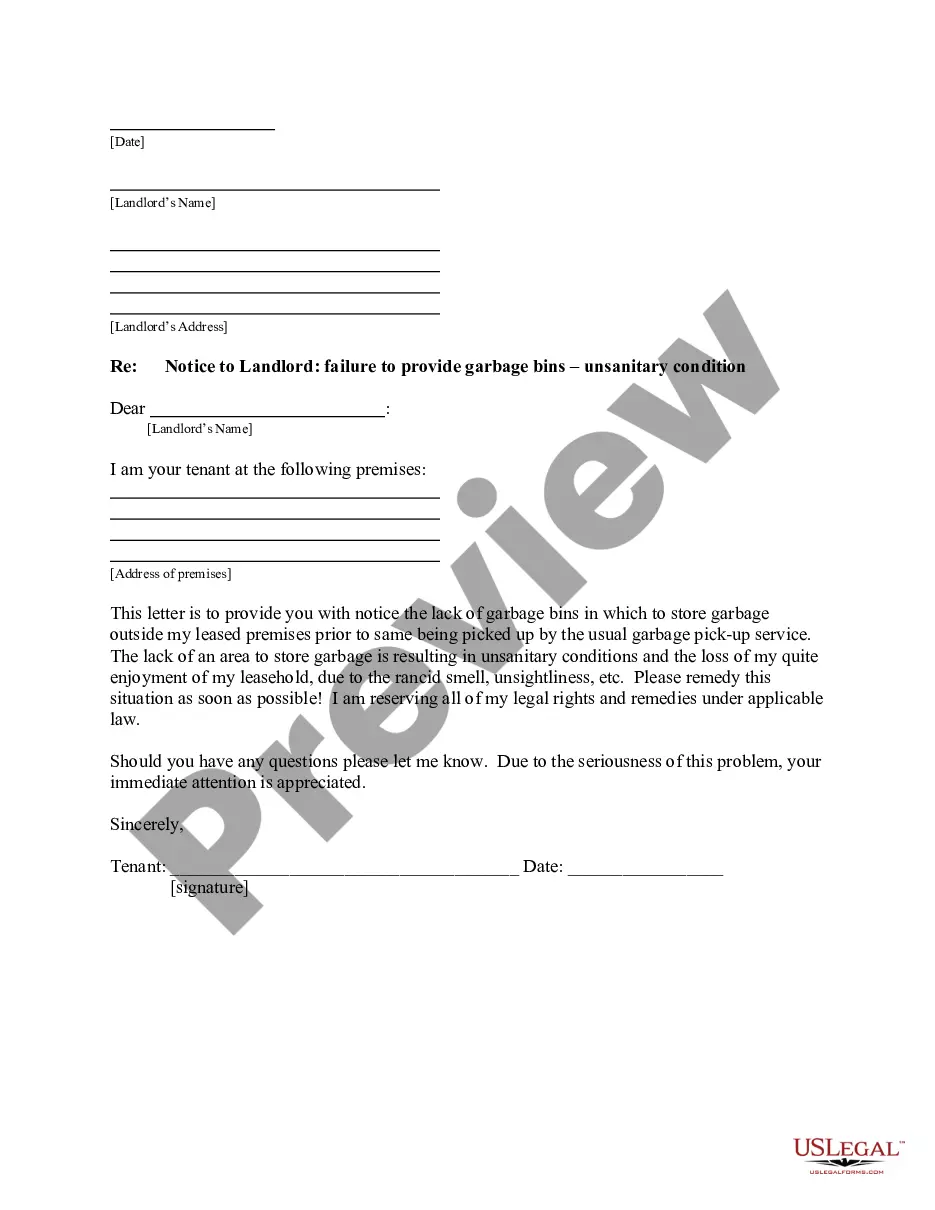

Description

How to fill out Delaware Landlord Tenant Commercial Package?

Have you been within a place the place you need to have documents for either company or specific uses nearly every day? There are a lot of legal papers themes available on the Internet, but discovering versions you can depend on isn`t easy. US Legal Forms provides 1000s of form themes, much like the Delaware Landlord Tenant Commercial Package, that are published in order to meet federal and state specifications.

If you are presently knowledgeable about US Legal Forms site and have your account, just log in. After that, you are able to download the Delaware Landlord Tenant Commercial Package web template.

If you do not come with an account and would like to begin to use US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for the correct area/county.

- Utilize the Preview option to review the shape.

- See the description to actually have chosen the proper form.

- When the form isn`t what you`re trying to find, take advantage of the Lookup field to get the form that fits your needs and specifications.

- Once you discover the correct form, simply click Purchase now.

- Opt for the costs prepare you would like, fill out the desired information and facts to generate your bank account, and pay for the transaction with your PayPal or charge card.

- Decide on a hassle-free file structure and download your version.

Get each of the papers themes you may have bought in the My Forms food selection. You can get a further version of Delaware Landlord Tenant Commercial Package anytime, if necessary. Just select the essential form to download or print the papers web template.

Use US Legal Forms, the most substantial variety of legal forms, in order to save some time and steer clear of mistakes. The assistance provides appropriately produced legal papers themes which you can use for a variety of uses. Generate your account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Tenant Rights to Withhold Rent in Delaware Tenants may withhold rent or exercise the right to "repair and deduct" if a landlord fails to take care of important repairs, such as a broken heater.

Delaware landlords cannot raise rent during the lease term unless the lease agreement allows for it. Additionally, if the rental property is a mobile home, rent increases are limited to once per year. Landlords must provide 60 days' notice before raising rent, and for mobile homes, a 90-day notice is required.

(a) If there exists any condition which deprives the tenant of a substantial part of the benefit or enjoyment of the tenant's bargain, the tenant may notify the landlord in writing of the condition and, if the landlord does not remedy the condition within 15 days following receipt of notice, the tenant may terminate ...

(§5502) If the tenant fails to pay rent, the landlord may, on the day after rent is due, send the tenant a notice that rent must be paid within five (5) days from the date the notice was given or sent, or the rental agreement will be terminated.

(§5502) If the tenant fails to pay rent, the landlord may, on the day after rent is due, send the tenant a notice that rent must be paid within five (5) days from the date the notice was given or sent, or the rental agreement will be terminated.

§ 5514. Security deposit. (a) (1) A landlord may require the payment of security deposit. (2) No landlord may require a security deposit in excess of 1 month's rent where the rental agreement is for 1 year or more.

Step 1 ? Send Eviction Notice to Tenant. Step 2 ? Wait to Hear from the Tenant. Step 3 ? File in Court. Step 4 ? Set A Hearing Date. Step 5 ? Appear in Court. Step 6 ? File a Writ of Restitution. Step 7 ? Repossessing the Property.

Considering the regulations published in the Delaware landlord-tenant law, Delaware is not considered a landlord-friendly state. The main reason for this is that tenants have a high grade of leverage over their landlords, which can affect the way in which they manage the rental agreement.

The landlord shall give the tenant at least 48 hours' notice of landlord's intent to enter, except for repairs requested by the tenant, and shall enter only between a.m. and p.m. As to prospective tenants or purchasers only, the tenant may expressly waive in a signed addendum to the rental agreement or other ...