Title: Understanding Delaware Notice of Qualifying Event from Employer to Plan Administrator Introduction: In Delaware, employers are required to notify the plan administrator about qualifying events that affect an employee's health insurance coverage. This comprehensive guide will provide an in-depth description of Delaware's Notice of Qualifying Event from Employer to Plan Administrator, including its purpose, requirements, and various types of qualifying events. Keywords: Delaware, Notice of Qualifying Event, Employer, Plan Administrator, Health Insurance Coverage, Requirements, Types 1. Purpose: The Delaware Notice of Qualifying Event from Employer to Plan Administrator is a formal communication that employers must send to the plan administrator to report any significant changes that affect an employee's health insurance. The purpose of this notice is to ensure proper coordination and administration of employee benefits within the state. Keywords: Purpose, Communication, Coordinate, Administration, Employee Benefits 2. Requirements for Employers: Employers in Delaware have a legal obligation to provide timely and accurate notice to the plan administrator regarding any qualifying event that may impact an employee's health insurance coverage. The notice must be submitted within a specified timeframe, typically within 30 days from the event's occurrence. Keywords: Requirements, Employers, Legal Obligation, Timely, Accurate, Notice, Qualifying Event, Health Insurance Coverage, Timeframe 3. Types of Qualifying Events: The Delaware Notice of Qualifying Event covers various types of events that may have an impact on an employee's health insurance coverage. These events include, but are not limited to: a) Termination of Employment: When an employee's job is terminated, or they leave voluntarily, it triggers a qualifying event that requires notice to the plan administrator. b) Reduction in Work Hours: If an employee's working hours are significantly reduced, it could impact their eligibility for health insurance coverage, making it necessary to notify the plan administrator. c) Divorce or Legal Separation: Changes in an employee's marital status due to divorce or legal separation could affect their eligibility for coverage, so this event must be reported to the plan administrator. d) Dependents' Loss of Eligibility: If an employee's dependents no longer meet the eligibility criteria for coverage, such as reaching the maximum age or losing student status, it is vital to notify the plan administrator. e) Medicare Entitlement: When an employee becomes entitled to Medicare benefits, it may affect their coverage options, requiring proper notification to the plan administrator. f) Death of an Employee: In the unfortunate event of an employee's death, their health insurance coverage will be impacted, necessitating notification to the plan administrator. Keywords: Types, Qualifying Events, Termination of Employment, Reduction in Work Hours, Divorce, Legal Separation, Dependents' Loss of Eligibility, Medicare Entitlement, Death of an Employee Conclusion: The Delaware Notice of Qualifying Event from Employer to Plan Administrator is a critical document that ensures proper coordination and administration of employee health insurance coverage. By adhering to the requirements and promptly notifying the plan administrator about various qualifying events, employers fulfill their obligations and contribute to the smooth functioning of employee benefits within the state. Keywords: Delaware, Notice of Qualifying Event, Employer, Plan Administrator, Health Insurance Coverage, Requirements, Types, Coordination, Administration, Employee Benefits, Obligations

Delaware Notice of Qualifying Event from Employer to Plan Administrator

Description

How to fill out Delaware Notice Of Qualifying Event From Employer To Plan Administrator?

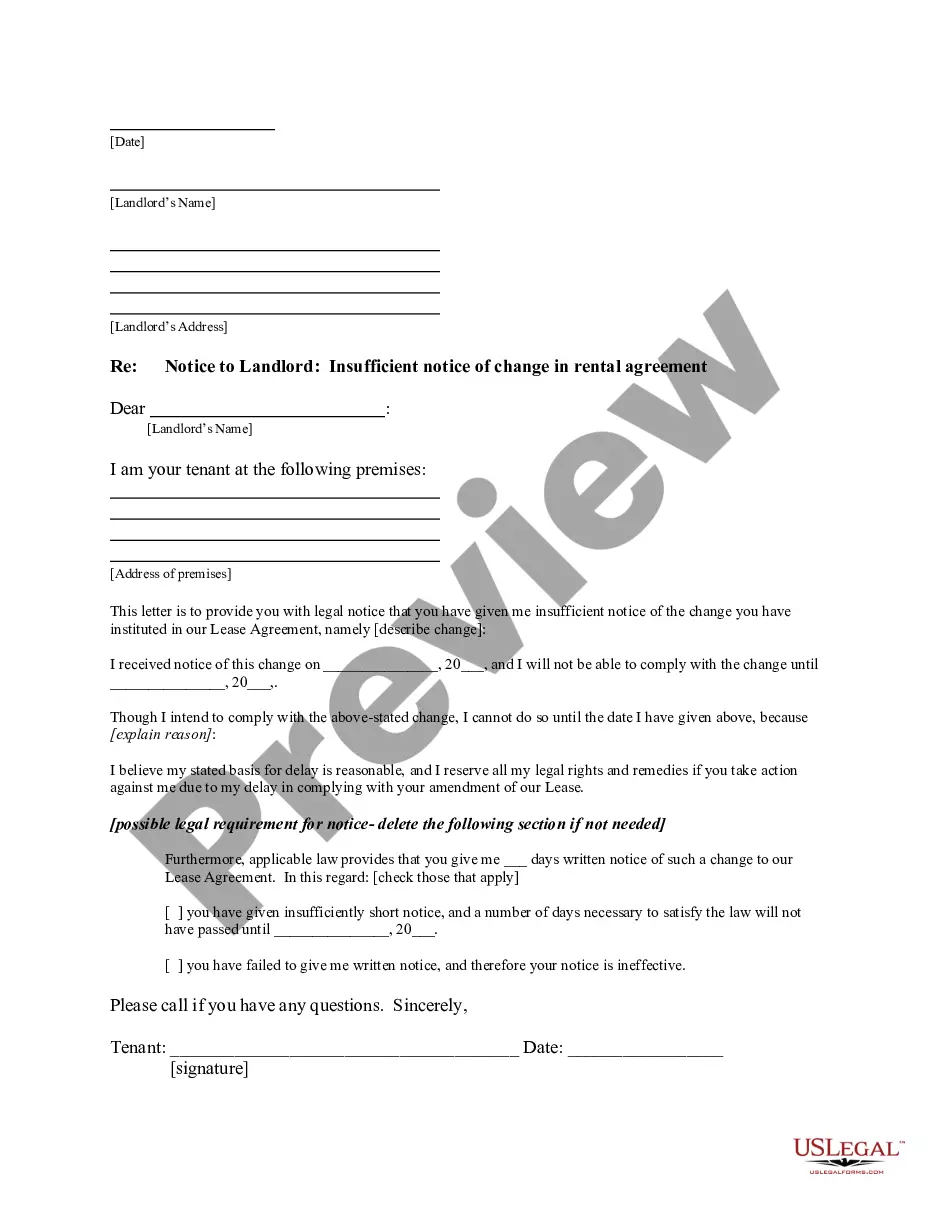

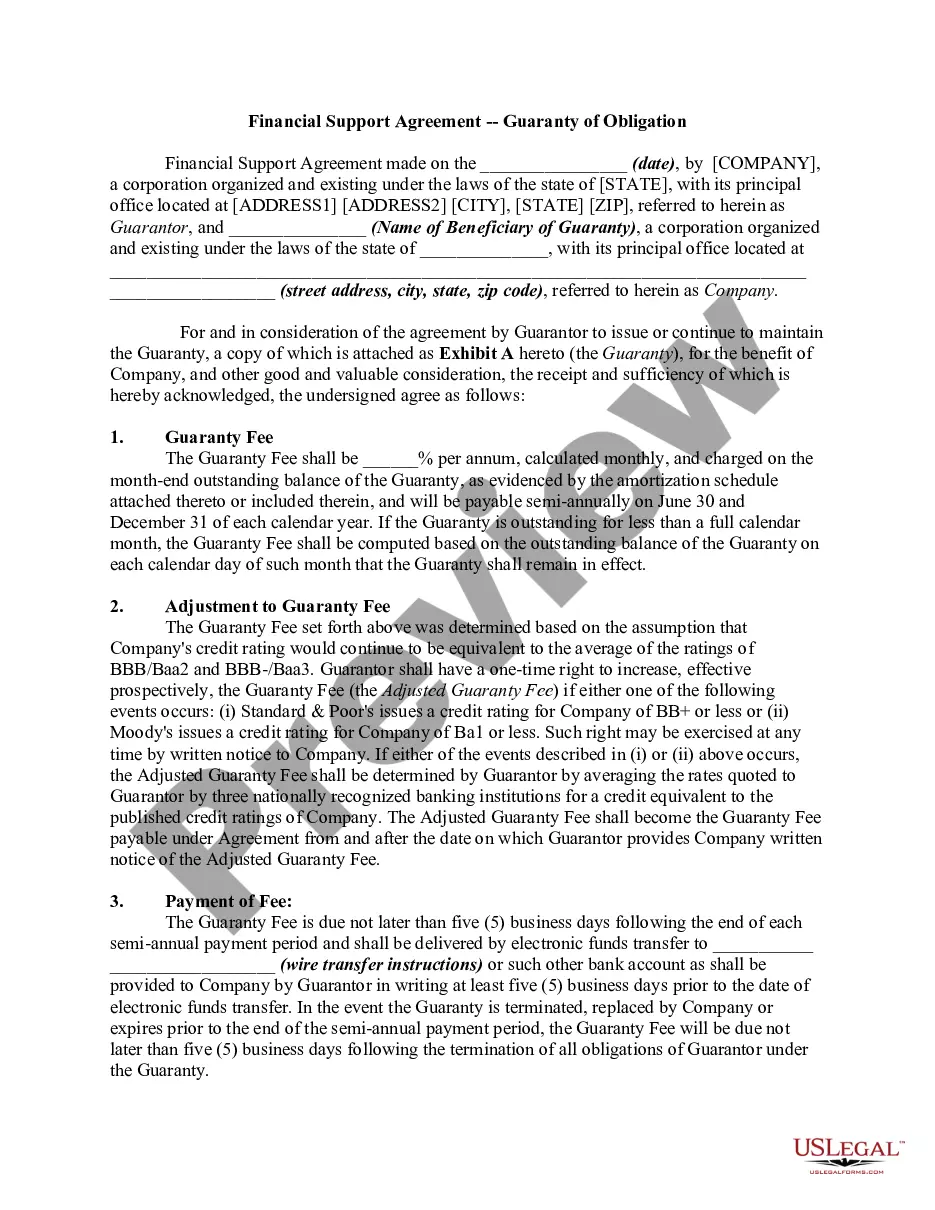

Finding the right legal record format can be quite a have a problem. Needless to say, there are a variety of templates available on the net, but how do you discover the legal form you want? Utilize the US Legal Forms site. The services provides a huge number of templates, such as the Delaware Notice of Qualifying Event from Employer to Plan Administrator, that you can use for business and private needs. All the kinds are checked out by professionals and fulfill state and federal requirements.

Should you be currently registered, log in for your profile and click on the Down load switch to find the Delaware Notice of Qualifying Event from Employer to Plan Administrator. Make use of your profile to check throughout the legal kinds you might have bought earlier. Proceed to the My Forms tab of your own profile and obtain yet another copy of your record you want.

Should you be a whole new user of US Legal Forms, listed below are basic guidelines that you can comply with:

- Initial, make certain you have selected the proper form to your city/state. You may examine the shape while using Review switch and browse the shape outline to make certain this is basically the right one for you.

- When the form does not fulfill your needs, use the Seach industry to discover the proper form.

- Once you are sure that the shape is proper, select the Buy now switch to find the form.

- Select the costs plan you want and enter in the needed info. Make your profile and purchase the transaction utilizing your PayPal profile or credit card.

- Pick the file format and down load the legal record format for your system.

- Total, revise and produce and indication the received Delaware Notice of Qualifying Event from Employer to Plan Administrator.

US Legal Forms may be the most significant collection of legal kinds that you can find various record templates. Utilize the service to down load expertly-produced papers that comply with express requirements.