The Delaware Comprehensive Special Tax Notice Regarding Plan Payments is a crucial document that provides important information regarding tax implications on various plan payments. This notice is applicable to residents of Delaware and serves as a detailed guide to understand the tax consequences associated with retirement plan distributions, including 401(k)s, IRAs, and other qualified plans. When it comes to Delaware Comprehensive Special Tax Notice Regarding Plan Payments, there are primarily three different types: 1. Delaware Comprehensive Special Tax Notice Regarding 401(k) Plan Payments: This type specifically focuses on 401(k) plans offered by employers. It outlines the tax treatment, options, and responsibilities associated with distributions from a 401(k) retirement plan in Delaware. This notice provides clarity on federal and state taxes, rollovers, and withholding requirements. 2. Delaware Comprehensive Special Tax Notice Regarding IRA Plan Payments: This notice addresses tax considerations related to Individual Retirement Accounts (IRAs). It explains the tax implications of distributions taken from traditional IRAs, Roth IRAs, SEP-IRAs, and SIMPLE IRAs in accordance with Delaware's tax laws. Moreover, it discusses rollover options, potential penalties, and taxation of contributions. 3. Delaware Comprehensive Special Tax Notice Regarding Qualified Plan Payments: This notice applies to distributions received from other qualified retirement plans, such as pension plans, profit-sharing plans, and government employee plans in Delaware. It provides a comprehensive overview of the tax consequences of receiving payments from these plans, including options for rollovers or lump-sum distributions. The Delaware Comprehensive Special Tax Notice Regarding Plan Payments serves as an informational tool for individuals making important financial decisions regarding their retirement funds. It includes critical details about federal and state tax regulations, such as different tax rates, exemptions, and reporting requirements. This notice aids Delaware residents in understanding how plan payments impact their tax liabilities and helps them make well-informed decisions to maximize their retirement savings. It is crucial for recipients of plan payments to carefully review this notice to ensure compliance with tax laws and to avoid any potential penalties or surprises at tax time. By understanding the tax implications associated with plan payments, individuals can effectively plan for their future, make appropriate elections, and minimize any unnecessary tax burdens.

Delaware Comprehensive Special Tax Notice Regarding Plan Payments

Description

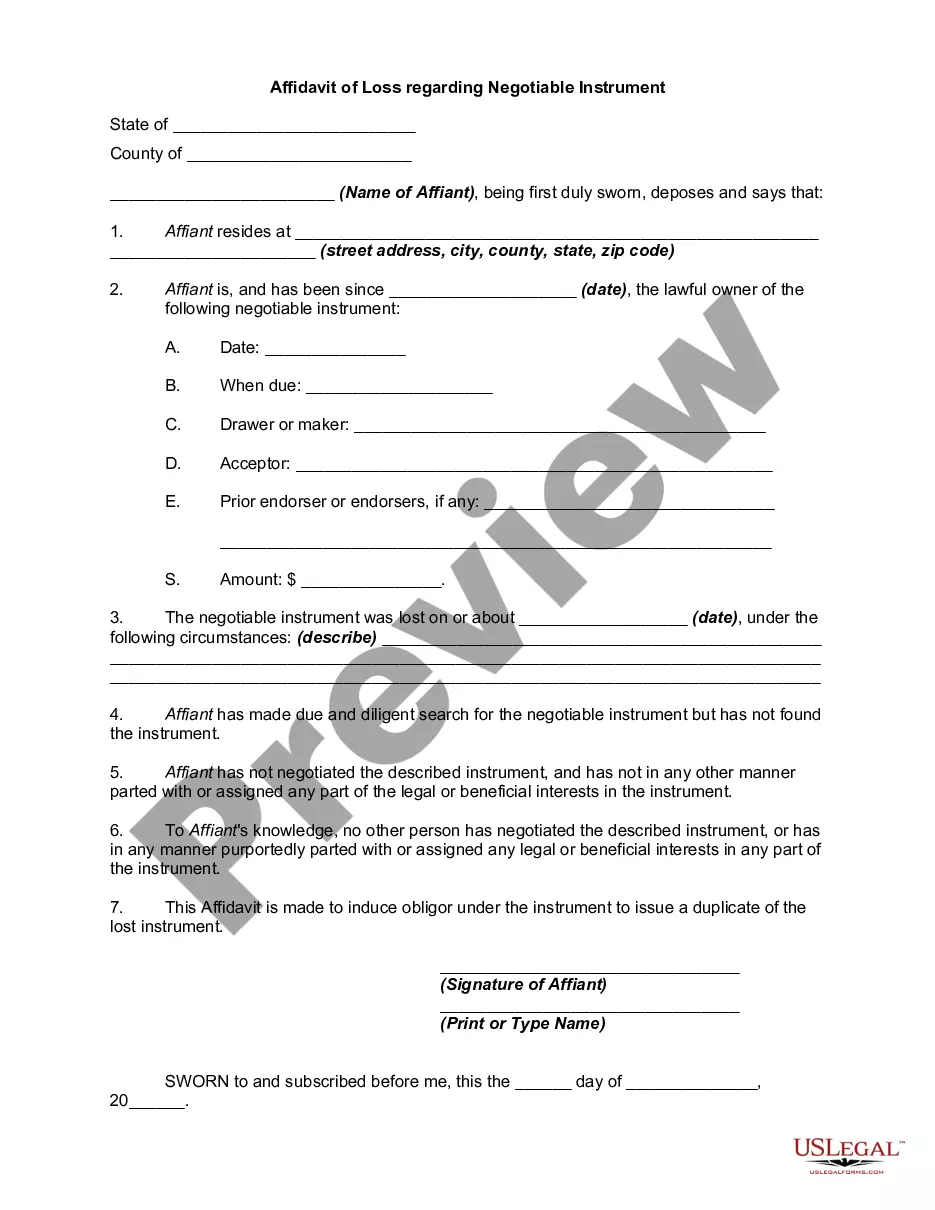

How to fill out Delaware Comprehensive Special Tax Notice Regarding Plan Payments?

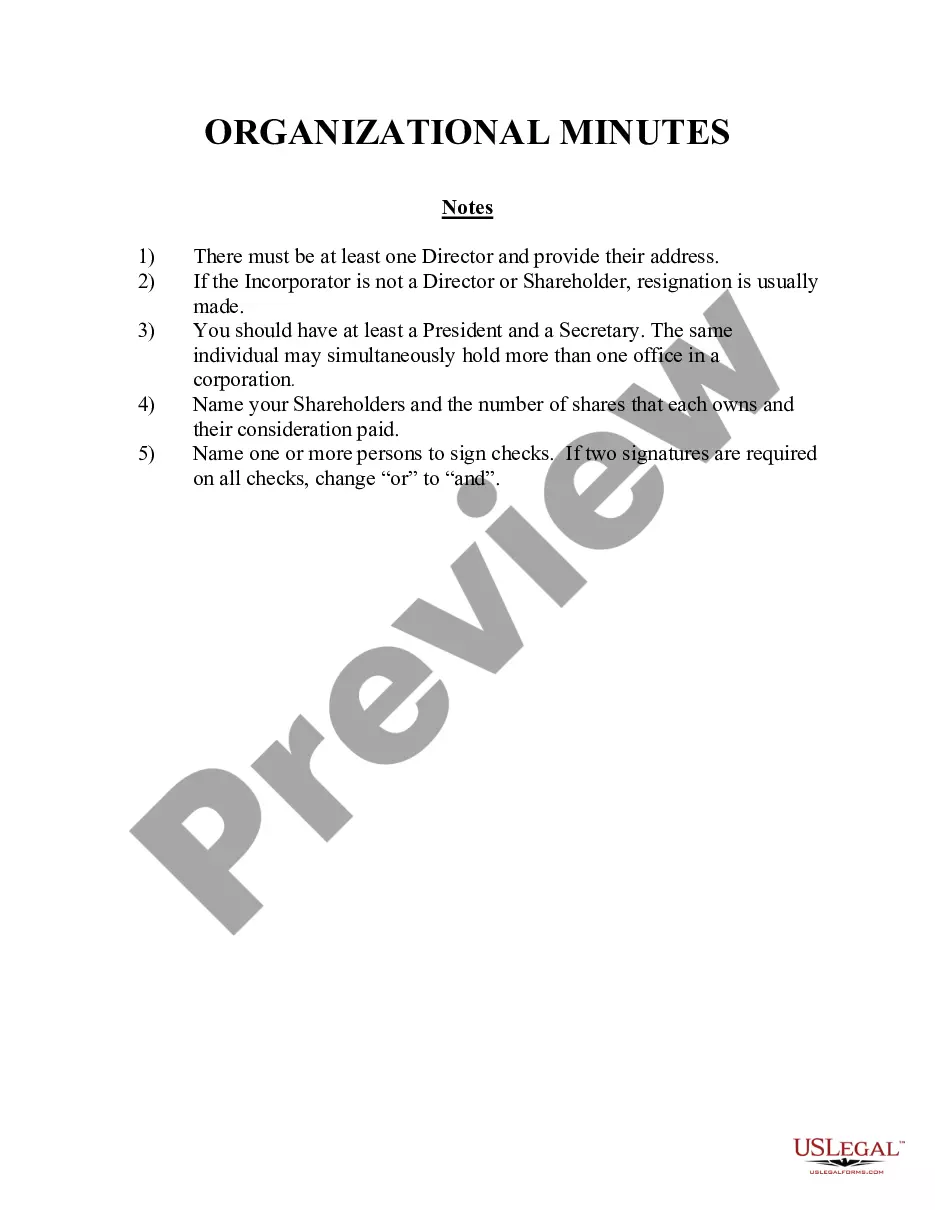

Are you within a placement where you will need files for possibly enterprise or individual uses almost every day time? There are tons of legal papers templates available online, but locating ones you can trust isn`t easy. US Legal Forms delivers thousands of form templates, such as the Delaware Comprehensive Special Tax Notice Regarding Plan Payments, which are written to meet state and federal needs.

In case you are previously knowledgeable about US Legal Forms web site and also have a merchant account, basically log in. After that, you can download the Delaware Comprehensive Special Tax Notice Regarding Plan Payments format.

If you do not offer an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you require and ensure it is for your appropriate metropolis/region.

- Take advantage of the Preview button to check the form.

- Look at the information to actually have selected the proper form.

- If the form isn`t what you`re trying to find, utilize the Lookup field to discover the form that suits you and needs.

- If you find the appropriate form, click on Acquire now.

- Select the prices plan you desire, complete the necessary info to generate your bank account, and purchase the order utilizing your PayPal or credit card.

- Decide on a handy paper structure and download your duplicate.

Locate all the papers templates you have bought in the My Forms food selection. You can aquire a additional duplicate of Delaware Comprehensive Special Tax Notice Regarding Plan Payments whenever, if required. Just click the necessary form to download or printing the papers format.

Use US Legal Forms, one of the most extensive collection of legal kinds, to conserve time and stay away from errors. The assistance delivers skillfully created legal papers templates that you can use for a variety of uses. Generate a merchant account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

As long as you do not withdraw your investment gains and keep them in the annuity, they are not taxed. A variable annuity is linked to market performance. If you do not withdraw your earnings from the investments in the annuity, they are tax-deferred until you withdraw them.

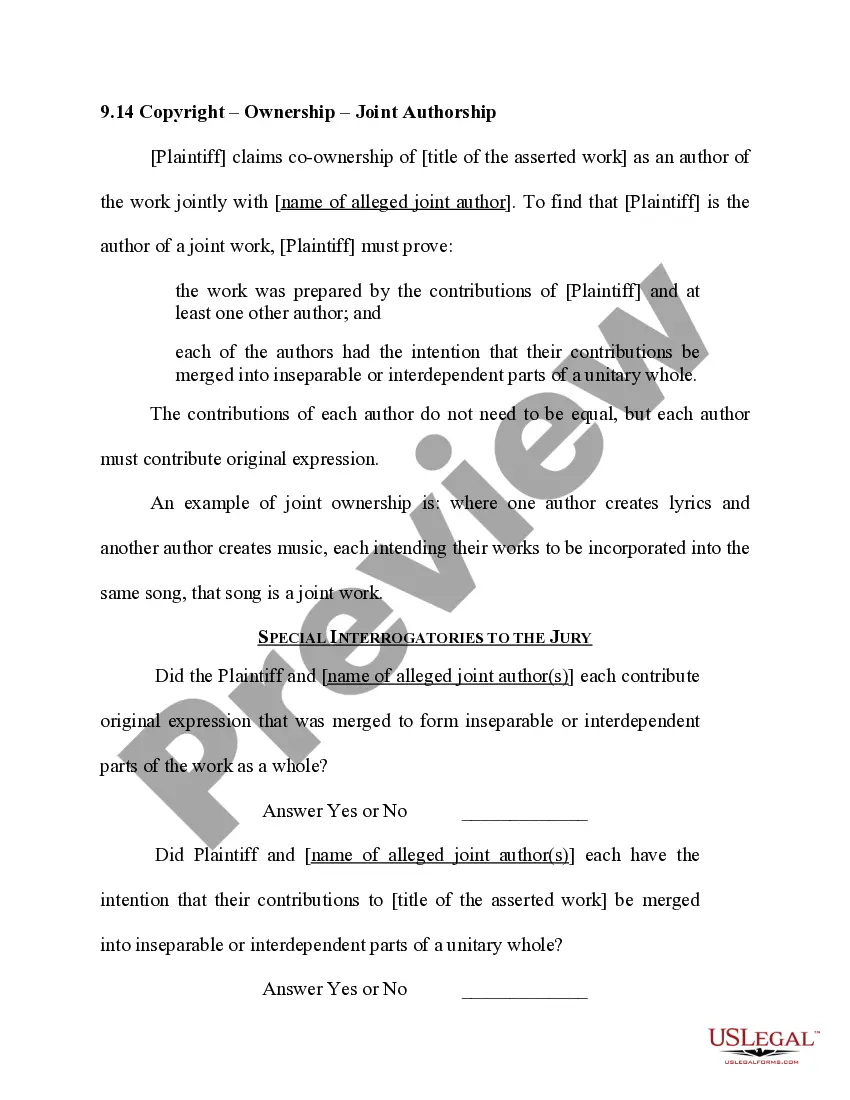

What is the General Rule? The General Rule is one of the two methods used to figure the tax-free part of each annuity payment based on the ratio of your investment in the contract to the total expected return. The other method is the Simplified Method, which is discussed in Pub. 575, Pension and Annuity Income.

Under the special rule, the net unrealized appreciation on the stock included in the earnings in the payment will not be taxed when distributed to you from the Plan and will be taxed at capital gain rates when you sell the stock.

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

Your rollover is reported as a distribution, even when it is rolled over into another eligible retirement account. Report your gross distribution on line 15a of IRS Form 1040. This amount is shown in Box 1 of the 1099-R. Report any taxable portion of your gross distribution.

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).