Delaware Restructuring Agreement is a legal document that outlines the terms and conditions for restructuring the operations, debts, or financial obligations of a business entity registered in the state of Delaware. This agreement provides a comprehensive framework for businesses looking to reorganize their operations or address financial distress. Let's explore the various types of Delaware Restructuring Agreement: 1. Chapter 11 Restructuring Agreement: This type of agreement applies to businesses filing for Chapter 11 bankruptcy protection in Delaware. It outlines the terms for reorganizing the company and reaching an agreement with creditors to repay debts while maintaining operations. 2. Debt Restructuring Agreement: This agreement focuses on restructuring the debt obligations of a Delaware-based business. It allows the company to negotiate new terms with creditors, such as extending repayment periods, reducing interest rates, or converting debt into equity. 3. Corporate Restructuring Agreement: This type of agreement is broader in scope and encompasses a range of measures aimed at reorganizing a company's structure, operations, or ownership. It includes actions like mergers, acquisitions, spin-offs, divestitures, or restructuring internal departments. 4. Financial Restructuring Agreement: This agreement primarily addresses a company's financial distress, aiming to improve its liquidity and solvency. It often involves negotiating with lenders, investors, or other stakeholders to modify existing financial arrangements, secure additional funding, or restructure balance sheets. 5. Creditor Restructuring Agreement: This type of agreement focuses on addressing the needs and interests of creditors when a company faces financial difficulties. It may involve modifying repayment terms, accepting partial debt forgiveness, or repurposing assets to maximize recovery for creditors. Delaware Restructuring Agreements are crucial in providing a legal framework for businesses navigating challenging financial situations while protecting the rights and interests of stakeholders. By utilizing these agreements, companies can aim to restore financial stability, improve operational efficiency, and ultimately achieve long-term success.

Delaware Restructuring Agreement

Description

How to fill out Delaware Restructuring Agreement?

Are you within a position the place you need to have files for sometimes company or specific purposes just about every day? There are tons of legal file layouts accessible on the Internet, but locating ones you can rely on is not easy. US Legal Forms provides 1000s of kind layouts, like the Delaware Restructuring Agreement, that are published to meet state and federal specifications.

If you are currently acquainted with US Legal Forms internet site and possess a free account, basically log in. Afterward, you are able to acquire the Delaware Restructuring Agreement format.

Should you not offer an accounts and wish to start using US Legal Forms, abide by these steps:

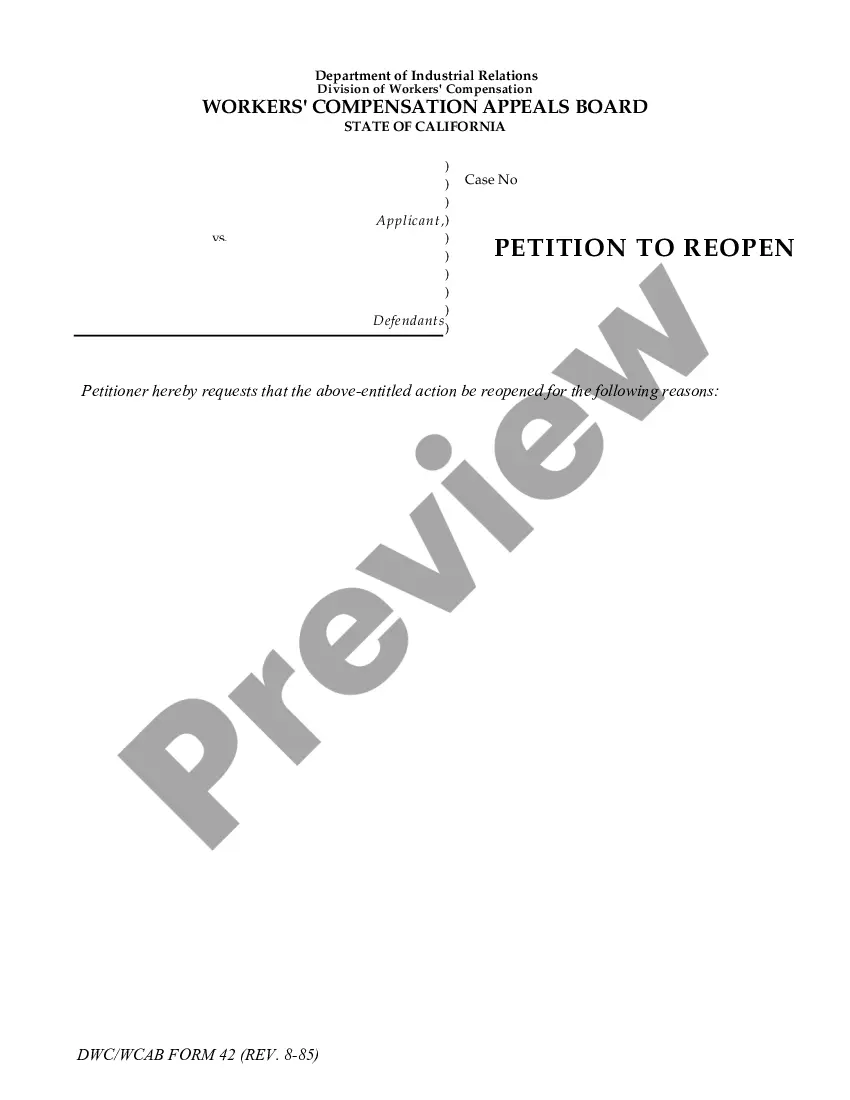

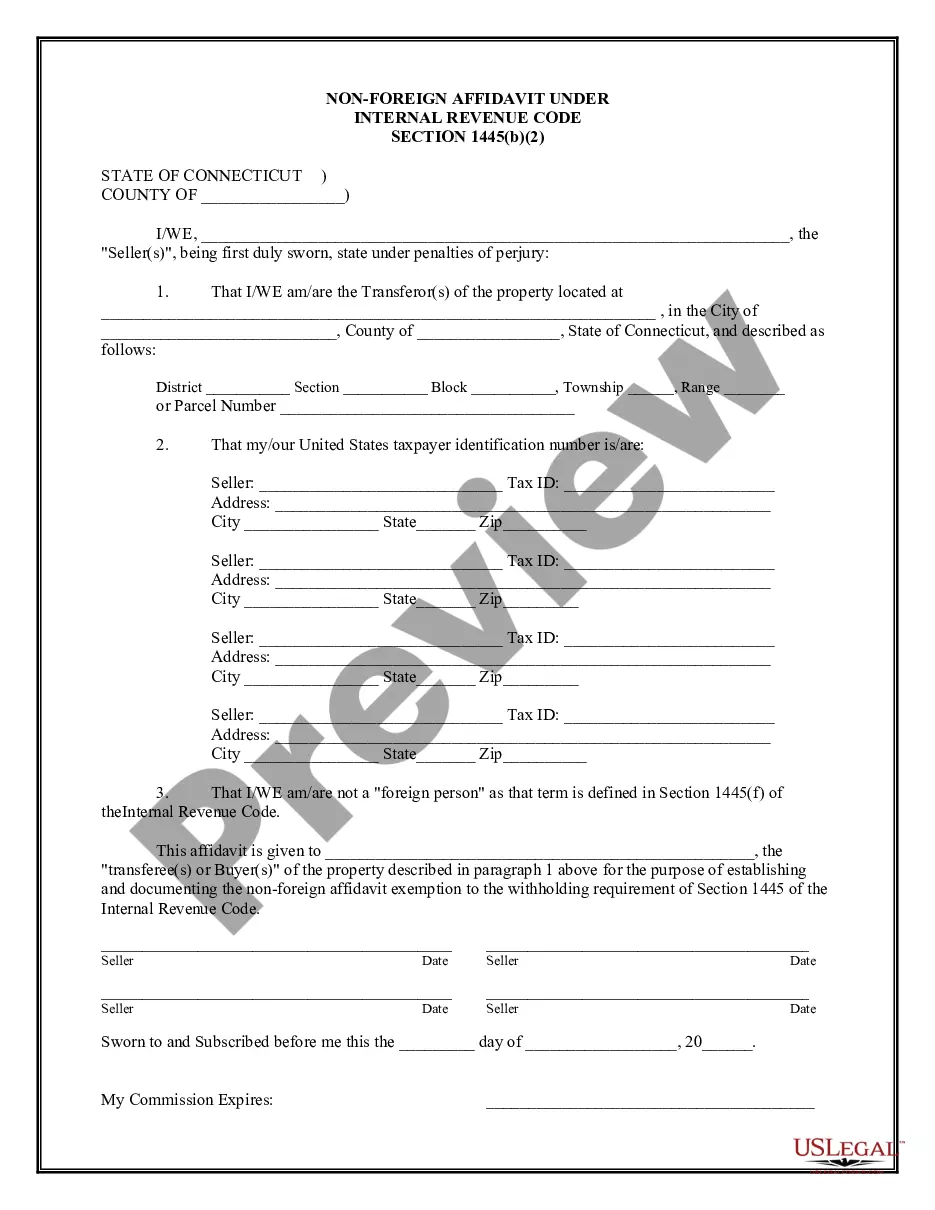

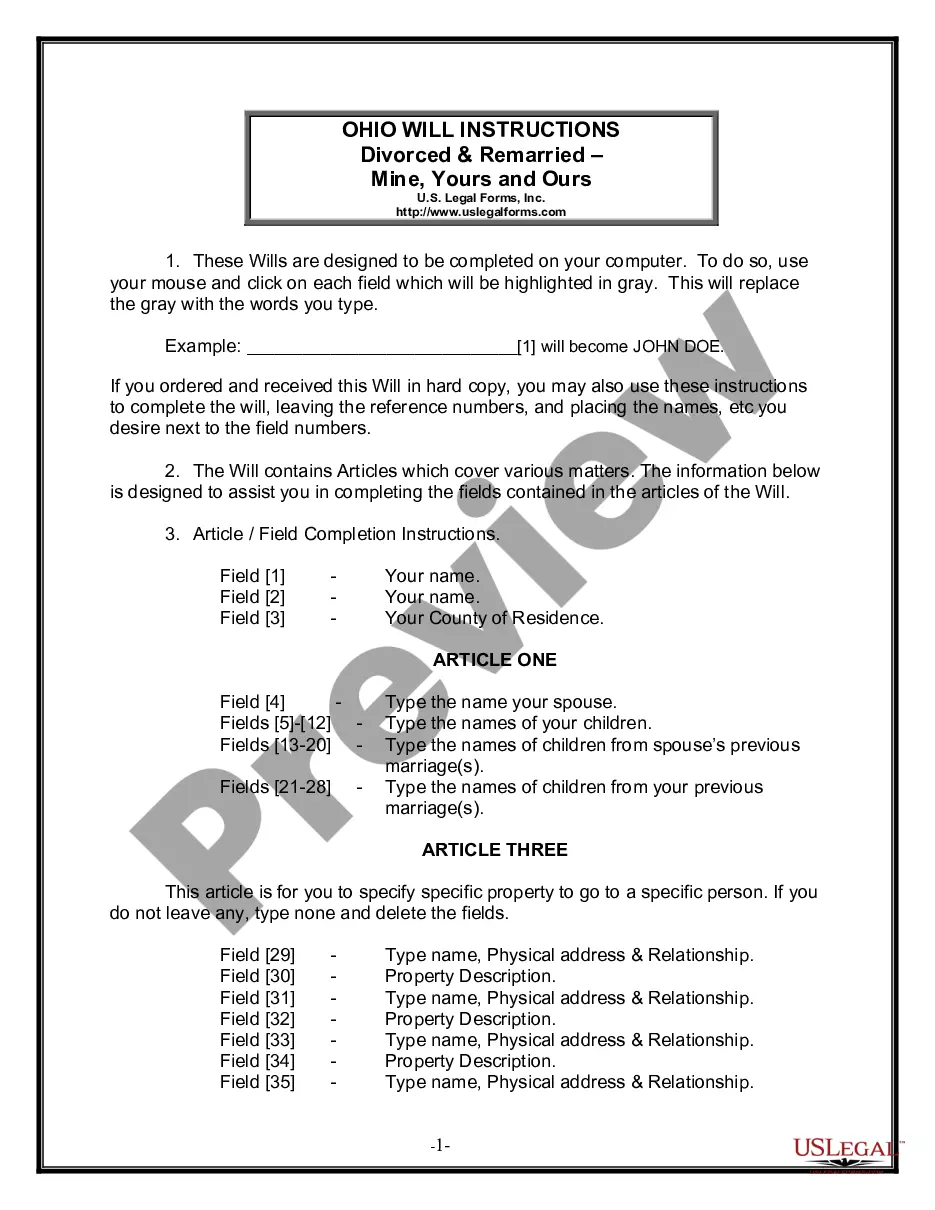

- Discover the kind you want and make sure it is for that proper area/region.

- Use the Preview key to analyze the shape.

- See the information to ensure that you have selected the appropriate kind.

- When the kind is not what you are trying to find, take advantage of the Search industry to find the kind that fits your needs and specifications.

- When you obtain the proper kind, simply click Buy now.

- Pick the pricing plan you want, complete the required details to produce your money, and purchase an order using your PayPal or bank card.

- Choose a hassle-free file formatting and acquire your version.

Discover all of the file layouts you have bought in the My Forms food list. You may get a additional version of Delaware Restructuring Agreement anytime, if needed. Just click on the needed kind to acquire or produce the file format.

Use US Legal Forms, the most extensive selection of legal forms, to save efforts and stay away from blunders. The service provides professionally manufactured legal file layouts which can be used for a selection of purposes. Create a free account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

Section 265 - Conversion of other entities to a domestic corporation (a) As used in this section, the term "other entity" means a limited liability company, statutory trust, business trust or association, real estate investment trust, common-law trust or any other unincorporated business including a partnership ( ...

No consent shall be effective to take the corporate action referred to therein unless consents signed by a sufficient number of holders or members to take action are delivered to the corporation in the manner required by this section within 60 days of the first date on which a consent is so delivered to the corporation ...

Section 225 - Contested election of directors; proceedings to determine validity (a) Upon application of any stockholder or director, or any officer whose title to office is contested, the Court of Chancery may hear and determine the validity of any election, appointment, removal or resignation of any director or ...

(a) Any 2 or more corporations of this State may merge into a single surviving corporation, which may be any 1 of the constituent corporations or may consolidate into a new resulting corporation formed by the consolidation, pursuant to an agreement of merger or consolidation, as the case may be, complying and approved ...

As amended, Section 228(e) now provides that the persons entitled to receive notice of action by written consent are persons who (i) were stockholders as of the record date for the action by written consent, (ii) would have been entitled to notice of the meeting if the action had been taken at a meeting and the record ...

Section 228 requires that a Stockholder Communication (a "228 Notice") disclosing the corporate actions approved via Stockholder Consent be sent to all stockholders who would have been entitled to participate in the vote if it was taken at a meeting.

(a) Upon application of any stockholder or director, or any officer whose title to office is contested, the Court of Chancery may hear and determine the validity of any election, appointment, removal or resignation of any director or officer of any corporation, and the right of any person to hold or continue to hold ...

Unless otherwise provided in the charter, any action of a meeting of stockholders/member may be taken, without a meeting and prior notice, by signed consent, delivered to the corporation, of stockholders/members having the minimum number of votes that would be necessary to take such action at a meeting at which all ...