Delaware Removal of two directors

Description

How to fill out Removal Of Two Directors?

US Legal Forms - among the greatest libraries of authorized varieties in the USA - provides a wide range of authorized document themes you are able to obtain or print out. Making use of the web site, you can get a huge number of varieties for enterprise and specific uses, sorted by types, claims, or search phrases.You will discover the latest versions of varieties such as the Delaware Removal of two directors within minutes.

If you already have a registration, log in and obtain Delaware Removal of two directors in the US Legal Forms local library. The Obtain switch will show up on every kind you look at. You have accessibility to all in the past delivered electronically varieties within the My Forms tab of the accounts.

If you would like use US Legal Forms initially, listed here are straightforward instructions to help you started:

- Ensure you have selected the right kind for your city/county. Click on the Review switch to review the form`s articles. See the kind description to ensure that you have selected the correct kind.

- In the event the kind doesn`t satisfy your requirements, take advantage of the Look for discipline at the top of the screen to get the the one that does.

- In case you are content with the shape, affirm your option by simply clicking the Acquire now switch. Then, pick the pricing strategy you want and supply your references to register for an accounts.

- Procedure the transaction. Utilize your charge card or PayPal accounts to perform the transaction.

- Select the formatting and obtain the shape on your own device.

- Make changes. Fill up, modify and print out and signal the delivered electronically Delaware Removal of two directors.

Every single template you included with your money lacks an expiration date and it is your own property eternally. So, if you would like obtain or print out another copy, just proceed to the My Forms portion and click around the kind you require.

Gain access to the Delaware Removal of two directors with US Legal Forms, probably the most considerable local library of authorized document themes. Use a huge number of specialist and status-distinct themes that meet your company or specific requirements and requirements.

Form popularity

FAQ

A board of directors can also remove a director "for cause." Cause is generally defined as some type of misconduct on the part of the director. For example, if a director was found to have committed fraud or misappropriated corporate funds, they could be removed for cause.

Section 109(1) of the CBCA and section 122(1) of the OBCA provide that a director of a corporation may be removed by an ordinary resolution of the shareholders passed at a special meeting of shareholders called for that purpose.

In addition, the certificate of incorporation may confer upon 1 or more directors, whether or not elected separately by the holders of any class or series of stock, voting powers greater than or less than those of other directors.

A shareholder wishing to remove a director must give special notice of their intention to the company, which then has 28 days to call a general meeting. At this meeting, shareholders will vote on the proposed resolution. If it is passed by a simple majority, then the director will be removed from their position.

Typically, the shareholders in a corporation need to achieve a majority vote in favor of adding the corporate director. The method to remove directors from a corporation is the same; shareholders vote on expulsion and amend the articles of incorporation respective to their corporate bylaws.

Complications in removing a director The director is an employee of your company - Although a director may have a service contract as an employee, they can be removed without their consent under the provisions of the Companies Act.

Can a Board Member Be "Fired?" In short, Delaware's General Corporation Law (the ?DGCL?) provides that shareholders are ultimately responsible for the appointment and removal of directors, through the mechanics and processes relating to the vote, and ordinarily set forth in the corporation's bylaws.

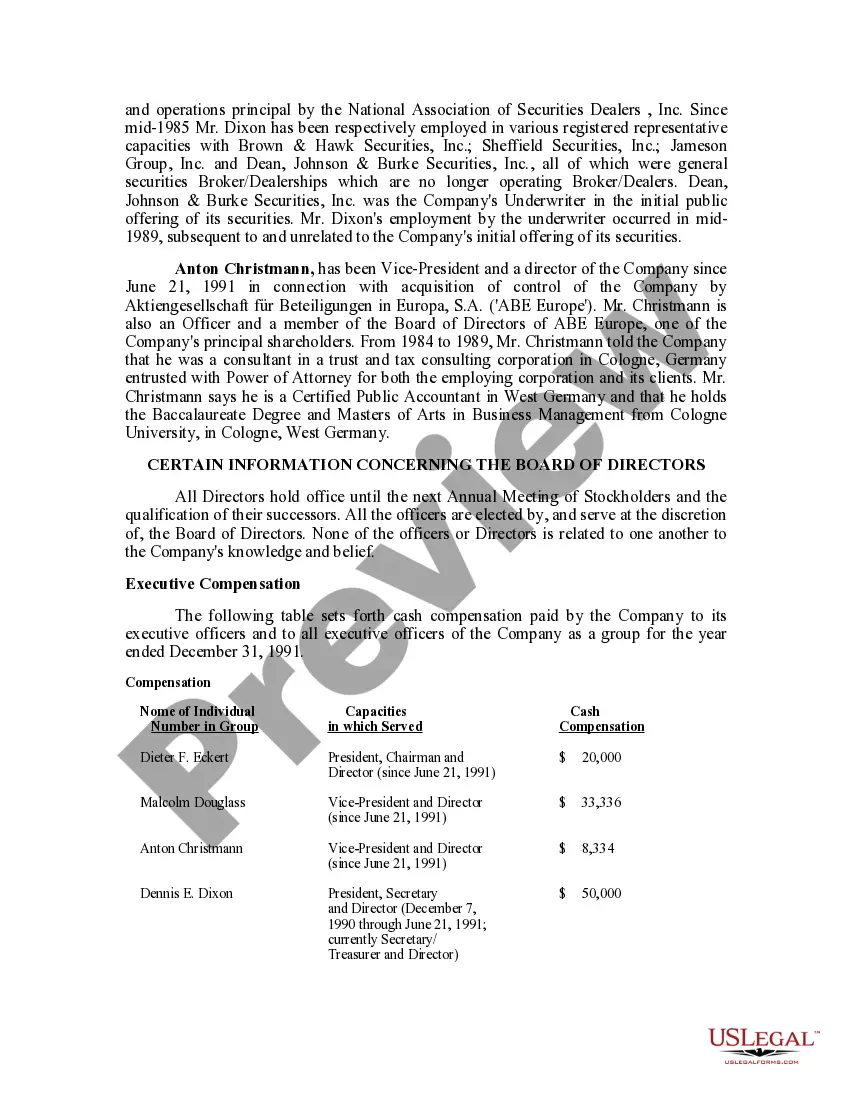

Pass a resolution: The shareholders or the board of directors must pass a resolution for the removal of the director. The resolution must be passed by a majority vote, as specified in the company's articles of association.