Delaware Ratification of change in control agreements with copy of form of change in control agreement

Description

How to fill out Ratification Of Change In Control Agreements With Copy Of Form Of Change In Control Agreement?

Are you in a place where you need paperwork for sometimes business or person purposes nearly every time? There are plenty of lawful record themes available online, but finding types you can trust is not easy. US Legal Forms offers a huge number of kind themes, much like the Delaware Ratification of change in control agreements with copy of form of change in control agreement, which can be published in order to meet state and federal requirements.

If you are previously informed about US Legal Forms web site and also have your account, merely log in. Following that, you are able to down load the Delaware Ratification of change in control agreements with copy of form of change in control agreement design.

Should you not offer an profile and wish to start using US Legal Forms, abide by these steps:

- Find the kind you want and make sure it is for that appropriate city/area.

- Use the Preview option to check the shape.

- See the description to ensure that you have selected the appropriate kind.

- In the event the kind is not what you are searching for, take advantage of the Research field to get the kind that meets your requirements and requirements.

- Once you obtain the appropriate kind, simply click Get now.

- Opt for the rates strategy you need, fill out the required info to produce your money, and pay for an order utilizing your PayPal or credit card.

- Decide on a convenient paper format and down load your duplicate.

Discover all of the record themes you have purchased in the My Forms food list. You can aquire a extra duplicate of Delaware Ratification of change in control agreements with copy of form of change in control agreement at any time, if required. Just go through the essential kind to down load or print the record design.

Use US Legal Forms, one of the most extensive collection of lawful forms, to conserve some time and prevent faults. The services offers skillfully created lawful record themes which you can use for a range of purposes. Create your account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

A change of control is a change in a company's ownership or management that results in the decision-making capacity of that entity being exercised by a different group of shareholders and/or directors.

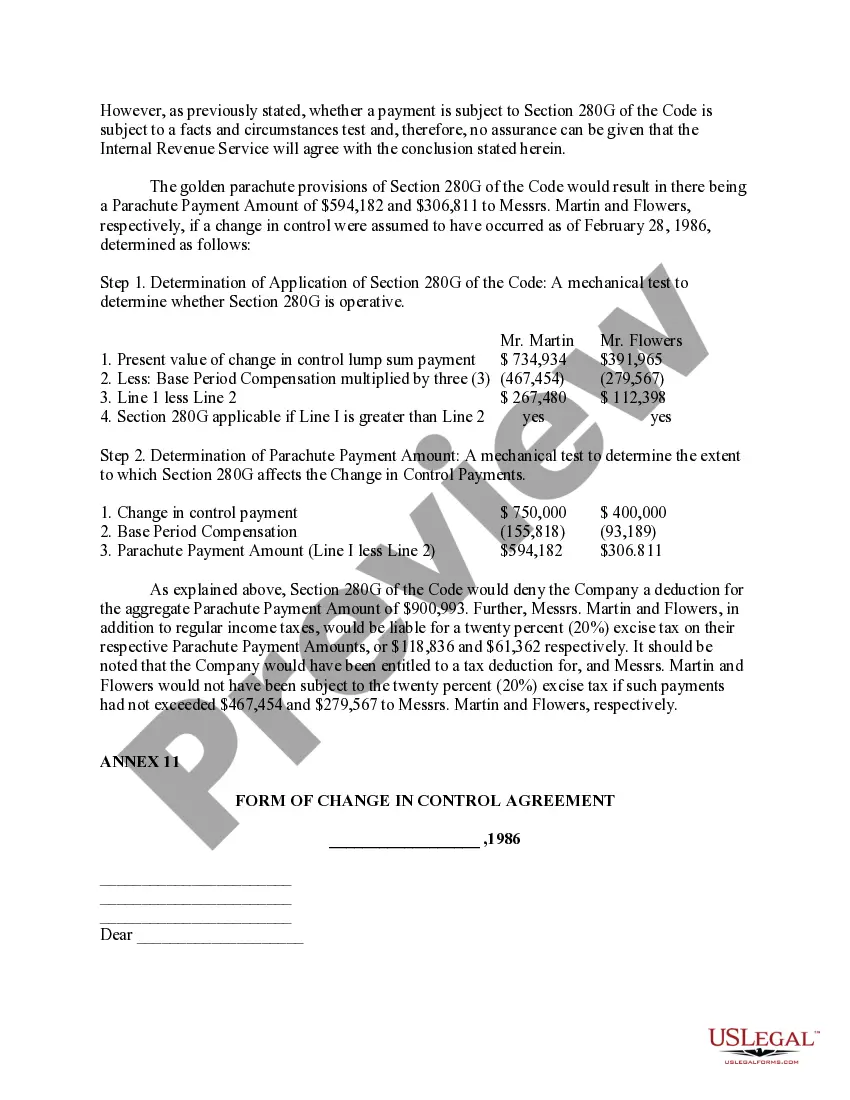

Change in control agreements are contracts that outline pay and benefits an executive will receive in the event of a change in company ownership. They are also sometimes known as ?golden parachutes,? as they provide protection for executives if they are forced out after a company takeover.

Also known as change of control. A provision in an agreement giving a party certain rights (such as consent, payment or termination) in connection with a change in ownership or management of the other party to the agreement.

(5) The term ?change in control? means? (A) for a corporation, the sale or transfer of a controlling interest in the corporation; (B) for a partnership or limited liability company, the sale or transfer of a controlling interest in the partnership or limited liability company; and (C) for an individual, the sale or ...

A party may try to ensure that the other party seeks consent to make the change and maintain the agreement, or provide some form of payment as compensation for the change, while retaining the right to terminate the agreement.

(c) ?Change of Control? means: (i) a sale of all or substantially all of the assets of the Company; (ii) the acquisition of more than 50% of the voting power of the outstanding securities of the Company by another entity by means of any transaction or series of related transactions (including, without limitation, ...

Parties normally seek to include provisions in an agreement that allow for either termination or an adjustment of their rights, such as payment, upon a change of structure or ownership of the other party. This is known as a ?change of control? clause.

A change of control is a change in a company's ownership or management that results in the decision-making capacity of that entity being exercised by a different group of shareholders and/or directors.