The Delaware Nonqualified Stock Option Plan offered by Mediocre, Inc. is designed specifically for officers, directors, consultants, and key employees. This plan grants these individuals the opportunity to purchase company stocks at a predetermined price, allowing them to benefit from future stock price appreciation. Now, let's delve into the details of this stock option plan, highlighting its key features and benefits. 1. Purpose: The Delaware Nonqualified Stock Option Plan of Mediocre, Inc. aims to attract and retain top-tier talent by providing an incentive in the form of stock options. It encourages dedication, loyalty, and commitment by aligning the interests of the plan participants with the company's overall success. This plan is a vital tool for motivating and rewarding key individuals who play crucial roles in Mediocre's growth. 2. Eligibility: This plan is specifically tailored to officers, directors, consultants, and key employees of Mediocre, Inc. These individuals, who contribute significantly to the company's success, are eligible to participate and receive stock options based on their performance, seniority, or any predetermined criteria. 3. Stock Option Grants: Under the Delaware Nonqualified Stock Option Plan, eligible individuals are granted stock options that allow them to purchase a predetermined number of company shares at an exercise price usually set at fair market value on the date of grant. The exercise price remains fixed during the option's term. 4. Vesting Schedule: Stock options granted under this plan generally vest over a specified period. Vesting may be based on time, performance milestones, or a combination of both. The vesting terms are determined by the company and may vary for different types of participants. Vesting incentivizes individuals to stay with Mediocre and continuously contribute to its success. 5. Exercise Period: Upon vesting, participants can exercise their stock options, converting them into actual shares of Mediocre's stock. The exercise period typically begins after the options have vested and ends after a predetermined duration. This grants participants the ability to purchase stocks at the exercise price, regardless of the current market value, potentially allowing them to profit from stock price appreciation. 6. Tax Implications: It's important to note that nonqualified stock options are generally subject to tax at the time of exercise. The participant may be liable for ordinary income tax on the difference between the exercise price and the fair market value of the stock on the exercise date. Consulting with a tax advisor is recommended to fully understand the tax implications based on individual circumstances. Different Types of Delaware Nonqualified Stock Option Plans for Mediocre, Inc. Participants: 1. Officer Stock Option Plan: Specifically designed for Mediocre's officers, this plan outlines eligibility criteria and benefits tailored to high-ranking executives within the company. 2. Director Stock Option Plan: This plan caters to directors serving on Mediocre's board, offering them stock options as a means of attracting and retaining these pivotal decision-makers. 3. Consultant Stock Option Plan: Aimed at consultants engaged by Mediocre, this plan rewards their contributions with stock options, fostering a mutually beneficial relationship between the company and consultants. 4. Key Employee Stock Option Plan: Tailored to Mediocre's key employees who significantly impact the organization's progress, this plan offers stock options as a form of recognition and financial reward. In conclusion, the Delaware Nonqualified Stock Option Plan of Mediocre, Inc. provides officers, directors, consultants, and key employees with the opportunity to acquire company shares at a predetermined price. By aligning the interests of these individuals with the company's success, Mediocre hopes to foster loyalty, motivation, and dedication among its top talent.

Delaware Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

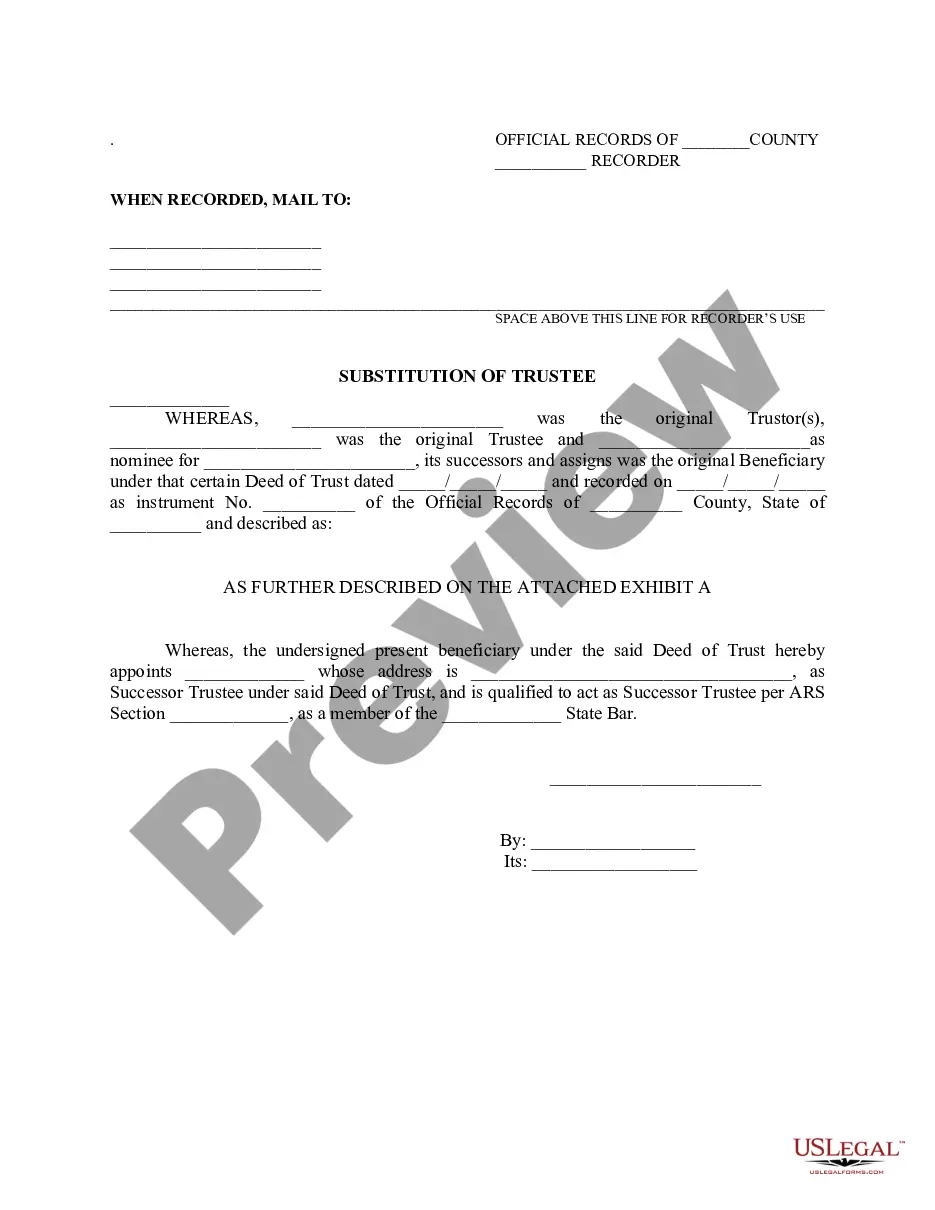

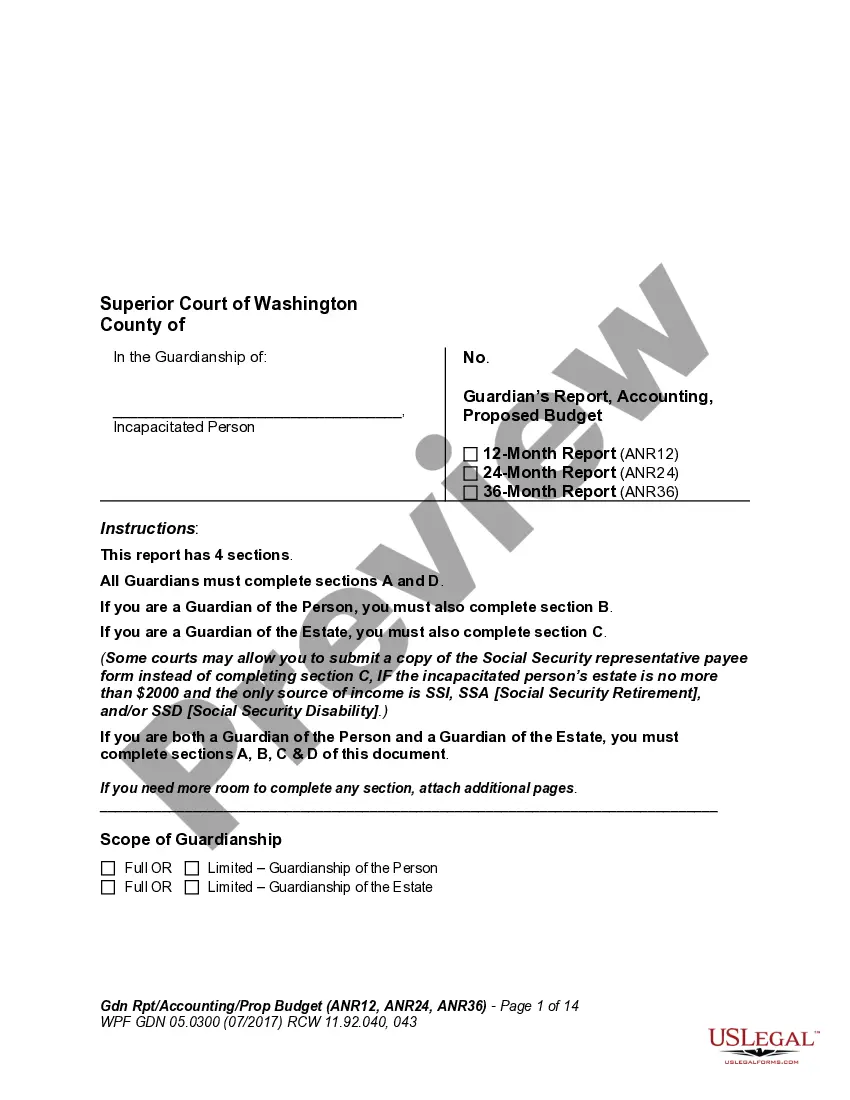

How to fill out Delaware Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

US Legal Forms - among the most significant libraries of authorized forms in America - gives a variety of authorized document web templates it is possible to acquire or print out. While using web site, you may get a huge number of forms for business and person purposes, categorized by classes, says, or keywords and phrases.You will discover the most recent variations of forms such as the Delaware Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees within minutes.

If you currently have a membership, log in and acquire Delaware Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees from your US Legal Forms local library. The Download switch will appear on each and every kind you perspective. You have accessibility to all previously delivered electronically forms inside the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, allow me to share basic recommendations to help you get started off:

- Be sure you have chosen the correct kind for the area/state. Click the Review switch to review the form`s articles. See the kind description to ensure that you have chosen the right kind.

- In case the kind doesn`t suit your specifications, use the Research discipline near the top of the display screen to obtain the one who does.

- When you are content with the form, confirm your selection by clicking the Acquire now switch. Then, opt for the costs strategy you favor and offer your accreditations to sign up on an bank account.

- Approach the financial transaction. Use your credit card or PayPal bank account to perform the financial transaction.

- Select the formatting and acquire the form on the device.

- Make alterations. Fill up, change and print out and signal the delivered electronically Delaware Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees.

Every single template you added to your account does not have an expiration time and is yours forever. So, if you would like acquire or print out an additional backup, just visit the My Forms portion and click on the kind you need.

Get access to the Delaware Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees with US Legal Forms, one of the most comprehensive local library of authorized document web templates. Use a huge number of specialist and status-distinct web templates that meet up with your company or person requirements and specifications.