Title: Delaware Approval of Abase Corporation's Stock Incentive Plan: A Comprehensive Overview Introduction: Delaware Approval of Abase Corporation's Stock Incentive Plan is a crucial step in ensuring effective implementation and management of stock-based compensation within the organization. This comprehensive description explores the purpose, benefits, types, and significance of obtaining Delaware approval, shedding light on the intricacies surrounding Abase Corporation's Stock Incentive Plan. Keywords: Delaware approval, Abase Corporation, Stock Incentive Plan, implementation, management, stock-based compensation, purpose, benefits, types, significance 1. Purpose of Abase Corporation's Stock Incentive Plan: The Abase Corporation's Stock Incentive Plan is designed to attract, motivate, and retain talented employees by offering them an opportunity to own shares of the company. This plan aims to align employees' interests with those of shareholders, boosting employee loyalty, and driving long-term company growth. Keywords: purpose, Abase Corporation's Stock Incentive Plan, attract, motivate, retain employees, ownership, alignment, shareholder interests, employee loyalty, long-term growth 2. Benefits of Abase Corporation's Stock Incentive Plan: a. Employee Retention: Stock incentives provide employees with a vested interest in the company's success, fostering loyalty and reducing turnover. b. Talent Attraction: Offering stock incentives acts as a powerful recruitment tool to attract top talents seeking to share in the company's future success. c. Motivation and Performance: Stock ownership motivates employees to perform at their best, as their efforts directly contribute to their financial gain. d. Alignment with Shareholder Interests: Stock incentives align employees' goals with those of the shareholders, promoting value creation and long-term sustainability. Keywords: benefits, Abase Corporation's Stock Incentive Plan, employee retention, talent attraction, motivation, performance, alignment, shareholder interests, value creation, sustainability 3. Types of Delaware Approval for Abase Corporation's Stock Incentive Plan: a. General Approval: This type of approval is granted by the Delaware Division of Corporations to authorize the implementation of Abase Corporation's Stock Incentive Plan. b. Change in Plan Approval: In case of significant amendments or modifications to the plan, Abase Corporation may seek separate approvals as required by Delaware state law. Keywords: types, Delaware approval, Abase Corporation's Stock Incentive Plan, general approval, change in plan approval, Delaware Division of Corporations, amendments, modifications, state law 4. Significance of Delaware Approval: Obtaining Delaware approval for Abase Corporation's Stock Incentive Plan ensures compliance with state laws, enhances legal validity, and provides protection for the company and its shareholders. Additionally, Delaware's business-friendly and well-established legal framework offers a favorable environment for effective implementation and management of stock-based compensation plans. Keywords: significance, Delaware approval, Abase Corporation's Stock Incentive Plan, compliance, state laws, legal validity, protection, shareholders, business-friendly, legal framework, implementation, management Conclusion: Delaware Approval of Abase Corporation's Stock Incentive Plan is a critical step towards implementing an effective stock-based compensation strategy. By aligning employee interests with those of shareholders, this plan fosters loyalty, attracts top talent, and motivates employees to contribute to the long-term success and growth of Abase Corporation. Keywords: Delaware Approval, Abase Corporation's Stock Incentive Plan, compensation strategy, alignment, loyalty, talent attraction, motivation, long-term success, growth.

Delaware Approval of Ambase Corporation's Stock Incentive Plan

Description

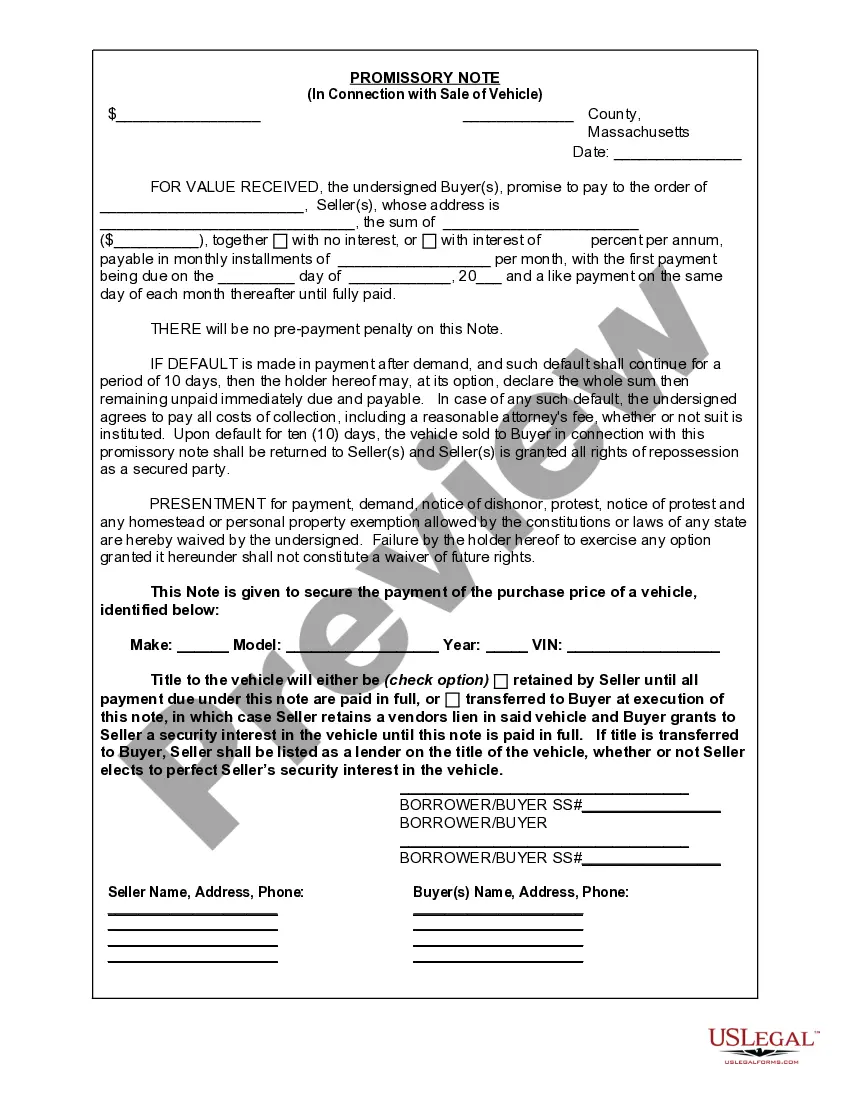

How to fill out Delaware Approval Of Ambase Corporation's Stock Incentive Plan?

US Legal Forms - among the biggest libraries of authorized varieties in America - offers a variety of authorized document web templates you are able to acquire or print out. While using site, you can find a large number of varieties for enterprise and individual purposes, categorized by groups, claims, or keywords.You can get the most up-to-date versions of varieties like the Delaware Approval of Ambase Corporation's Stock Incentive Plan in seconds.

If you currently have a monthly subscription, log in and acquire Delaware Approval of Ambase Corporation's Stock Incentive Plan in the US Legal Forms local library. The Obtain option will appear on each develop you see. You get access to all previously downloaded varieties inside the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, listed below are straightforward directions to get you started off:

- Ensure you have selected the proper develop to your area/region. Click on the Review option to analyze the form`s information. Read the develop explanation to ensure that you have chosen the proper develop.

- In the event the develop doesn`t match your requirements, use the Research industry near the top of the display to discover the the one that does.

- Should you be happy with the form, verify your option by visiting the Buy now option. Then, select the prices strategy you favor and supply your qualifications to sign up for an account.

- Approach the financial transaction. Use your Visa or Mastercard or PayPal account to accomplish the financial transaction.

- Pick the structure and acquire the form on the system.

- Make changes. Fill out, change and print out and sign the downloaded Delaware Approval of Ambase Corporation's Stock Incentive Plan.

Every design you added to your bank account lacks an expiry date which is your own permanently. So, if you want to acquire or print out an additional duplicate, just check out the My Forms segment and then click about the develop you require.

Gain access to the Delaware Approval of Ambase Corporation's Stock Incentive Plan with US Legal Forms, the most extensive local library of authorized document web templates. Use a large number of expert and condition-distinct web templates that meet up with your business or individual requires and requirements.

Form popularity

FAQ

Section 242 of the DGCL governs the procedures by which a corporation may amend its certificate of corporation, or charter, and generally requires approval by (a) the board of directors and (b) holders of a majority in voting power of the outstanding stock entitled to vote thereon and by the holders of a majority in ...

Section 203 is an antitakeover statute in Delaware which provides that if a person or entity (an ?interested stockholder?) acquires 15% or more of the voting stock of a Delaware corporation (the ?target?) without prior approval of the target's board, then the interested stockholder may not engage in a business ...

(a) A corporation may, whenever desired, integrate into a single instrument all of the provisions of its certificate of incorporation which are then in effect and operative as a result of there having theretofore been filed with the Secretary of State 1 or more certificates or other instruments pursuant to any of the ...

If (1) one corporation's (?the parent?) ownership in another corporation[1] or corporations (?the subsidiary?) amounts to at least 90% of the outstanding shares of each class of stock entitled to vote on a merger and (2) at least one of these corporations is a Delaware corporation and unless the laws or a foreign ...

Section 232 - Delivery of notice; notice by electronic transmission (a) Without limiting the manner by which notice otherwise may be given effectively to stockholders, any notice to stockholders given by the corporation under any provision of this chapter, the certificate of incorporation, or the bylaws may be given in ...

§ 243. Retirement of stock. (a) A corporation, by resolution of its board of directors, may retire any shares of its capital stock that are issued but are not outstanding.

(a) Any 2 or more corporations of this State may merge into a single surviving corporation, which may be any 1 of the constituent corporations or may consolidate into a new resulting corporation formed by the consolidation, pursuant to an agreement of merger or consolidation, as the case may be, complying and approved ...

Under the Delaware General Corporation Law, amendments to a corporation's certificate of incorporation require the approval of stockholders holding a majority of the outstanding shares entitled to vote on the amendment.